GDP (US$ Billion)

18.12 (2018)

World Ranking 118/193

GDP Per Capita (US$)

2,566 (2018)

World Ranking 138/192

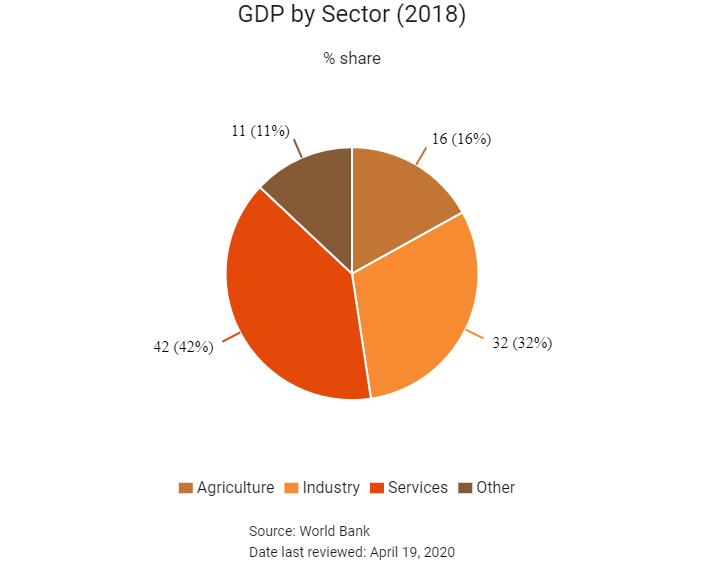

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

75.1 (2016)

Currency (Period Average)

Lao Kip

8679.41per US$ (2019)

Political System

Unitary single-party people’s republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

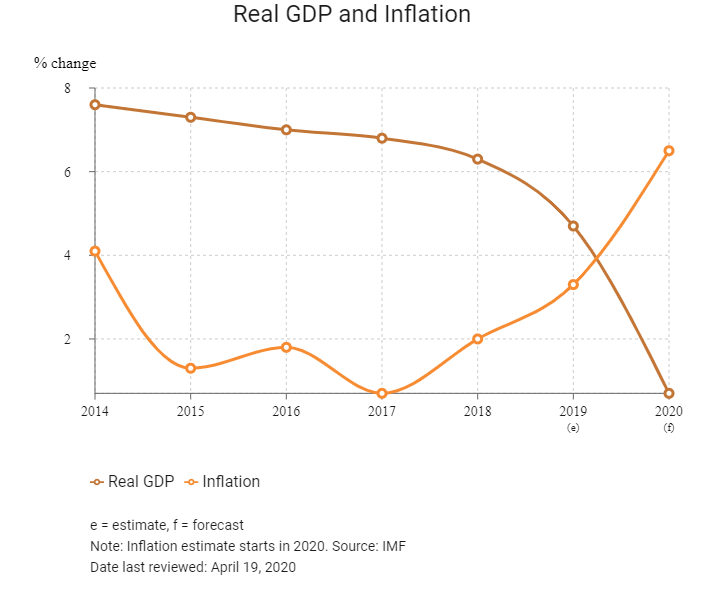

Laos is one of the fastest-growing economies in East Asia and the Pacific, underpinned by improving access to electricity, education and roads, as well as the implementation of structural reforms aimed at improving the business environment. However, it still lags behind its regional peers. The country’s economic performance will cool somewhat over the medium term as the recent accumulation of public debt places increased pressure on its growth potential. The government is seeking to maintain macroeconomic stability by taking steps to improve domestic revenue collection, control expenditure and strengthen public debt management.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

April 2016

At its five-year congress, the National Assembly appointed Bounnhang Vorachith as president and leader of the ruling Lao People's Revolutionary Party (LPRP), succeeding Choummaly Sayasone who, served as the ruling party's general secretary and president of Laos from 2006 to 2016.

September 2016

Former United States President Barack Obama became the first sitting United States president to visit Laos. The United States committed USD90 million dollars over three years to help clear unexploded bombs that the United States dropped on Laos during the Vietnam War.

December 2016

The governments of Laos and Mainland China announced the joint construction of a high speed rail line between Mainland China and Thailand to link Laos with the transport hubs in these countries.

July 2018

The collapse of a dam in July triggered a pause in the approvals of new hydropower projects and an official review of all existing ones in the country.

