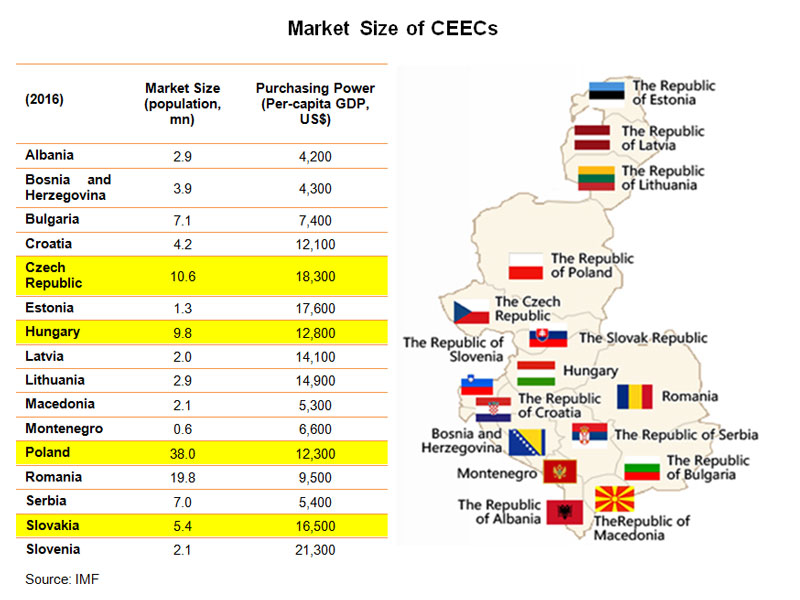

The Visegrad Four (V4) nations, consisting of the Czech Republic, Hungary, Poland and Slovakia, have had remarkable success in aligning and strengthening their economies to compete and play a dominant role in the regional economy of Central and Eastern Europe (CEE). They are poised to benefit most from the multifaceted alignment of the “16+1” format co-operation between Central and Eastern European countries and China) and Belt and Road Initiative (BRI).

The V4 countries, located in the heart of Europe, have seen rising trade and investment flows on the back of strengthened Sino-CEE co-operation and connectivity. Meanwhile, more and more V4 businesses have taken on a more global perspective in searching for new markets.

Hong Kong, given its unique combination of a vibrant capital market and a large professional services cluster with extensive global networks and affiliations, can be a crucial link in providing the important capital flows and the highly sought-after assurance to new-to-the-market V4 enterprises and investors.

Enhanced connectivity and increasingly vibrant investment flows have not only made it possible for each of the V4 countries to reinvent and reposition itself in the bigger picture of Sino-CEE co-operation, they have also provided traders and manufacturers with more possibilities in terms of regional distribution and supply chain management.

V4 Countries as Core BRI Partners in CEE

Central and Eastern European Countries (CEECs) have played an increasingly pivotal role in China’s foreign policy, and are key partners in the BRI. The “16+1” format and the BRI have multifaceted alignment as both development initiatives led by China are aiming at intensifying and expanding co-operation with the 16 CEECs, including investment in infrastructure and cooperation in industry and technology development.

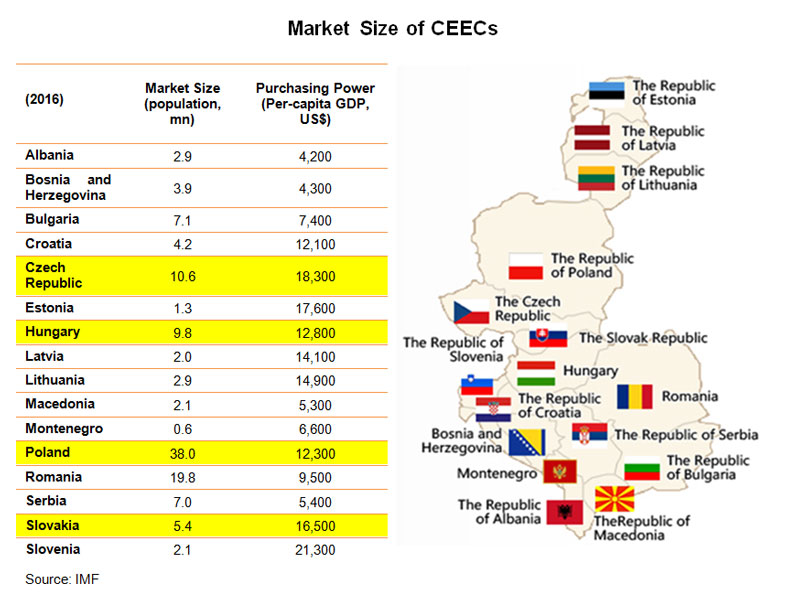

Different CEECs may benefit differently from the strengthening Sino-CEEC co-operation and connectivity subject to their own development plans and national strategies. The V4, which play a leading role in the regional economy and have had remarkable success aligning and strengthening their economies to compete effectively regionally and internationally, are poised to benefit most in drawing trade and investment interest.

Representing more than half of the population and nearly two-thirds of the economic output of the 16 CEE member countries under the umbrella of the “16+1” format, the V4 are naturally important and active participants in the BRI. They offer a progressively interesting logistic alternative for shippers and their forwarders moving cargo between Asia and Western Europe, which is considered a priority to the success of the BRI as it aims to enhance the connectivity between Asia, Europe and Africa.

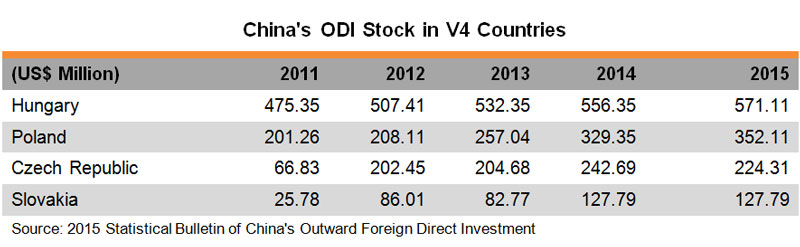

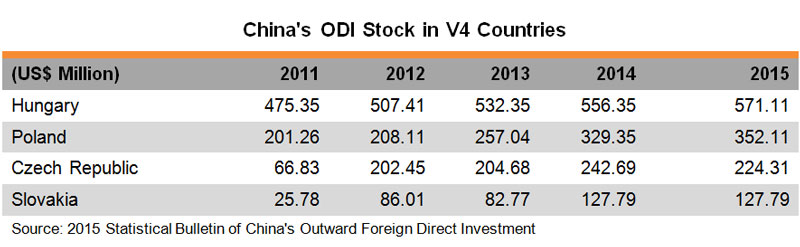

Banking on the good Sino-V4 relations and China’s continuous implementation of its “going out” strategy, China’s outbound direct investment (ODI) in the V4 countries has been flourishing, while bilateral trade blossoms. In the five years ending 2015, China’s ODI to the V4 grew by more than 65% from US$769mn to US$1.28bn, accounting for nearly two-thirds of China’s ODI in the 16 CEECs. Though China’s investment in V4 countries and the other CEECs is far from significant in the light of China’ total ODI, Hong Kong’s professional services providers and Chinese-funded corporate structures have quite often been involved in Sino-V4 investment deals such as M&As and takeovers.

While cash-rich Chinese investors have already made successful inroads into V4 countries by acquiring promising businesses over the past decade, more brownfield and greenfield projects, both private and public, are expected to materialise in the bloc in the coming years. Such a sustained wave of Chinese investment, plus generous funding from European Structural and Investment Funds (ESIF) supporting mega infrastructure projects, research and innovation and small businesses (including start-ups), will certainly give a big shot in the arm for the V4 economy to rejuvenate its industrial and commercial prowess.

Amount budgeted for period 2014-2020 Czech Republic Czech Republic, through 11 national and regional programmes, benefits from ESIF funding of €24 billion representing an average of €2,281 per person over the period 2014-2020 Hungary Hungary, through 9 national and regional programmes, benefits from ESIF funding of €25 billion representing an average of €2,532 per person over the period 2014-2020 Poland Poland, through 24 national and regional programmes, benefits from ESIF funding of €86 billion representing an average of €2,265 per person over the period 2014-2020 Slovakia Slovakia, through 9 national programmes, benefits from ESIF funding of €15.3 billion representing an average of €2,833 per person over the period 2014-2020

Source: European Commission |

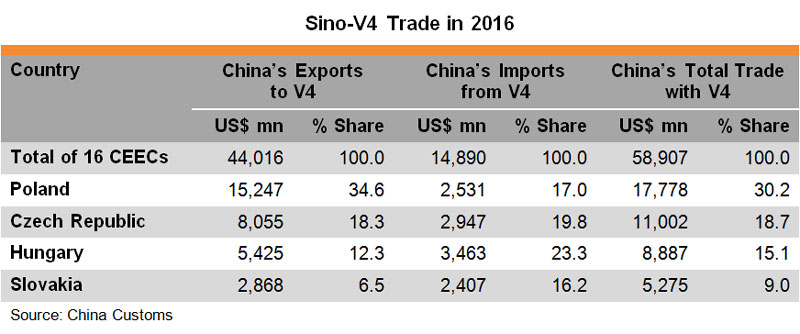

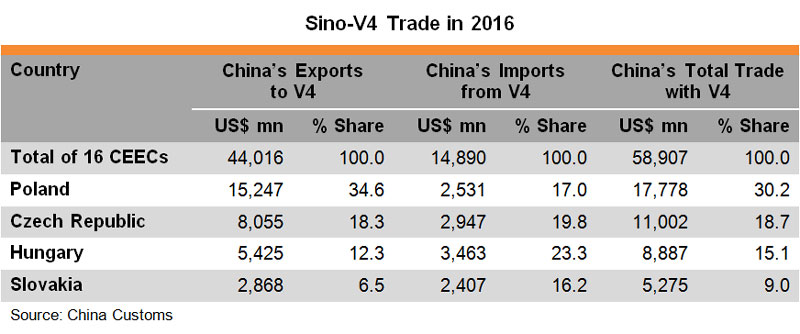

Just as they are the leading recipients of Chinese ODI in CEE, the V4 countries are also the leading trading partners of China among the 16 CEECs, accounting for 73% of the total Sino-CEEC trade in 2016. Trade between China and CEECs has remained unbalanced, however. This unbalanced trade pattern – China exported nearly twice as much as it imported from the V4 countries in 2016 – has become a raison d’etre for deeper and wider Sino-V4 cooperation from mergers and acquisitions (M&As) and takeovers to higher value-added manufacturing, technology exchanges and infrastructure and real estate (IRES) projects.