August 2018

A consultation process (scheduled to last six months) began for the proposed 770MW Pak Lay hydropower project on the Mekong mainstream in Laos. The consultation involved two regional stakeholder forums and a field visit to the Pak Lay project. The power plant was estimated to require a USD2.13 billion investment. Construction is likely to begin in 2022.

August 2018

Mainland China Southern Power Grid Co signed a memorandum of understanding with the Government of Laos to carry out a feasibility study to explore the possibilities of developing a national power grid in Laos.

December 2018

The Chinese government approved a special fund at the 4th Mekong-Lancang Cooperation Foreign Ministers’ Meeting. The fund would enable Mekong countries to carry out 138 projects, with Laos receiving about USD4.5 million to implement 21 projects.

June 2019

New 500kV and 230kV transmission lines would be installed in the capital city, Vientiane, as a joint project between Électricité du Laos and Mainland China Electric Power Equipment and Technology, an affiliate of State Grid Corporation. The project would provide a sustainable supply of electricity for the development of the capital city.

June 2019

Mainland China and Thailand announced that they had banned the direct and indirect import of pigs, wild boars and related products from Laos owing to the first African swine fever outbreak reported by the country.

July 2019

Souliyapon Intertrade Co selected China Machinery Engineering Co (CMEC) to serve as the general contractor for a 230MWp solar photovoltaic project in Laos's Borikhamxay Province. Under the USD345 million contract, CMEC will be responsible for the power plant's design, supply, civil engineering, construction, installation, commissioning and other works. The deal was subject to certain conditions. The construction of the facility is expected to be completed over a period of two years.

September 2019

Tropical storm Podul and tropical depression Kajiki caused flooding in Laos' southern provinces, which caused more than 580,000 people to be displaced and damaged infrastructure and crops in the region.

October 2019

The Government of Laos signed a memorandum of understanding with Petroleum Trading Lao to carry out a feasibility study and complete detailed design for the Laos-Vietnam railway Project. The rail line would start from Thakhaek district in Khammuan province of Laos to Vung Ang seaport in Vietnam's central Hà Tinh province. The single-track railway line would cover around 150km in Laos and another 120km on the Vietnamese side. It would be used for both freight and passenger transport. The study was expected to be completed between eight and 12 months. Construction was expected to start by the end of 2021, with completion expected by 2024.

February 2020

Laos and Thailand held a meeting from February 25-26, 2020, aimed at boosting bilateral trade and investment.

March 2020

Construction started on the power supply project for Laos-Mainland China railway scheme. The power supply project, running along the railway line through five provincial administrative regions in northern Laos, involved the construction of 20 circuits of 115kV transmission lines, totalling 268km, as well as 635 power towers. The project would extend 11 bays in 10 substations to supply power from Electricite du Laos (EDL) grid to 10 railway traction substations. The project was being executed by a joint venture between China Southern Power Grid Yunnan International Co and EDL on a build-operate-transfer model. The project is due to become operational in March 2021. The 414km railway line will run from the Boten border gate at the Laos-Mainland China border to Vientiane and is due to be operational in December 2021.

April 2020

A proposed 13-measure economic stimulus package was endorsed by the cabinet. Measures included establishing a separate task force to address the economic impact of Covid-19. A new electricity tariff to ensure the supply of electricity, in effect from May 1, 2020, through December 31, 2025, had been approved. Other policies included duty fee exemption for imports of goods to be used specifically for the outbreak, exemption of profit tax (PT) for businesses earning between LAK50 million and LAK400 million for the June quarter of 2020, deferring tax collection from tourism-related businesses for three months; postponing mandatory contribution to social security by affected businesses for three months, and extending the road tax payment by three months.

Sources: BBC Country Profile – Timeline, Mekong River Commission, Vientiane Times, Asia News, IMF, Fitch Solutions

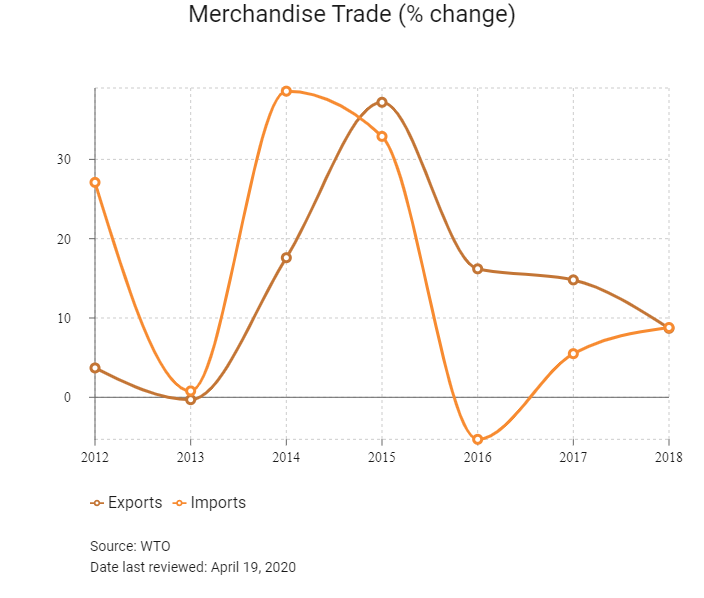

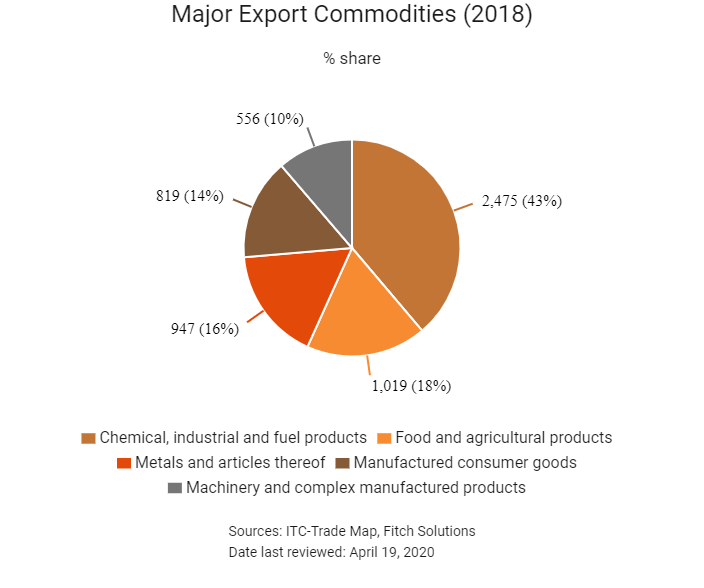

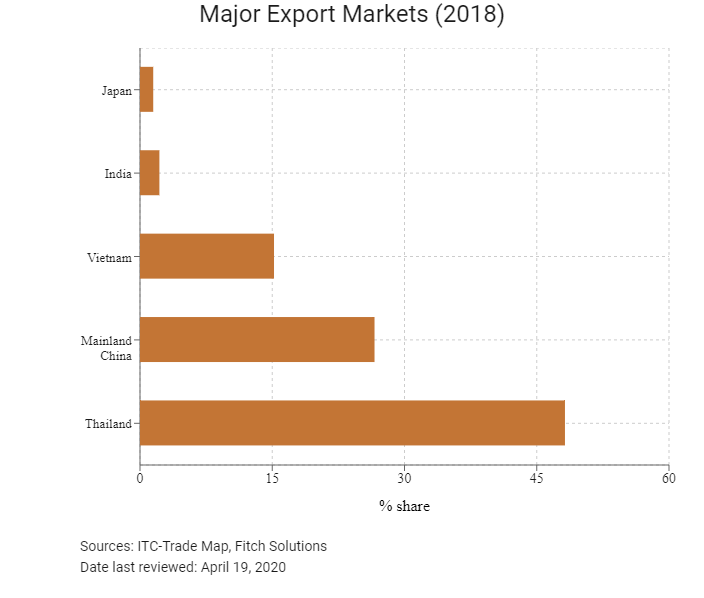

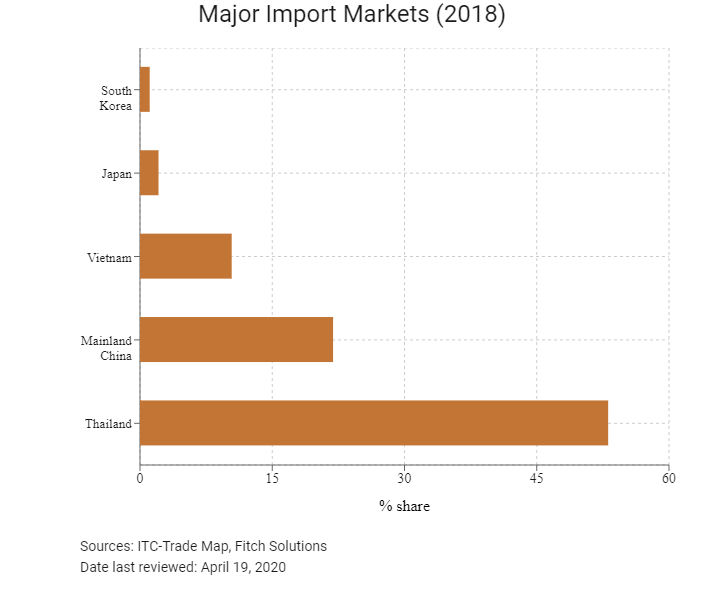

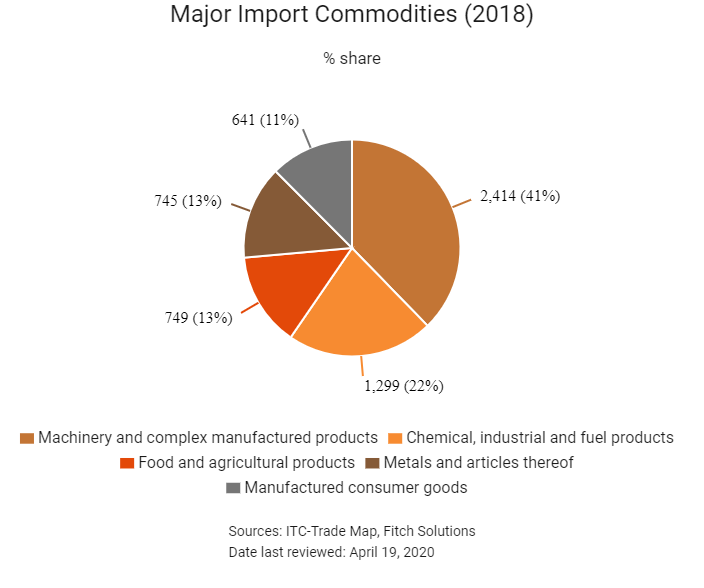