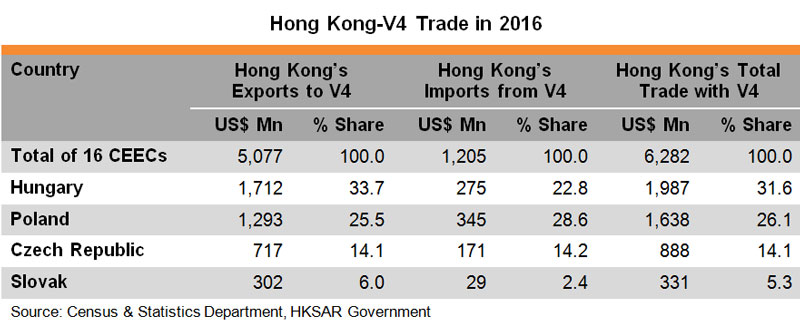

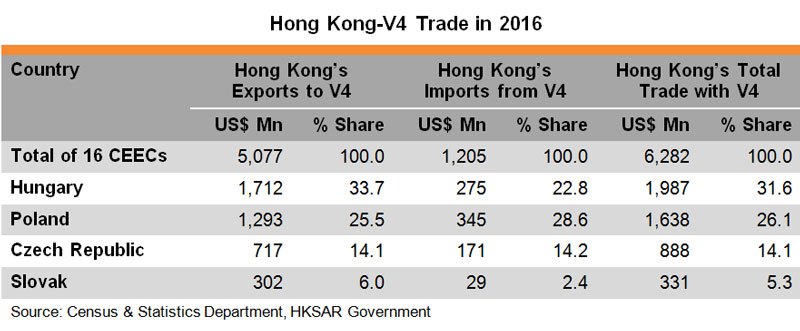

The pattern of Hong Kong’s trade with V4 countries coincides with that of Sino-V4 trade – with the four countries accounting for more than 75% of Hong Kong’s total trade with the 16 CEECs in 2016. Boasting a year-on-year growth in trade of between 9% and 22%, (compared to the regional average of less than 7%) Hungary, Poland and Slovakia were not only Hong Kong’s key trading partners in the CEE, but the city’s fast-growing export destinations in the region last year.

As the vibrant Sino-V4 investment flows are playing an increasingly important and active role in nurturing V4 businesses to take on a more global perspective, more and more V4 enterprises are looking further afield in their search for new markets. This is also partly due to the dire need to compensate for the loss of the Russian market due to the ongoing economic sanctions between the EU and Russia. In this regard, Hong Kong, widely considered a safe and clear-cut gateway for V4 companies to explore the Chinese mainland market, is seeing an encouraging inflow and expansion of well-known V4 enterprises, products and brands.

The unique combination of a vibrant capital market with diverse financing channels and a large professional and financial advisory services cluster with extensive global networks and affiliations has thus made Hong Kong an irreplaceable partner for V4 investors, intermediaries and project owners hoping to take advantage of BRI and “16+1” opportunities. As a regional hub for legal services and dispute resolution underpinned by a trusted common law system and an independent judiciary, Hong Kong can be a crucial link in providing highly sought-after assurances to new-to-the-market V4 enterprises and investors.

New Positions of V4 Nations in Sino-CEE Co-operation

Strengthening Sino-V4 trade and investment flows are certainly good signs of the successful implementation of the 16+1 format and BRI in CEE. They have empowered the V4 countries to reinvent and reposition themselves in the bigger picture of Sino-CEE co-operation, while providing traders and manufacturers with far more possibilities in terms of regional distribution and supply chain management.

Poland: Profiting from Increasing Asia-Europe Rail Traffic

Poland, as the region’s largest economy, has successfully captured the lion’s share of the increasing Eurasian rail traffic and developed itself into a rail logistics hub for Asia-Europe cargo trains, thanks partly to the ongoing Russian-Ukrainian conflicts that have compromised the Eurasian rail traffic passing through Russia and Ukraine to Hungary or Slovakia. This, together with the nation’s unrivalled advantage of being the only one among the V4 countries to have access to open sea, has made Poland a natural choice with respect to regional distribution in CEE.

New projects, such as the Pomeranian Special Economic Zone (PSEZ) in Biala Podlaska near the Polish-Belarusian border, will also further empower the country to better accommodate the increasing demand for railway track gauge change (due to the differences of the Russian broad-gauge system and the European standard gauge system), transshipment and even manufacturing processing facilities.

Riding on the better Asia-Europe rail connection, and the cheaper rail freight due to Asia-bound trains not usually being as fully loaded as Europe-bound trains, Polish companies such as vegetables and fruit growers have started to send apples and other processed food to the Chinese market by rail. This trend has also led to Hong Kong traders and service providers becoming a lifestyle showcase for Polish food and beverages including wine, beer, spirits, fruit and derivatives such as jam, juices and cosmetics.

Hungary: Leading the Way in BRI Co-operation

Hungary is the first European country to sign a memorandum of understanding (MoU) on BRI cooperation with the Chinese mainland. The country’s “Opening to the East” policy is very much in line with the BRI and has been well received by investors such as China’s leading electric automaker BYD, which opened its first fully-owned bus plant in Europe in the northern Hungarian town of Komarom in April this year. Meanwhile, several well-known Hungarian companies, including the world-leading Building Information Modeling (BIM) software developer and a significant player in the field of global female healthcare, have continued to grow their Asian businesses through either their regional headquarters or partners in Hong Kong.

Being the No.1 destination of Chinese outbound FDI in CEE, Hungary is also an important partner to RMB internationalisation in Europe. Home to the regional headquarters of the Bank of China (BOC), which has operated a subsidiary in the country since 2003 and maintained a full-fledged branch since 2014, Hungary was selected by the Bank to launch its first RMB clearing centre in CEE in October 2015 and its first Chinese RMB and Hungarian forint debit card in Europe in January 2017.

As regards logistics, the thrice-weekly direct cargo flights from Hong Kong to Budapest, the capital of Hungary, have made the country a possible air hub for cargo distribution in CEE, while the ongoing project of the high-speed Budapest-Belgrade rail line (which is expected to achieve substantial progress this year) and its further extension to Skopje, the capital of Macedonia, and the Greek capital Athens, will afford the landlocked country a better connection with seaports in the Adriatic and Mediterranean Seas. There is also the already serviceable China-Europe land-sea fast intermodal transport route connecting Hungary with the Greek Port of Piraeus operated by China COSCO Shipping.

The Czech Republic: Boom Time for China-Led M&As

Having one of, if not the best flight passenger connections with the Chinese mainland among CEECs, the Czech Republic welcomes more Chinese tourists (more than 300,000 in 2016) than any other country in the region. The increased belly cargo capacities plus the new cargo flights routing from Hong Kong to Prague have also enabled Chinese express delivery companies to better fulfill the cross-border e-commerce bonanza.

Boosting one of the densest rail networks in Europe (after Luxembourg and Belgium), the Czech Republic has also attracted many multinationals such as Foxconn and Amazon to set up regional logistics centres. As a leading global producer of wheelsets, wheels, axles and other wheelset components for rolling stock, Czech companies are also heavily involved in the expanding Eurasian rail development. One such company, which won the MTRC contract to supply wheels for MTR passenger trains in 2015, opened its first Asia office in Hong Kong in September 2016.

Aside from tourism and logistics, Czech Republic sees a wide array of Chinese-led M&A deals spanning sport, real estate, airlines, travel agencies, hotels, breweries and most recently a DIY and gardening chain. Ongoing deals, including the takeover of the Group Skoda Transportation, the biggest producer of railway vehicles in CEE, by China Railway Rolling Stock Corporation (CRRC), are expected to open the door for Chinese manufacturers to march into the European market, source of technology and pool of talents. Some of the M&A deals have been done through the corporate structures of Chinese enterprises in Hong Kong, while at least one famous Czech glass and lighting company has set up a holding company in Hong Kong to stay close to both the production base in the Chinese mainland and the rosy residential and commercial property market in Asia.

Slovakia: BRI Investment and the Route to Modernisation

Slovakia, with the highest per-capita car production in the world, has been a magnet for auto-related investment in CEECs. All three established car producers – Volkswagen, Peugeot Citroën and Kia – and their tier 1 and tier 2 suppliers are constantly expanding their manufacturing plants in the country, while the investment project Jaguar Land Rover (starting production in 2018) has become the largest business case in Europe during the last seven years.

The recent acquisition of the country’s largest steel mill in Košice by He-Steel Group of China, the world’s second largest steel maker, has not only helped the Chinese steel maker to gain a foothold in the European steelmaking industry to avoid prohibitive EU anti-dumping duties on steel imports, but also highlighted Slovakia’s strategic location to facilitate manufacturing industries such as automotive and electronics that utilise raw materials coming from non-EU European suppliers such as Ukraine.