Merchandise Trade

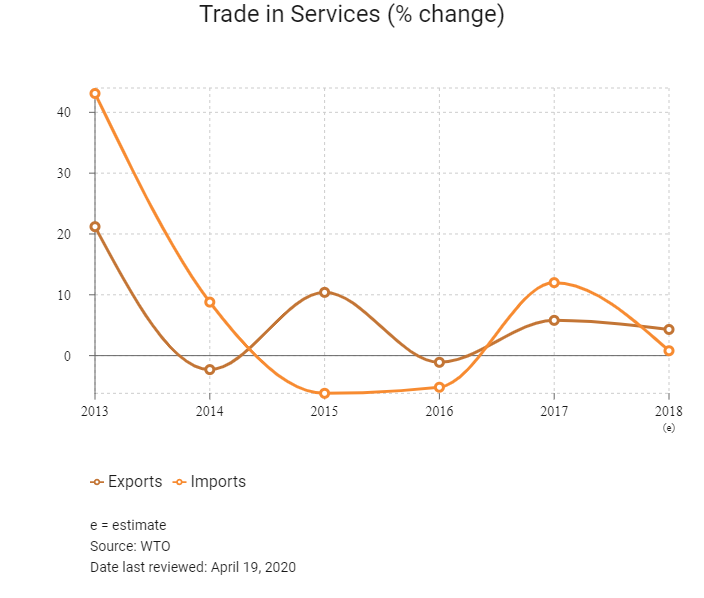

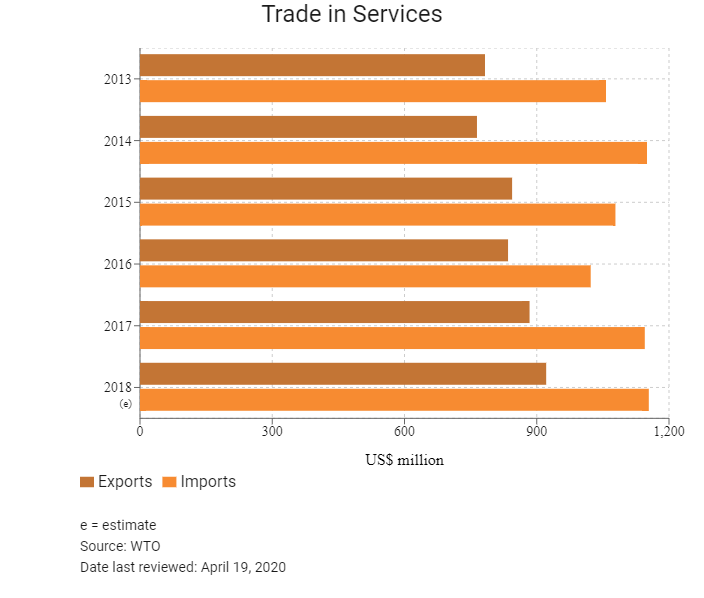

Trade in Services

- Laos became the 158th member of the World Trade Organization (WTO) on February 2, 2013.

- All goods imported into Laos are subject to import duty. Exemptions are available to enterprises operating promoted investment activities.

- The ASEAN was established on August 8, 1967 in Bangkok, Thailand, with the signing of the ASEAN Declaration (Bangkok Declaration) by the founding members of ASEAN, namely Indonesia, Malaysia, the Philippines, Singapore and Thailand. Laos joined the association on July 23, 1997. ASEAN Vision 2020, adopted by the ASEAN leaders on the 30th anniversary of ASEAN, agreed on a shared vision of ASEAN to promote economic growth and regional stability.

- Generally, duty rates are based on the ASEAN tariff nomenclature for imports from ASEAN member countries (ASEAN Trade in Goods Agreement – ATIGA).

- Under ATIGA, ASEAN aims to deepen economic links among member states by reducing trade barriers to allow a free flow of goods in the region. Cambodia, Laos, Myanmar and Vietnam have reduced their import duties to 0-5% on 98.86% of their tariff lines. Laos is continuing efforts to reduce its tariffs for ASEAN imports to zero. Focus is given to addressing non-tariff barriers, which is positive for investors as it will help to lower overall trade costs, increase trade volumes and create a larger market and economies of scale for businesses.

- Laos has signed free trade agreements (FTAs) with ASEAN dialogue countries – Australia and New Zealand (under their Closer Economic Relations FTA), Mainland China, India, Japan and South Korea – otherwise, normal rates are applied. Duty rates range between 0% and 40% depending on whether the goods are from within the ASEAN region or from another source.

- Excise tax is levied on consumers of certain imported goods, domestic produced goods, and services within the territory of Laos. The rates range from 5% to 90%. Importers file and pay excise tax at the time of filing at customs checkpoints. Domestic producers and service suppliers file their monthly excise tax returns no later than the 15th day of the following month.

- The standard value added tax (VAT) rate is 10%. VAT is imposed on the final consumer of goods and services. Domestic goods and services used for production, trading, and consumption in Laos; goods imported into Lao, and services rendered by foreigners to Lao customers, are subject to VAT. Certain goods and services are exempt including unprocessed agricultural products, seeds, fertilisers, textbooks, education services, medical services, certain bank services, and financial institution services.

- Exported goods are zero-rated, except for natural resources that are not finished goods, which are subject to a 10% VAT. The conventional credit method is used to calculate the VAT payable. Excess input VAT can be carried forward for six months (extendable) relating to goods and services. Excess input VAT arising from capital expenditure that is regarded as fixed assets can be claimed until it is fully utilised. Input VAT for exports is refundable.

- One unique feature is that VAT is imposed on the services rendered by overseas service providers to domestic service users (withholding VAT at a rate of 10%).

- Individual companies in the petrochemical industry are required to file an annual import plan. The government controls the retail price and profit margins of gasoline and diesel, which weakens profitability and flexibility in this sector. Other goods prohibited for import and export range from explosives and weapons to certain forestry products and wildlife.

- In May 2016, Lao Prime Minister Thongloun Sisoulith issued a moratorium on the export of logs and timber in order to decrease shipments of illegally obtained logs, timber, processed wood, roots, branches, and trees from natural forests.

Sources: WTO – Trade Policy Review, national sources, Fitch Solutions

Multinational Trade Agreements

Active

- ASEAN: The ASEAN Free Trade Area (AFTA) is a trade bloc agreement supporting local manufacturing in all ASEAN countries. Laos benefits from increased regional integration and tariff liberalisation, which includes the elimination of import duties in various sectors and classes of goods and maximum tariffs of up to 5% between members. These factors will help reduce input costs for businesses and increase the country's exporting capacity and industrial base in the long term. The 10 member states are Brunei, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Myanmar, Cambodia, Laos and Vietnam. Exports of most agricultural and industrial products from Laos to these markets are not subject to tariff rates, except for those under the General Exception List or the Sensitive List when exporting to newer ASEAN members (Cambodia, Myanmar and Vietnam). As a member of ASEAN, Laos' economy is open to other significant trade agreements with key regional markets, such as Mainland China and India.