To prepare for the expected increase in rail cargo traffic between Europe and Asia and strengthen its attractiveness for international manufacturing and logistics companies, Slovakia, riding on its favourable catchment zone in between seaports in southern Europe (e.g., the Slovenian Port of Koper and the Italian Port of Trieste) and northern Europe (e.g., the Port of Hamburg), is active in developing and upgrading its infrastructure. This includes the modern transshipment facilities of Slovakian cities such as Bratislava, the country’s capital, and Košice in eastern Slovakia, close to Ukraine, Hungary and Poland.

Hardware aside, the Slovakian government is keen on adopting and promoting the use of new technology such as electronic locks and electronic customs clearance systems to allow cargo owners and forwarders to facilitate a more effective means to track or trace cross-border cargo movement. Meanwhile, the country is stretching its wings wide to Asia, including, but not confined to, a plan to start a double tax treaty negotiation with Hong Kong soon.

Editor's picks

Trending articles

In its 13th Five-Year Plan, Guangxi has made accelerating the growth of processing trade one main thrust of its outward economic development. It aims to increase the value-added of processing trade by encouraging the diversification of assembly processing into R&D, design as well as upstream and downstream sectors. It also wants to establish a “Nanning-Qinzhou-Beihai Electronic Information Processing Trade Industry Belt” by using processing trade parks and bonded zones as carriers. As Guangxi’s processing trade trends towards mid- to high-end, some of the labour-intensive processes have started to move out and industry chains are being formed with neighbouring ASEAN countries.

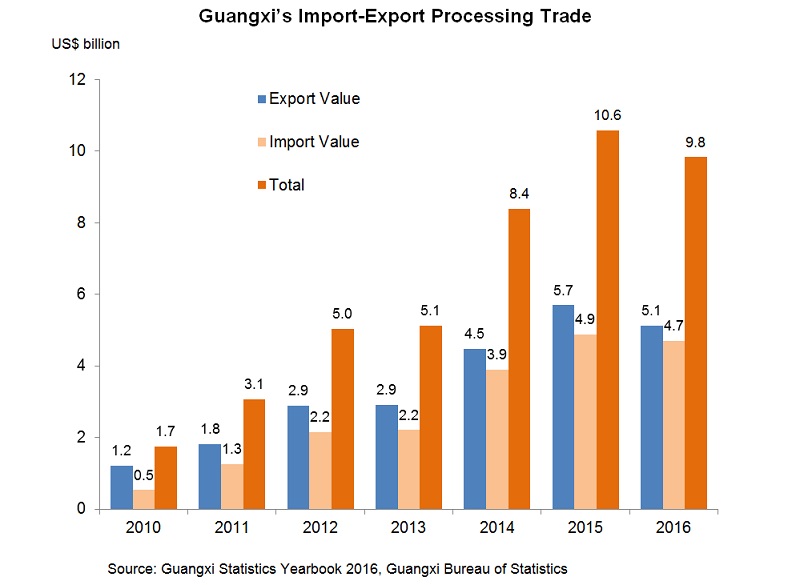

Processing Trade Develops in Leaps and Bounds

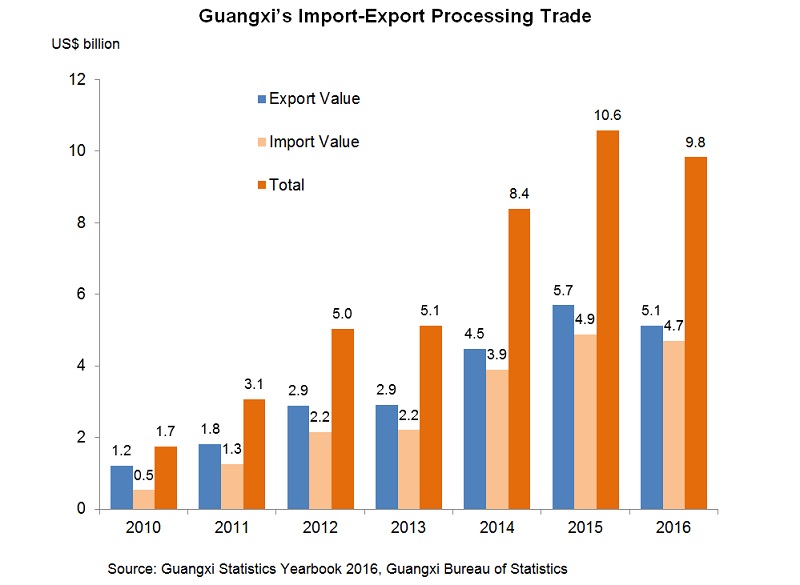

The past few years have seen marked growth in Guangxi’s processing trade. Higher logistics costs notwithstanding, a considerable number of industries in China’s eastern region have moved into the autonomous region. Although in 2016 overall external demand was sluggish and Guangxi’s exports also dropped, from 2010 to 2016 Guangxi’s total import and export value from processing trade still registered a hefty average annual growth rate of 33.3%. In particular, processing trade exports grew at an average annual rate of 27.2%. In 2010, processing trade constituted 9.9% of Guangxi’s overall external trade, but the figure climbed to 20.6% in 2016. Currently, the raw materials, parts and components used in processing trade come from different areas, but exports after assembly mostly transit through Hong Kong.

Further Driving Processing Trade

In a bid to further drive processing trade development, Guangxi proposed a second round of “doubling plan” in 2016. The Implementation Opinions on Promoting the Innovative Development of Processing Trade (the Implementation Opinions) it released in June 2016 proposed that by 2020, the import and export volume of processing trade will double that in 2016 to more than US$20 billion. Meanwhile, there should be further improvements in the structure of export goods from processing trade, with mechanical and electrical products and high-tech products comprising more than 75% and 50%, respectively, of all processing trade exports.

The Implementation Opinions proposed a number of incentive measures to support the development of the processing trade industry, including:

- Processing trade enterprises whose projects fall under the scope of the Catalogue of Encouraged Industries in the Western Region with total investment exceeding RMB50 million will be eligible, up to 31 December 2020, for a reduced enterprise income tax rate of 15% while contribution to local coffers will be exempted.

- In key industrial parks, basic endowment insurance premium will be reduced from 20% to 14% while collection of contributions to the water conservancy fund will be temporarily suspended for processing trade enterprises in these parks.

- For projects in priority development industries with intensive land usage as determined by Guangxi, the minimum land assignment price may be set at no less than 70% of the relevant standards.

- Concerted efforts will be made to give more financial support to processing trade transfer projects. In 2016, a total of more than RMB600 million in specific funds, inclusive of RMB300 million from the Guangxi government and funds from the central government designated for foreign trade and economic development, were allocated for further improving the environment for the development of processing trade industries.

As for labour costs, take the city of Beihai as an example. According to Beihai Industrial Zone (BIZ), the average monthly wage of an ordinary worker is about RMB2,500. It is worth noting that some Guangxi cities along the Sino-Vietnamese border are stepping up labour services co-operation with neighbouring Vietnamese regions. With the signing of a cross-border labour services co-operation agreement in early 2017 between the Guangxi border cities of Chongzuo, Fangchenggang and Baise with the Vietnam border provinces of Quảng Ninh, Lang Son, Cao Bang and Ha Giang, a mechanism for labour services co-operation has been formally set up.

With the sustained development of Guangxi’s economy, labour demand at the autonomous region’s border regions will also grow rapidly. As neighbouring Vietnam has surplus labour, cross-border co-operation in labour services is conducive to Vietnam workers going to work in Guangxi. It has been estimated that the labour cost of each cross-border worker is lower than that of a Guangxi worker by more than RMB10,000 a year.

Processing Trade Trending Towards High Value-added

In recent years, Guangxi’s industrial structure has been turning gradually towards high technologies and electronics, so its processing trade is also advancing in that direction. To promote further processing trade development, the Implementation Opinions suggest that active guidance should be given on bringing in whole chains of supporting industries so that Guangxi’s processing trade can be developed in clusters and its value-added can be increased continually. The autonomous region is now building an electro-plating park in Tieshan port area to provide support for related upstream industries.

Beihai hosts some 600 large and small enterprises in the field of electronics, one of the fastest-growing industries locally. Electronic information is the pillar industry in BIZ, followed by food, pharmaceuticals and equipment manufacturing. According to a BIZ representative, the industry chains there are now extending upstream in the direction of R&D, and BIZ has set up a foundation for supporting this sector. So far, BIZ is host to five state-level high-tech enterprises and eight provincial-level R&D centres and technology centres; it has also set up the first quality inspection centre in Guangxi for electronic information products.

About 20,000 workers are employed in BIZ and the number is expected to hit 30,000 in 2017. Most are local and there is little problem with recruitment. However, one BIZ representative said that labour demands of enterprises now entering the zone are less urgent than before, and they are more concerned with local support in terms of value improvement. BIZ is well aware that, in the long-run, it cannot depend on incentive policies alone. Instead, there is a need to develop support services and upgrade the standards of industrial services including, for example, raising the standards of inspection and testing services, offering certification of standards, and training of personnel, all of which are vital in lending support to R&D. To further enhance the business environment, BIZ will also set up a port joint inspection centre to facilitate customs clearance.

Industry Chain Relationship with ASEAN

For its processing trade, Guangxi uses raw materials, parts and components from different sources, while exports after assembly mostly transit through Hong Kong. Guangxi’s processing trade, however, has ceased to be simple processing with supplied materials: enterprises using Guangxi as a production base make use of labour forces in peripheral areas to carry out and incorporate international co-operation in production capacity. Guangxi figures indicate that some enterprises in the Beibu Gulf area have begun to gradually transfer some low value-added, and very labour-demanding, processes to ASEAN countries.

Although the productivity of Guangxi’s workers is higher than that of their counterparts in some ASEAN countries such as Vietnam, Cambodia and Laos, labour costs in Guangxi are also higher. Consequently, some manufacturers in the Beibu Gulf area have started carrying out industrial division of labour with neighbouring ASEAN countries. This entails outsourcing some simple assembling processes to Vietnam or Cambodia, then shipping back the semi-finished products for further assembly in Guangxi. In this way, a processing trade industry chain involving Guangxi and ASEAN has begun to take shape.