- ASEAN-Mainland China FTA (ACFTA): The framework agreement on Comprehensive Economic Cooperation between ASEAN and Mainland China , signed on November 5, 2002, marked ASEAN's first FTA with a dialogue partner. Trade relations between Laos and Mainland China benefit from trade preference in terms of tariff exemption or reduction under ACFTA. Mainland China is an important market for Laos as it is the country's major trading partner and an important source of investment.

- ASEAN-Japan FTA (AJFTA): The framework for a Comprehensive Economic Partnership (CEP) between ASEAN and Japan was signed by leaders at the ASEAN-Japan Summit on October 8, 2003, and was aimed at establishing a CEP agreement between ASEAN and Japan. The agreement on the ASEAN-Japan CEP (AJCEP) concluded in November 2007 and signing was completed on April 14, 2008. AJCEP is comprehensive in scope, with chapters on trade in goods; sanitary and phytosanitary measures; standards, technical regulations and conformity assessment procedures; investment; and services and economic cooperation. The agreement aims to liberalise and facilitate the trade in goods between ASEAN and Japan, and promote cooperation in fields such as information and communications technology, intellectual property, and small- and medium-sized enterprise development. The parties will also continue to discuss and negotiate improvements to the chapters on trade in services and investment. Trade relations between Laos and Japan benefit from trade preference in terms of tariff exemption or reduction under the AJFTA. Japan is a large developed market and one of Laos' major trade partners.

- ASEAN-South Korea FTA (AKFTA): ASEAN and South Korea consolidated their partnership by signing the Framework Agreement on Comprehensive Economic Cooperation at the ninth ASEAN-South Korea Summit on December 13, 2005, which provides for the establishment of the ASEAN-South Korea FTA. Under this framework, three major agreements on trade in goods (August 24, 2006), trade in services (November 20, 2007) and investment (June 2, 2009) were signed. The agreement provides for the progressive reduction and elimination of tariffs by each country on almost all products. Laos benefits from trade preference in terms of tariff exemption or reduction under this agreement.

- ASEAN-India Trade in Goods Agreement FTA (AIFTA): AIFTA was signed at the 7th ASEAN Economic Ministers (AEM) – India Consultations on August 13, 2009. The agreement entered into force on January 1, 2010 for India and some ASEAN member states. The ASEAN-India Trade in Services and Investment Agreements were signed in November 2014. Laos benefits from trade preference in terms of tariff exemption or reduction under AIFTA. This will help Laos in terms of trade growth and diversification given the size and performance of the Indian economy and other ASEAN member states.

- Laos-Vietnam Border Trade Agreement: Apart from ASEAN, Laos benefits from reciprocal access under the trade agreement between Laos and Vietnam for 32 tariff lines with 50% of the AFTA rate, while all other products are at a 0% rate, except for 155 tariff lines which fall under the GEL of Vietnam. Vietnam is a high-growth developing market and Laos's third highest import source and export destination.

- The ASEAN-Australia-New Zealand FTA (AANZFTA): Signed on February 27, 2009, the agreement is ASEAN's first FTA with two developed countries simultaneously and the first ASEAN FTA done in a single undertaking. AANZFTA is ASEAN's most ambitious FTA to date, covering 18 chapters that include new areas that ASEAN had not previously negotiated on, such as competition policy and intellectual property. AANZFTA also includes an Economic Cooperation Support Programme, which will provide technical assistance and capacity building to the parties of the AANZFTA with the aim of supporting the implementation of the agreement and supporting the overall regional economic integration process. The agreement entered into force for all parties in 2012 and work is currently under way to resolve and implement the built-in agenda as stipulated under the agreement. The agreement aims to eliminate tariffs on 99% of exports to key ASEAN markets by 2020.

- ASEAN-Hong Kong FTA (AHKFTA): Hong Kong and ASEAN commenced negotiations of an FTA and an investment agreement in July 2014. After 10 rounds of negotiations, Hong Kong and ASEAN announced the conclusion of the negotiations in September 2017 and signed the agreements on November 12, 2017. The agreements are comprehensive in scope, encompassing trade in goods and in services, investment, economic and technical co-operation, dispute settlement mechanisms and other areas. The agreements will bring legal certainty, better market access and fair and equitable treatment in trade and investment, thus creating new business opportunities and further enhancing trade and investment flows between Hong Kong and ASEAN. The agreements will also extend Hong Kong's FTA and investment agreement network to cover all major economies in South East Asia. The agreement came into force on January 1, 2019, but it will take time for all members of ASEAN to comply as implementation is subject to the completion of the necessary procedures. Hong Kong is a key export market and the reduction of tariffs will ease the trading process. Hong Kong's potential as a key export market increases the importance of the AHKFTA.

Under Negotiation

Regional Comprehensive Economic Partnership (RCEP): Negotiations on a framework agreement for RCEP stalled after India announced its withdrawal from the trade pact at a RCEP summit held in Bangkok in November 2019. Expectations had been for negotiations to conclude in 2019, paving the way for the agreement to enter into force by late 2020. RCEP negotiations without India may now be concluded in 2020, but the withdrawal of India represents a setback to attempts to counter the growing wave of protectionism in the US and other parts of the world. RCEP will have broader and deeper engagement with significant improvements over existing regional FTAs and agreement will need to be reached on politically sensitive issues, including trade in services, investment rules and protection for intellectual property rights, as well as tariffs, where the target is to remove trade barriers on at least 92% of products within ten years. Formally launched in 2012, RCEP is a Mainland China and ASEAN-led project which, before the withdrawal of India, involved 16 countries, namely the ten ASEAN countries and the ASEAN Free Trade Partners (Australia, Mainland China, India, Japan, South Korea and New Zealand). It would have been the world’s largest trade pact covering nearly half the world’s population, one third of global GDP and around 29% of global trade.

Note: Only major FTAs cited

Sources: WTO Regional Trade Agreements database, Asean.org, Fitch Solutions

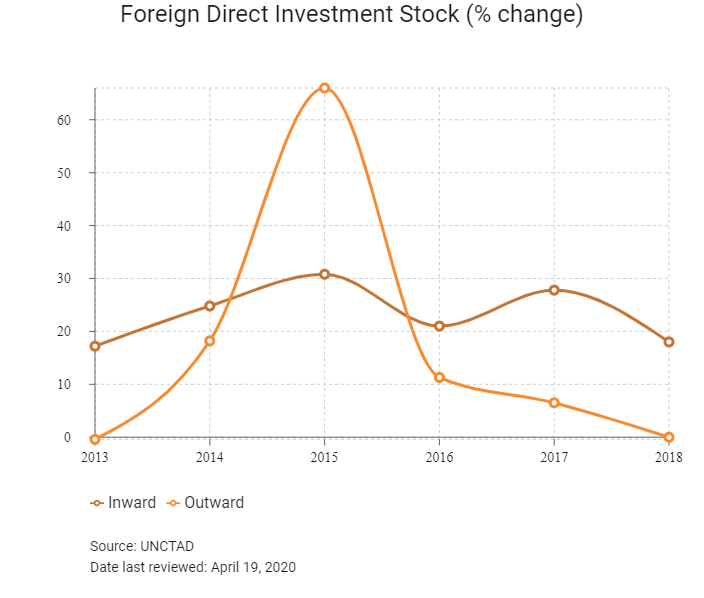

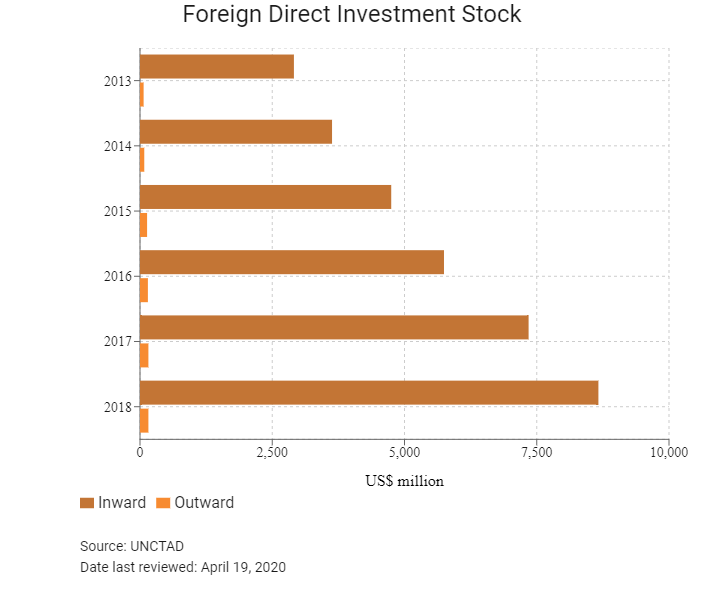

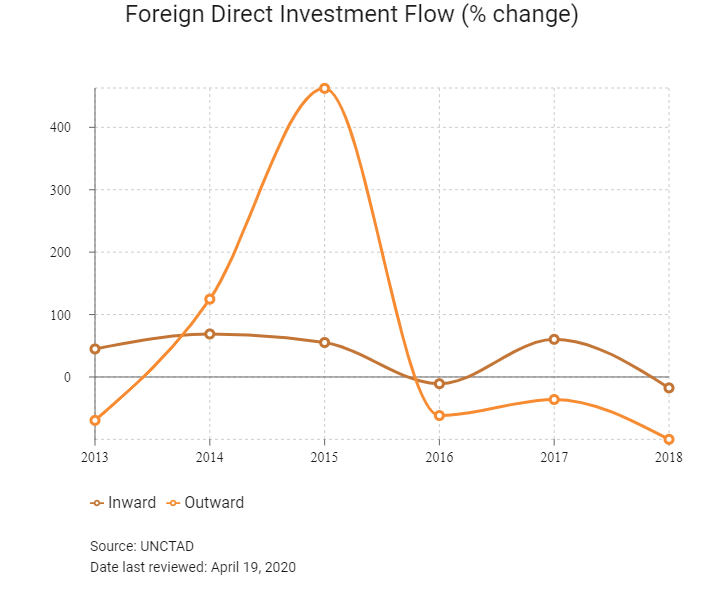

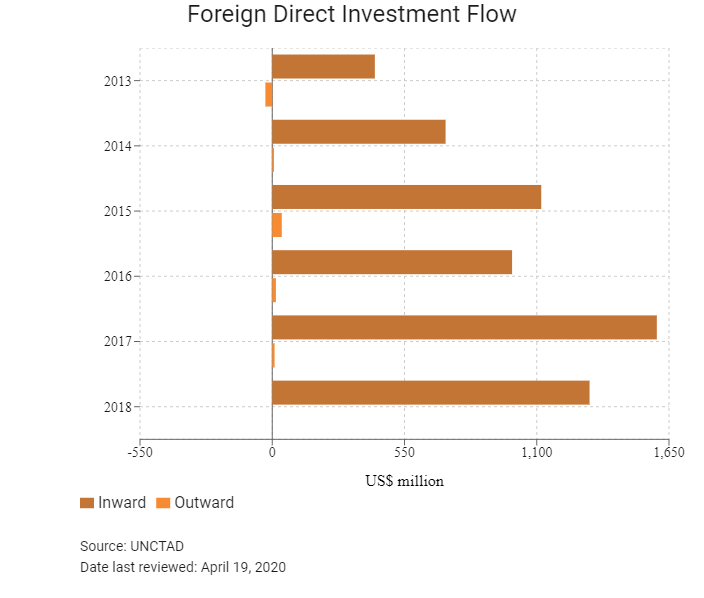

Foreign Direct Investment