As an example, a Taiwan electronics enterprise has invested in an industrial park in Cambodia through a company it has set up in Beihai. Semi-finished products produced by lower-cost labour in Cambodia are shipped back to Beihai for deep processing or final assembly. Since low-end processes have been transferred to Cambodia while mid- to high-end processes are retained in Beihai, the number of workers the enterprise employs in Beihai has been reducing gradually from 4,000 in 2015 to about 2,000 in 2016. Although there is a reduction in the number of workers, overall output value has not decreased.

From Guangxi’s perspective, this is an inevitable development trend. Even though enterprises are moving out some production processes, Beihai no longer wants to take in low-end, low value-added electronics industries. Industrial parks also want to create a sound operating environment so that enterprises will continue to use Beihai as a management centre while building industry chains with ASEAN countries.

Given the fact that the electronics industry requires specialised services support, BIZ, for example, has established an electronic information product inspection and testing centre so that enterprises do not have to send their products outside Guangxi for inspection and testing. The next step is to provide various types of quality certification locally. A port joint inspection and testing centre will also be set up to allow formalities such as customs declaration and commodity inspection to be carried out within the park premises. A skills training school has also been set up inside the park through the joint efforts of businesses and academic institutions to train related technical staff.

|

China-Malaysia Qinzhou Industrial Park China-Malaysia Qinzhou Industrial Park (CMQIP) has been jointly built by government consortia from Malaysia and China. It is one of the two parks under the “two countries, twin parks” co-operation between China and Malaysia (the other is Malaysia-China Kuantan Industrial Park in Kuantan Port, Malaysia). About 15km from the city of Qinzhou, CMQIP has a planned area of 55 sq km. The first phase will cover 15 sq km, of which 7.8 sq km is designated as a start-up area. It is expected that the whole 15 sq km will be developed in 2017, well ahead of the target date of 2020. By early 2017, 66 enterprises had signed agreements to set up operations in the park or were about to do so. CMQIP is intended as an international park and enterprises from around the world are welcome. Standard factory buildings with worker dormitories are available in its processing trade zone. To the east of CMQIP is Sanniang Bay, a 4A grade tourist district; to the west is Maowei Sea, a national ocean park. CMQIP will therefore make use of tourism resources in its neighbourhood to create an international tourist attraction complete with facilities for leisure, vacationing, business, conventions and exhibitions, culture and sports. CMQIP had its foundation laid in 2012 and, after years of efforts in infrastructure building, it is now ready for enterprises to move in and operate. Six industrial clusters are gradually being built up: medicine and healthcare, information technology, marine industry, equipment manufacturing, materials and new materials, and modern services (including cultural creation and tourism). In addition, talks are also under way to introduce traditional Malaysian priority industries such as bird’s nest processing, halal food and rubber, as well as the deep processing of palm oil imported from Malaysia. In choosing sites for the twin parks, Malaysia and China have decided on a port city with a view to co-operating in the development of both industry chains and logistics chains. Industries now located in Malaysia-China Kuantan Industrial Park include steel and aluminium processing and ceramics, and they have set their sights on the regional market. CMQIP intends to tighten Chinese-Malaysian industrial co-operation. At this stage it is bringing in different types of industries in order to make the park a success. It also has plans to gradually introduce Malaysia’s priority industries such as bird’s nest processing and halal food processing. At the end of 2016, with China and Malaysia signing the Protocol on Inspection, Quarantine and Veterinary Hygiene Requirements for the Exportation of Raw, Uncleaned Edible Bird’s Nest from Malaysia to China, Qinzhou and CMQIP in Guangxi may become the designated port of importation and processing base, respectively, for Malaysian raw bird’s nest. |

Bonded Zones Offer More Value-Added Development

Guangxi’s 13th Five-Year Plan mentions that better use should be made of various bonded port zones and export processing zones to step up the development of processing trade. In fact, its bonded port zones are now promoting the development of more value-added activities in different industries. For example, Nanning Bonded Port Zone not only runs a bonded warehouse, but it is also venturing into the exhibition and maintenance of imported cars, repairing of returned exported equipment, aviation logistics, aeroplane related maintenance and training, as well as the deep processing of imported food and health food.

Qinzhou Bonded Port Zone (QBPZ) is pursuing the processing of imported cotton in its bonded zone. The yarns from spinning can either be imported into mainland China or exported. On the mainland, imported fruits and meat must be imported through designated ports that are equipped with inspection and testing facilities. QBPZ is also qualified in this respect, so it is planning to develop the processing of cold-chain imports, targeting mostly imported fruits and meat where the main processes involved are cutting and repackaging. Another project is wood processing, in which imported bonded wood is processed into boards or wooden components for buildings. QBPZ is also developing cross-border e-commerce, aiming to offer a platform for ASEAN SMEs to enter the China market by helping them handle import formalities. Its position is to focus on specialty products from Southeast Asia, and its target markets are Guangxi and the southwestern region.

It is worthwhile for Hong Kong’s manufacturing industry to pay attention to the progress of Guangxi’s efforts in promoting co-operation in production capacity with ASEAN. Hong Kong can capitalise on the development room available to integrate regional supply chains more effectively. Guangxi’s electronics industry has been growing rapidly in recent years. To support the development of the industry, a modern electro-plating industry park is being planned in Tieshan Port, Beihai. Nevertheless, Guangxi’s manufacturing sector still lacks supportive professional services such as R&D, brand promotion, inspection and testing, etc. These vital aspects in manufacturing can offer opportunities for co-operation between Hong Kong’s related sectors and Guangxi’s manufacturing industry.

Editor's picks

Trending articles

Belt and Road investment priorities and need to boost northern states fuels expansion of Special Economic Zones.

The development of Malaysia's growing number of Special Economic Zones (SEZs) is being shaped by several investment requirements related to the Belt and Road Initiative, as well as by a change in priorities on the part of the country's government.

As the Malaysian government looks to diversify the country's economy, it faces three key challenges, all of which have implications for the SEZ sector. Firstly, it is keen to rebalance economic growth across the country while looking to nurture innovation in the digital-technology sector. On top of that, it is determined to capitalise on the new opportunities emerging from the ASEAN integration programme.

With inward investment focussed almost exclusively on Kuala Lumpur and the southern states of Selangor and Johor, promoting interest in the country's northern regions is seen as a vital part of any move to rebalance the economic map. The key project here is the development of the East Coast Economic Region (ECER), an initiative that was initially green-lit in 2008.

As envisaged, the ECER spans the northern states of Kelantan and Terengganu, as well as Pahang in the east and Mersing in southeastern Johor. It extends across 51% of Peninsular Malaysia, and focuses primarily on the country's traditional strengths in manufacturing, agribusiness, oil, gas, petrochemicals and tourism.

As of May 2016, some 38.5% (US$3.1 billion) of all inbound investment in the ECER had been sourced from Chinese investors. The majority of this funding has been channelled into the Malaysia-China Kuantan Industrial Park. Set in the eastern coastal state of Pahang, this was the first industrial park in the country to be jointly developed by Malaysia and China. Among the more recent investments has been the funding of a $133 million aluminium component manufacturing facility by the Guangxi Investment Group.

In order to create much-needed jobs, however, the northern states require considerably more investment. In line with this, back in 2016, the Terengganu state government lobbied to launch a new SEZ extending across Besut, Setiu, Kuala Nerus, Kuala Terengganu and Marang. The proposed 729,400-hectare development is said to have been modelled on the Shenzhen SEZ in southern China. At present, it is planned that the initial phase will utilise some 221,000 hectares, with the second phase requiring an additional 508,400 hectares.

With improving the country's digital infrastructure one of the key elements in the government's plan to encourage multinationals and SMEs to create new jobs, Malaysia launched the world's first Digital Free Trade Zone (DFTZ) in March this year. The ceremony to mark the formal adoption of the scheme was attended by Najib Razak, the Malaysian Prime Minister, and Jack Ma, the Executive Chairman of Alibaba Group and an adviser on the development of Malaysia's digital economy.

Once completed, the DFTZ will boast an e-fulfilment hub at the Kuala Lumpur International Airport (KLIA) Aeropolis, a 405-hectare development zone focussed on air cargo and logistics as well as the development of an aerospace/aviation cluster. The initial phase will roll out later this year, with Alibaba, Cainiao, Lazada and POS Malaysia already signed up as tenants. The facility will also be the launch site in 2019 for Alibaba's Electronic World Trade Platform – part of the company's bid to streamline global trade arrangements for SMEs.

The second phase of the DFTZ will see the establishment of the Kuala Lumpur Internet City (KLIC). Developed by Catcha Group, the Malaysian/Singaporean internet giant, it is hoped that KLIC will emerge as the key digital hub for global or local internet-related companies looking to target Southeast Asia.

The project will be housed within Bandar Malaysia, a commercial and residential zone located on the site of a former air-force base. The site is being developed by a consortium led by the China Railway Engineering Corp.

In other developments, Bandar Utama, on the outskirts of the capital, will be the terminal for the Kuala Lumpur-Singapore high-speed rail link, scheduled to begin operation in 2026. With a journey time of just 90 minutes, the link is expected to boost business and tourism traffic.

At present, stops are planned at Putrajaya, Seramban, Alor Gajah, Muar, Batu Pahat and Iskandar Puteri in Johor Bahru. All of these locations are intended to be promoted as investment hubs in the coming years, with Iskandar Puteri having something of a head start over the other designated sites.

Forming part of Iskandar Malaysia – the main southern development corridor in the state of Johor – Iskandar Puteri is a 2,217-square-metre SEZ. Established in 2006, it was envisaged as a world-class business, residential and entertainment hub, with its management keen to capitalise on its proximity to Singapore.

Among the businesses already operating within its precincts are Legoland Malaysia, Gleneagles Medini Hospital and Pinewood Iskandar Malaysia Studios. It is also the site of the Medini 'smart city', one of Malaysia's largest urban developments.

Within Medini, investors in six designated sectors – health and wellness, education, financial services, leisure and tourism, the creative industries, and logistics – can take advantage of a number of tax breaks and several other incentive packages. The site is expected to get a further boost in 2019 following the completion of a high-speed rail link to Singapore's Mass Rapid Transit rail system.

In addition to developing domestic SEZs, the country's Ministry of International Trade and Industry has announced that a number of Malaysian companies will be playing key roles in developing several SEZs in neighbouring Laos. These include Savan Park, a commercial and industrial hub jointly funded by the Laos government, and Savan Pacifica Development, a Malaysian consortium.

Among the other projects is the Dongphosy SEZ, a 70-hectare duty-free retail and residential zone intended to promote tourism, which is being jointly developed by Malaysia's UPL Lao and the Laos government. Malaysian companies are also involved in the development of an SEZ in Thakek, southern Laos.

Geoff de Freitas, Special Correspondent, Kuala Lumpur

Editor's picks

Trending articles

Industrial Co-operation under the Belt and Road Initiative

In line with the Belt and Road Initiative (BRI), trade co-operation between Malaysia and China has been strengthened by the countries jointly establishing two industrial parks – one in Kuantan in Malaysia, the other in Qinzhou in the Chinese region of Guangxi. Under the context of ‘Two Countries, Twin Parks’ [1], these industrial parks are intended to enhance the regional supply chain management and optimise the flow of trade and investment which runs between Malaysia and China.

One of the chief aims of the BRI is to encourage countries along the BRI to improve investment and the ease of trade facilitation. To this end, the BRI attempts to improve the capability of customs clearances and the coordination of cross-border supervision.

Malaysia is an important gateway for trade along the 21st Century Maritime Silk Road. At present, China and Malaysia are in the process of forming a cooperative ‘port alliance’, which seeks to fast-track trade flows by raising customs efficiency. It has been reported that, in addition to their contribution to trade cooperation, the new industrial parks could also serve as a testing ground for joint customs clearances between the two countries. Such a development might contribute to the advancement of the strategic direction of regional trade facilitation under the BRI.

The Malaysia-China Kuantan Industrial Park (MCKIP) is the first industrial park in Malaysia jointly developed by Malaysia and China, as well as the first to be accorded ‘National Park’ status. Its sister park in Guangxi, China is the Malaysia Qinzhou Industrial Park (CMQIP). Together, the two parks have been identified by both governments as an ‘Iconic Project for Bilateral Investment Co-operation’, which will drive the development of industrial clusters in both countries.

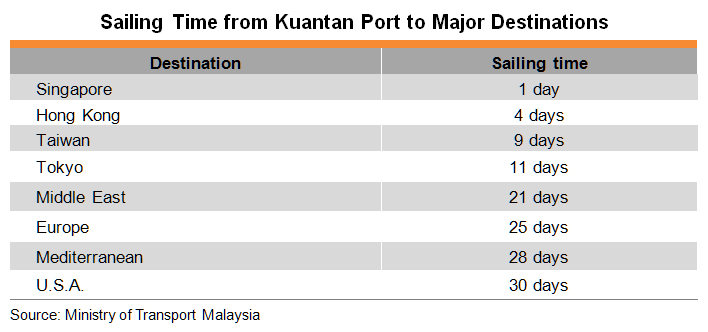

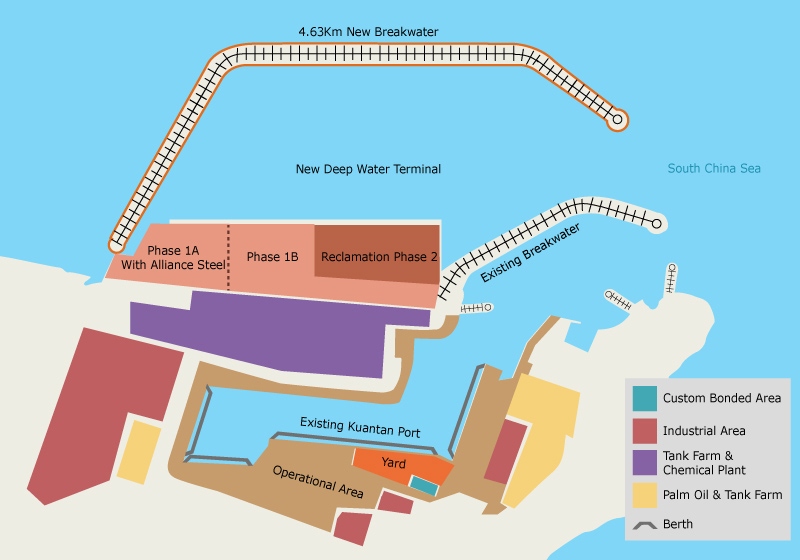

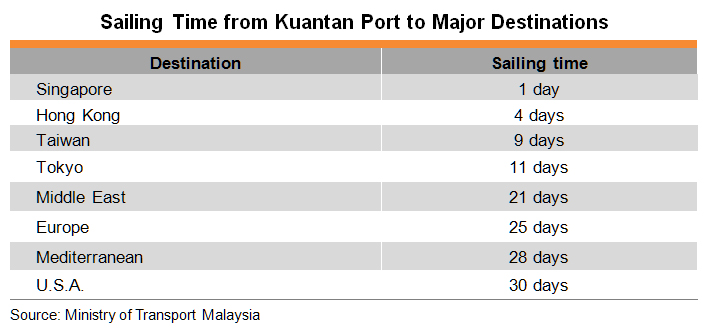

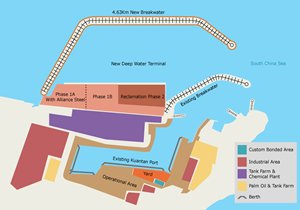

Kuantan Port will be an important gateway for logistics services for MCKIP, which is located just 10 kilometres away. At present, Kuantan Port mainly handles bulk cargoes for nearby industrial areas. In order to meet increased demand in the future, Kuantan Port is currently expanding its bulk cargo terminal. It is developing a new deep-water terminal (NDWT) which aims to become a container port for trans-shipment cargoes.

In June 2016, Kuantan Port received approval from The Ministry of Finance in Malaysia to establish a Free Zone port, so that it can provide value-added services for trans-shipment cargoes. Kuantan Port will act as the catalyst for MCKIP, with the synergy between the port and the industrial park forming a dynamic platform for investors expanding their business in the ASEAN region.

MCKIP: A Government-to-government Collaboration

Source: Kuantan Port Consortium

In 2008, the Malaysian government established the East Coast Economic Region Development Council (ECERDC) in order to develop and stimulate growth on the east coast of Peninsular Malaysia. It is a statutory body designed to spearhead the socio-economic development of the East Coast Economic Region (ECER) [2]. The five key economic sectors here are manufacturing, oil, gas and petrochemicals, tourism, agriculture and human capital development. The launch of MCKIP in 2013 has been one of the key milestones for the ECER.

By collaborating with Malaysia on the development of MCKIP, China can further enhance the flow of its trade and investment with Malaysia. At the same time, MCKIP provides a ‘going out’ platform where Chinese companies can expand their production capacities along the Belt and Road countries, in order to get closer to their final markets, in particular within the ASEAN.

MCKIP is a bilateral Malaysia-China government-to-government collaboration. MCKIP Sdn. Bhd. (MCKIPSB) is a 51:49 joint venture between a Malaysian consortium and a Chinese consortium. IJM Land holds a 40% equity interest in the Malaysian consortium; together, Kuantan Pahang Holding Sdn. Bhd. and Sime Darby Property hold 30% and the Pahang State Government holds the remaining 30%. The 49% stake of the Chinese consortium is held between the state-owned conglomerate Guangxi Beibu Gulf International Port Group (with a 95% equity interest) and Qinzhou Investment Company (the remaining 5% interest).

Positioning of MCKIP

MCKIP targets heavy industry and high-end/high technology industry. These include energy saving and environment friendly technologies, alternative and renewable energy, high-end equipment manufacturing and the manufacture of advanced materials. There are three distinct phases within the industrial park, namely MCKIP 1 (which consists of 1,200 acres of land), MCKIP 2 (1,000 acres) and MCKIP 3 (800 acres).

The construction of MCKIP 2 and MCKIP 3 should take place concurrently. While MCKIP 2 is designated for high-end and high technology industry development, MCKIP 3 is designated for multi-purpose development (including light industry, commercial property, residential areas and tourism parks). The entire MCKIP building project is expected to be completed in 2020. Since MCKIP 3 is intended for an assortment of different business opportunities, it is believed that it will attract foreign investment from a wide variety of countries for various purposes.

MCKIP 1 is designated for high technology industries and heavy industries. The first investor to be established there is Alliance Steel (M) Sdn. Bhd. [3] (Alliance Steel), which has been granted approval to invest RM5.6 billion in its facility in 2016. Its production site, which will cover 710 acres of land, is currently under construction. The steel mill is expected to be operation by the end of 2017. Once it is in full service, Alliance Steel expects to generate more than 3,500 job opportunities.

|

Alliance Steel (M) Sdn. Bhd. It’s estimated that the annual local demand for steel in Malaysia is over 10 million tonnes. However, the existing production facilities of some local steel mills are lagging behind in terms of productivity and technology innovation. Bringing in a new investor in the form of MCKIP will enhance the productivity and quality of steel production in Malaysia. Inspired by the Belt and Road Initiative, there are many infrastructure and construction developments now in progress along the 21st Century Maritime Silk Road. With its current production facilities in Guangxi, Alliance Steel is expanding its production facilities in MCKIP in order to meet the rising demand for steel in the ASEAN and international markets. Alliance Steel aims to upgrade levels of production technology and increase the degree of production automation in Malaysia’s new production sites. Its integrated modern steel mill will apply China’s most technologically advanced manufacturing process to produce the best quality high carbon steel rods, wires and H-shaped steel. Within its enclosed integrated steel mill, conveyor belts will be used to ensure the smooth flow of material and thereby streamline the operation. All waste water will be recycled and reused in the production process in order to minimise the impact on the environment. According to Alliance Steel, it will source raw materials from Malaysia as much as possible. Yet, some raw materials may still need to be imported. Maritime transport from China’s Qinzhou Port (in Guangxi) to Malaysia’s Kuantan Port takes just three days. In the early stages of its new operation, Alliance Steel may recruit some technicians from China before training up local talent in Malaysia. Alliance Steel is also co-operating with Malaysia’s institutions to establish a training programmes for local people, in order to enhance their metallurgy operation techniques. In this way, it will further strengthen the social and economic ties between two countries. |

Besides Alliance Steel, many China-based companies are planning to expand their production bases to MCKIP in order to extend their supply chain coverage within the region. For example, Guangxi Zhongli Enterprise Group Co. Ltd. will invest RM2 billion for the development of manufacturing of clay porcelain and ceramic in MCKIP 1. Meanwhile, ZKenergy (Yiyang) New Resources Science and Technology Co. Ltd. will invest RM200 million for the development of an engineering and production-based centre that will produce renewable energy for MCKIP’s own consumption. This will help MCKIP to position itself as a leading ‘green’ environmental-friendly industrial park.

In addition to the aforementioned projects in MCKIP, other investment projects led by China and Malaysia companies are already in the pipeline. The new investors include China’s Guangxi Investment Group Co. Ltd., which will invest RM580 million on an aluminum component manufacturing facility. Another is Malaysia’s LJ Hightech Material Sdn. Bhd., which will invest RM1 billion in a high-technology production-based plant to produce concrete panels and activated rubber powder for the construction industry. The construction works for these projects in MCKIP are expected to begin in the first quarter of 2017. Once completed, they will create more than 3,000 job opportunities.

Investment Environment in MCKIP

MCKIP not only welcomes investors from China and Malaysia, but also from ASEAN region and beyond. In addition to the current ECER incentives package [4], the Ministry of International Trade and Industry (MITI), together with the ECERDC, has offered special incentives packages for investors in MCKIP (subject to Terms and Conditions). Below are some highlights of the fiscal incentives in MCKIP:

-

Fifteen years of 100% corporate tax exemption from the year of statutory incomes derived, or 100% Investment Tax Allowance on qualifying capital expenditure incurred for five years.

-

15% of income tax rate for qualified knowledge workers [5] in MCKIP until 31 December 2020.

-

Import duty and sales tax exemption for raw materials, parts and components, plants and machinery and equipment.

-

Stamp duty exemption on transfer or lease of land or building used for development.

-

Investors can apply for Unit Kerjasama Awam-Swasta (UKAS) facilitation fund up to 10% of project cost or RM 200 million (whichever is lower), to finance the development of basic infrastructure.

Apart from fiscal incentives, MCKIP also offers other competitive incentives [6] and support in order to encourage both local and overseas investment. These include competitive land prices, flexibility in the employment of expatriates and the facilitation of human capital development. At present, MCKIP is still at the early stages of development. By implementing incentives and measures such as these, MCKIP aims to attract a range of investors from various industry sectors.

Synergistic Development of Kuantan Port

Located just 10 kilometres away from MCKIP, Kuantan Port currently handles mainly break bulk cargoes (such as steel pipes, sawn timber and plywood), dry bulk cargoes (such as iron ore, coal and fertilisers), liquid bulk cargoes (such as palm oil, vegetable oil, mineral oil and petrochemical products) and container cargoes. Kuantan Port is an all-weather port with 11.2 meter draft and the capacity to handle vessels up to 40,000 DWT (Dead Weight Tonnage). There are 22 berths at Kuantan Port with bulk cargoes accounting for 95% of throughput. At present, container business is relatively small and mainly handles automotive components for Pekan Automotive Industrial Park.

Kuantan Port is operated by Kuantan Port Consortium Sdn. Bhd. (KPC) [7]. It can offer well-developed port facilities and services, and a strong network of global shipping connections. As such, the port is set to be a catalyst for the development of the industrial and manufacturing activities in MCKIP, as well as those in Kuantan Port Industrial Area [8] and Gebeng Industrial Estate [9].

At present, major shipping lines which operate at Kuantan Port include Evergreen Marine Corporation Ltd, Jardine Shipping Services, Malaysia International Shipping Corporation Bhd. and Pacific International Lines.

Source: Kuantan Port Consortium

As it stands, Kuantan Port provides port services for the nearby high-end and high technology industries and heavy industries, such as those based at the Kuantan Port Industrial Area, Gebeng Industrial Estate and Pekan Automotive Industrial Park. In order to meet the extra port service demand now being created by MCKIP, Kuantan Port is currently under expansion. There will be three phases in the port expansion. Phases 1A and 1B will cover the import and export of bulk cargoes. In Phase 2, a new deep water terminal will be developed, which will be able to handle up to 200,000 DWT or 18,000 TEUs container vessels.

Construction of Phase A1 is now underway and is expected to be completed by the end of 2017. Phase 1A will be able to handle ships up to 150,000 DWT. The expected completion time of Phase 1A is in line with the completion time of Alliance Steel production sites at MCKIP 1. This will enable Alliance Steel to import raw materials from overseas markets and then export its final products to the international markets via Kuantan Port. The construction of Phase 1B is also underway and it should commence operation in late 2018. Both Phase 1A and Phase 1B will target the handling of bulk cargoes. Presently, a new 4.7 kilometres breakwater is under construction, which will create a sheltered harbor. This sheltered basin will allow for berths to operate safely and efficiently throughout the year, even during the monsoon season.

Strategic Partnerships along the New Silk Road

In terms of their potential growth, Kuantan Port and MCKIP go hand in hand. Although Kuantan Port currently handles mainly bulk cargoes, the Phase 2 development is intended to be a container port, in order to handle the import and export of light industry cargoes for MCKIP 3. The new deep-water terminal will become a major trans-shipment hub on the east coast of Malaysia. By the time of completion, it is estimated that Kuantan Port will be able to handle 52 million freight weight tonnes of bulk and container cargoes.

In light of China’s 21st Century Maritime Silk Road development, Kuantan Port will become a key trading gateway. China and Malaysia are forming a ‘port alliance’ to fast-track trade by reducing customs bottlenecks at both ends. Under the port alliance, 10 Chinese ports (including Dalian, Shanghai, Ningbo, Qinzhou, Guangzhou, Fuzhou, Xiamen, Shenzhen, Hainan and Taicang) will collaborate with six Malaysian ports (including Port Klang, Malacca, Penang, Johor, Kuantan and Bintulu). The final details are still being worked out, but the development is geared towards improved trade facilitation and integration within the region. It has been reported that the strategic imperative is to set up joint customs clearance facilities between ports of China and Malaysia, in order to reduce the overall time and cost of moving goods across the borders.

Kuantan Port to Perform Re-distribution Function

In June 2016, Kuantan Port received approval from The Ministry of Finance in Malaysia to establish a free zone port [10]. This will strengthen Kuantan Port’s plans to develop into a trans-shipment hub. A Free Zone is defined as a place outside Malaysia where there is no required payment of customs duty, excise duty, sales tax or service tax. According to KPC, the Free Zone in Kuantan Port may cater for commercial activities including trans-shipment, trading, regional distribution, inspection/sampling and related value-added services (such as repackaging, relabelling and break bulking).

By way of example, international distributors who have established their own sales network in the region can consolidate their products destined for Malaysia and other ASEAN and south Asian countries. They can then save costs by shipping them, in the first instance, to Kuantan Port free zone warehouse in the form of FCL (full container load). There, the importer may arrange re-packing or re-labeling for their products before redistributing the products in LCL (less than a container load) to their final market destinations in the region.

Evolving Business Potentials

Most of the current investments in MCKIP come from China-based companies, mainly involving heavy industry and high-end/high technology industry. In fact, MCKIP not only targets investors from China and Malaysia, but also other ASEAN countries and beyond. In particular, with the upcoming development in MCKIP 3 as a multi-purpose zone, new business opportunities may arise in areas such as commercial property development, residential management and hotel management.

MCKIP is the engine for new growth at Kuantan Port. Expecting a sharp increase in demand for bulk cargo services driven by the high-end/high technology industries and heavy industries establishing themselves in MCKIP 1 and MCKIP 2, Kuantan Port’s expansion plans are under way. With the port set to evolve into a trans-shipment hub for the ASEAN, it will become a free zone in order to provide value-added services for the container cargoes. Many investment opportunities exist in the construction of port facilities and other value-added logistics services.

Together, MCKIP and Kuantan Port are being developed into an industrial hub and an integrated logistics centre in Malaysia. These developments have created a new trade platform for companies which are interested in exploring the range of business opportunities in the ASEAN along the 21st Century Maritime Silk Road.

[1] In ‘Two Countries, Twin Parks’, ‘Two Countries’ represents Malaysia and China; ‘Twin Parks’ represents Malaysia-China Kuantan Industrial Park (MCKIP) and China-Malaysia Qinzhou Industrial Park (CMQIP).

[2] The ECER covers Kelantan, Terengganu, Pahang and the district of Mersing in Johor. It occupies an area of 66,000 square kilometres or 51% of the total area of Peninsular Malaysia.

[3] Alliance Steel (M) Sdn. Bhd. is a state owned joint-stock enterprise by Guangxi Beibu Gulf Port International Group Co. Ltd. and Guangxi Sheng Long Metallurgical Co. Ltd.

[4] For details, please refer to ECER investment opportunities.

[5] A non-resident is subject to income tax in Malaysia for his income which only comes from Malaysian sources, at a uniform rate of 28% unless he works less than 61 days in the year or his country of residence has concluded a double taxation agreement with Malaysia.

[6] For details, please refer to Malaysia-China Kuantan Industrial Park.

[7] Kuantan Port Consortium Sdn. Bhd. (KPC) is jointly owned by IJM Corporation Berhad and Beibu Gulf Holding (Hong Kong) Co. Ltd. on a 60:40 equity holdings with the Government of Malaysia having a special rights share.

[8] Kuantan Port Industrial Area is located within the vicinity of the port.

[9] Gebeng Industrial Estate is a world-class petrochemical zone covering 8,600 hectares.

[10] Source: Kuantan Port Consortium Sdn. Bhd.

Editor's picks

Trending articles

Despite their differences, China and Vietnam both have much to gain under the ambitious Belt and Road Initiative.

Will prospects for the Hai Phong port be clearer thanks to BRI investment?

Although Vietnam has achieved remarkable economic progress in recent years, its poor infrastructure is still seen as likely to blight any future development. In particular, major network upgrades to its transport, power and technology systems are desperately needed if it is to deliver the smoother and more cost-effective trade flow that is vital for success in the region's increasingly connected markets.

In light of this, it could be argued that China's ambitious Belt and Road Initiative (BRI) could benefit Vietnam enormously. Under the terms of the BRI, China will help fund and construct a world-class network of high-speed railways, motorways, pipelines and ports across South Asia and Southeast Asia, with Vietnam seen as a key component of this blueprint for economic revitalisation.

Vietnam's strategic location and ease of access to its ASEAN neighbours has seen it earmarked for a pivotal role in the BRI. Indeed, its co-operation is required if China is to make good on its promise to deliver a series of trade routes running from Fujian, passing through Southeast and South Asia and onwards to Europe.

A particular focus is the planned upgrade of North Vietnam's Hai Phong port, a development seen as a priority under the terms of the BRI. A US$1.2-billion project, it has been divided into two distinct phases.

Phase one is the actual construction work on the port, a project to be managed by the Vietnam Marine Administration. The second phase is a joint venture between a number of Vietnamese and Japanese enterprises and will involve the construction of two wharves with a total length of 750 metres, giving the port the capacity to service 100,000-tonne container ships.

Once fully operational, the facility will form part of a direct trade link, connecting China and Vietnam's northern region with the US and European markets, while bypassing Singapore. Outlining the priorities driving the development, Nguyen Hung Viet, the General Director of the Hai Phong Port Joint Stock Company, said: "This year, we will focus on investing in the Tan Vu terminal, Hai Phong's leading facility. We plan to enlarge its yard by a further 10 hectares, giving it total yard area of 55 hectares. We will also be building additional administration facilities. Further investments will include the provision of new piers, wharves and cranes."

Despite the obvious economic benefits to both parties of enhancing Vietnam's infrastructure and its connectivity to China, a number of sensitivities remain. In addition to the ongoing territorial dispute regarding the South China Sea, Vietnam has also expressed concerns about the quality of the construction work, the sustainability of the project and about any possible environmental damage.

Highlighting this, a statement from OBOR Watch, a self-appointed monitor of the progress of the Initiative, said: "China's business practices have excited local protests in several countries where state-owned enterprises have constructed energy and infrastructure installations. Indeed, a number of Chinese firms have been accused of cutting corners, ignoring safety standards, and using second-hand or low-quality materials and equipment."

Despite such concerns, Chinese investment in BRI-related projects is still being officially welcomed in Vietnam. During a September 2016 summit in Beijing, attended by the Vietnamese Prime Minister Nguyen Xuan Phuc and the Chinese Premier Li Keqiang, the two sides publicly reaffirmed their commitment to the BRI and to the investments that have already been agreed. These include the China Export-Import Bank's 2013 financing of the Ninh Binh coal-based fertilizer plant and, in the same year, the China Development Bank's investment in Phase One of the Vung Ang Power Plant.

China is also playing a significant role in the development of Vietnam's railway infrastructure. To this end, China Railway Sixth Group Company has been awarded the contract to construct the Cat Linh-Ha Dong urban railway project in Hanoi. China has provided most of the $550 million funding for the project through preferential credit loans of about 1.2 billion yuan ($169 million), as well as through another $250 million in concessional loans.

Another cornerstone BRI project that was high on the agenda at the Beijing summit was a standard gauge upgrade to the rail link between Lao Cai on the border with China's Yunnan province and Hanoi and Hai Phong. Once completed, this will allow greater trade volumes to be carried along the line, a necessity given the expanded capacity of Hai Phong's port capabilities once its own upgrade has been completed.

Geoff de Freitas, Special Correspondent, Ho Chi Minh City

Editor's picks

Trending articles

With work now under way on the China-Laos Railway Project, hopes are high that it will form a key element of the Belt and Road Initiative, transforming Laos' infrastructure and delivering rapid and affordable freight transit across Southeast Asia.

Can Laos help bridge China's trade transportation gap with Southeast Asia?

Charged with revitalising the least-developed country in the ASEAN bloc, the priority of the Laos government has long been to alleviate poverty by boosting industrialisation. It has also been keen to capitalise on the country's key asset – its strategic geographical location, a location that sees it uniquely positioned to act as a bridge between China and the Southeast Asian states of Myanmar, Thailand, Cambodia and Vietnam.

One key problem, however, has perennially undermined any bid by Laos to fully realise the benefits of its unique location – its wholly underdeveloped transportation infrastructure. Now, though, there is a growing expectation that the Belt and Road Initiative (BRI) – China's ambitious multinational infrastructure and trade facilitation investment programme – could be a key element in changing all of that.

In particular, it is believed that the BRI-backed China-Laos Railway Project could transform the fortunes of this landlocked nation. The project, which is seen as essential if Laos is to meet its own economic targets, has already been designated as a priority under the terms of the nation's Eighth Five Year Plan.

Once completed, the US$7 billion project will deliver a high-speed rail link running from southern China, through Laos and terminating at the industrial eastern coast of Thailand. The 428km standard-gauge Laos section will run south from the China-Laos border at Boten to Luang Prabang, Vang Vieng and Laos' capital Vientiane. It will then continue on to the Nong Khai Thai-Laos border crossing, ultimately connecting with Thailand's rail network.

Clearly evangelical about the prospects for the line, Bouchanh Sinthavong, the Lao Minister of Public Works and Transportation, has gone on record as saying: "This railway will benefit Lao people of all ethnic groups. It will reduce transportation costs, while stimulating the development of the agricultural and industrial sectors, as well as tourism, investment and general trade. On top of that, it will also generate income for people across the country."

The project has also been welcomed by the private sector. Highlighting the potential benefits of the line, Yao Bin, the Chairman of the Krittaphong Group, one of Laos' largest construction companies, said: "It currently takes more than 30 days to transport goods from Thailand to the coastal provinces of China by sea. Once the China-Laos Railway is up and running, the entire process could be cut to less than 24 hours."

Despite such upbeat sentiments, concerns over the possible social and environmental consequences caused a year-long delay in the launch of the project. Work, however, did eventually begin on 1 January this year, with construction scheduled for completion before 2022.

Once completed, trains on the line will travel at an estimated speed of between 160-200km/h, making it – by far – Laos' longest and fastest railway. In total, some 60% of the line will run either over bridges or through tunnels. Along the route, there will be a total of 33 stations, including 21 by-pass stations, 11 passenger stations and one main freight station. The construction work involves 175.5km of subgrade, 170 bridges (with a total length of 69.2km), and 72 tunnels (with a total length of 183.9km).

In terms of ownership, China will maintain a 70% stake in the line, with Laos retaining the remaining 30%. The cost of the project has been estimated at in excess of $7.2 billion – more than half of Laos' annual GDP and equivalent to $17.1 million per kilometre. The cost will primarily be met by the Export-Import Bank of China.

In addition to the main rail line, there are also plans to construct a freight terminal in Vientiane, which will facilitate connections to the Saysettha Development Zone, an existing China-Laos co-operative project. According to Liu Hu, Saysettha's General Manager, the prospect of the rail link has already seen 32 new businesses established with the Zone.

By 2030, it is hoped that the zone will be home to some 150 companies, providing 30,000 much-needed new jobs in the region. According to official forecasts, the zone will also yield $300 million a year for local government coffers.

Geoff de Freitas, Special Correspondent, Vientiane

Editor's picks

Trending articles

In order to boost its economy and attract investment, Indonesia’s government is determined to overhaul the country’s essential infrastructure. In line with this, the Sea Toll Road programme – a development with a number of similarities to China’s Belt and Road Initiative – will significantly enhance Indonesia’s maritime capabilities. With the country’s business environment becoming ever more vibrant, while its infrastructure shortcomings become less of a problem, innovative and visionary Hong Kong entrepreneurs – including those in the service sector – should prepare themselves for a whole new world of opportunities.

A World of Opportunities and a Huge Funding Gap

Indonesia is at the very forefront of the boom in infrastructure redevelopment taking place across Southeast Asia. Despite difficulties in maintaining the country’s mandated 7% annual economic growth, President Joko Widodo seemingly remains determined to improve the country’s essential infrastructure.

As part of the 5.5% increase in the overall spending specified in the 2017 State Budget, a total of IDR 387.3 trillion (approximately US$30 billion) has been earmarked for infrastructure development. This is the largest amount ever allocated to such projects and represents an increase of 22% on the previous budget.

In terms of where the money will actually be spent, the Committee of Infrastructure Priorities Development Acceleration (KPPIP) has identified 30 projects – out of 225 national strategic undertakings – as priorities for the period 2016-2019.

The government has adopted an innovative and seemingly effective approach for generating funding for these infrastructure projects. Its new tax amnesty programme, for instance, is said to have proved particularly successful. When its first phase ended on 30 September 2016, the programme had already netted the Indonesian government some IDR 97.2 trillion (approximately US$7.5 billion, 59% of the overall target) in additional tax revenue.

The tax amnesty programme offers unprecedented immunity from prosecution as well as concessional tax penalties to individual and corporate taxpayers who voluntarily declare assets (in or outside Indonesia) that went undeclared prior to 31 December 2015. The amnesty is now scheduled to run from 18 July 2016 to 31 March 2017 (the reporting period of the Indonesian tax authority).

Though considered the most successful tax amnesty programme ever undertaken anywhere in the world, Bank Indonesia – the country’s central bank – is forecasting that the final sum repatriated will still be far below the figure required to complete the current infrastructure redevelopment programme. Indeed, it is estimated that the state and regional budgets will only raise around 40% of the total infrastructure funding requirement as set out in the National Medium Term Development Plan (RPJMN) 2015-2019 – IDR 1.98 quadrillion (approximately US$142 billion) out of IDR 4.8 quadrillion (US$345 billion). It is expected that this shortfall will be covered through co-operation with the private sector on a Public Private Partnership (PPP) basis.

Java: Leading Indonesia’s Regional Investment

Home to nearly 60% of all native Indonesians, Java is the most densely populated island on Earth. It’s also a favourite destination for many of those looking to invest in Indonesia and accounts for 54% of the total investment the country secured in 2016. This includes both domestic (DDI) and foreign investment (FDI), across the six economic corridors stipulated under the Masterplan for Acceleration and Expansion of Indonesia’s Economic Development (MP3EI).

Java is made up of four regions and two special territories. Of these, Banten, Central Java, East Java, the Special Territory of Jakarta and West Java were ranked high on the Top 10 lists of DDI and FDI destinations for 2016, with East Java particularly popular among domestic investors and West Java among foreign investors.

This concentration of investors reinforces the island’s role in driving the country’s industrial development and service sectors under the provisions of the MP3EI. As a result, Java looks sure to remain a prime target for international investors as Indonesia take its place amongst the world’s developed countries.

The comparative lack of interest in investment outside of Java, however, may hamper the country’s overall development. In 2014, in order to encourage a more even spread of investment across the country and in line with his ambition to transform Indonesia into a ‘global maritime axis’, President Widodo announced the Sea Toll Road programme as part of the 2015-2019 National Medium Term Development Plan (RPJMN 2015-2019).

China’s Maritime Silk Road and Indonesia’s Sea Toll Road: The Crossover

The Sea Toll Road program is intended to boost Indonesia’s maritime capabilities, which currently support 40% of its international sea trade flow. It also includes measures designed to strengthen governance and close any security gaps seen as likely to threaten the flow of trade or fishing activities within the waterway.

The programme focuses on enhancing inter-connectivity between islands (local integration) and upgrading port infrastructure (globally connected). When fully implemented, Indonesian ports should be more competitive and more attractive to international shippers and forwarders, particularly when compared to the ports of Singapore and Malaysia, both which are currently more popular channels for international traffic.

As part of the Sea Toll Road project, 24 of the nation’s 111 commercial seaports will be expanded, including five hub ports – Belawan/Kuala Tanjung in Sumatra, Tanjung Priok/Kali Baru in Jakarta, Tanjung Perak in Surabaya, Makassar in South Sulawesi, Bitung in North Sulawesi. Some 19 feeder ports are also within its remit, including Batam in Sumatra, Tanjung Emas in Semarang and Sorong in Papua. The programme will expand their capacities, allowing them to handle higher levels of cargo and passenger traffic between western and eastern Indonesia, while also facilitating the further development of the country’s Industrial Estates.

This hub-and-feeder model has also been designed to increase national security by limiting the movement of foreign vessels to hub ports in domestic waters. At the same time, by utilising the feeder ports for regional consolidation, it lends flexibility to the schedule frequency of many of the ports, while also shortening the routes between them.

Logically, any upgrade to the ports of western Indonesia should increase their chances of attracting vessels looking to trans-ship across the Straits of Malacca without calling at Singapore. The developments in eastern Indonesia, meanwhile, are largely designed to reduce the regional price disparity of goods in western and eastern Indonesia by up to 30%. The intention is to achieve this by consolidating the fragmented forwarding sector and rebalancing the inter-island cargo flows.

At present, six regular cargo routes are being introduced, while around 100 sea transport routes are being optimised in order to boost connectivity between the different regions of the country. By 2019, the plan is to build or acquire 609 vessels in order to support the fleet’s expected increase in passenger and cargo traffic. With such moves being implemented in tandem with other logistics infrastructure projects, in order to ease congestion and achieve shorter holding times for containers at major seaports, it is hoped that logistics costs in Indonesia will be reduced from their current level of 26% of GDP to 19% by 2020, then reduced still further to 9% by 2035.

From a more strategic and international point of view, the Sea Toll Road programme is very much in line with China’s Belt and Road Initiative (BRI), which looks to improve business connectivity between Southeast Asia, Africa and the Indian continent. In light of this then, the development of logistics infrastructure along many of Indonesia’s busiest waterways, including the straits of Malacca, Sunda, Lombok and Wetar, is crucial to the success of both of these far-reaching initiatives.

Opportunities for Foreign Investment

In 2015, the realised funds for infrastructure development totalled IDR 190 trillion (US$14.42 billion), more than double the 2010 allocation. For 2017, another record-high level of funding has been allocated for infrastructure spending. Despite this, Indonesia remains in dire need of private participation in its development programme, as the existing funds can only meet roughly 40% of the total infrastructure funding required up until 2019.

Aside from its major on-going infrastructure developments, such as the Sea Toll Road, Indonesia is committed to several other substantial projects, most notably the provision of facilities for the 2018 Asian Games, scheduled to be held in Jakarta and Palembang in South Sumatra. In order to deliver on these commitments, the government has continually revised its negative investment list in a bid to widen the scope of foreign investment in Indonesia. It is hoped that this will engage the private sector by offering foreign investors more favourable terms with regard to ownership and local SME partnership requirements.

Since September 2015, the Indonesian government has introduced a series of economic stimulus packages designed to boost investment through deregulation and fiscal incentivisation. These measures have included streamlining the approval and procurement procedures required for infrastructure projects, a temporary reduction in tax on revalued fixed assets and cuts to energy prices.

At present, one of the other options available for infrastructure financing is the newly established 57-member Asian Infrastructure Investment Bank (AIIB), of which Indonesia is one of the co-founders and one of its principal backers. To date, the AIIB has approved only one programme in Indonesia – the National Slum Upgrading Project, an initiative intended to revitalise basic infrastructure, including drainage systems and water supply access, in 150 towns and cities across Indonesia. Two more projects – related to improving the safety and efficiency of dam operations and establishing a regional infrastructure development fund – are currently under consideration.

No Strangers to Indonesia: Hong Kong Investors

As far as foreign investment is concerned, Hong Kong is no stranger to Indonesia. In 2016, for instance, Hong Kong was the four-largest FDI investor in Indonesia. In this regard, it was behind only Singapore, Japan and the Chinese mainland, while being ahead of the Netherlands and the US. Between 2011 and 2016, Hong Kong’s realised investment in Indonesia grew at a compound annual growth rate (CAGR) of 76%, rising from US$135.0 million to US$2.2 billion.

In October 2013, during a speech to the Indonesian Parliament, Xi Jinping, China’s President, first outlined his vision of the 21st Century Maritime Silk Road and his plans to establish the AIIB. Since that time, Hong Kong’s investment commitment in Indonesia has soared, rising from US$2.9 billion in 2013 to US$4.5 billion in 2015.

A significant proportion of Hong Kong’s investment in Indonesia has been in the real estate, industrial estate and business sectors. At present, a substantial number of Hong Kong companies have investments in Indonesia, including such well-known property developers as Hongkong Land, the Baleno, Bossini, Giordano and Samuel and Kevin fashion brands, toy manufacturers Lung Cheong and Itacho Sushi, the popular sushi chain.

At present, only a relatively small number of Hong Kong-based SMEs have the financial and staff resources required to manage mega-infrastructure projects. A substantial number of innovative and visionary Hong Kong entrepreneurs – including those in the services sector – are, however, ideally equipped to capitalise on many of the other opportunities emerging across Indonesia. As its business environment grows more vibrant and its infrastructure deficiency becomes a thing of the past, Indonesia’s population is becoming ever more willing and able to spend. In combination, all of this makes Indonesia an irresistible prospect for Hong Kong’s outward-looking business community.

A case in point here is OpenPort, a Hong Kong-based end-to-end logistics solution provider, offering app-based services for tracking business-to business shipments in emerging markets. Since opening its Jakarta office in late 2015, OpenPort has contributed significantly to the development of Indonesia’s logistic sector, an industry estimated to have a potential market value of around US$250 billion.

It has achieved this by introducing a common platform for shippers and forwarders, allowing them to track the delivery of goods in real time. This has resulted in a cost-effective and seamless integration of the logistics network and continuous optimisation of supply chains. This has proved a hugely appealing proposition for all parties involved in the increasingly intricate supply chains required by contemporary businesses.

Overall, OpenPort’s Java Office found success through its partnership with many of Indonesia’s increasingly tech-savvy logistics players. By working hand-in-hand with them, it is now seeking to continuously improve the country’s logistics network.

Editor's picks

Trending articles

Seen from the outset as a key partner in bringing China's Belt and Road Initiative to fruition, Malaysia has made clear progress with regard to a number of related infrastructure projects, despite some concerns about the consequences.

The Strait of Malacca: A vital channel for the success of the BRI.

When China's plans for the Belt and Road Initiative (BRI) were first unveiled, it was generally assumed that Malaysia would benefit substantially from the investments on offer and the likely co-operative opportunities. China is, after all, Malaysia's biggest export market and its most significant trading partner.