Foreign Direct Investment Policy

- Under its National Development Vision for 2021-2025, the government has identified investment in agriculture, services, industry and handicrafts and has demarcated the country into three zones that are eligible for various tax and other non-fiscal investment incentives. These efforts by the Lao government to attract foreign direct investment (FDI) inflows have huge potential for investors.

- The Laotian Investment Promotion Department (IPD) promotes FDI and evaluates foreign investment proposals. Laos has set up various special economic zones (SEZs) in the country, offering benefits, such as PT and VAT reductions. PT incentives are provided under the Law on Investment Promotion 2016. This law divides investment areas into three zones, namely Zone 1, Zone 2, and Zone 3. The PT exemptions are as follows:

- Zone 1: Areas designated as poor zones or remote zones with socio-economic infrastructure unfavourable to investment; PT is exempt for 10 years.

- Zone 2: Areas designated as zones with socio-economic infrastructure favourable to investment; PT is exempt for four years.

- Zone 3: Areas designated as SEZs; PT is exempt as per relevant regulations.

- Additional PT exemptions are available if investment is in the activities set out in item 2, 3, 5, and 6 of Article 9 of the Law on Investment Promotion, as follows:

- Item 2: Clean, toxic-free agriculture, planting seed production, animal breeding, industrial plantation, forestry development, protection of environment and bio diversity, activities promoting rural development and poverty reduction.

- Item 3: Environmentally-friendly agricultural processing industry; national, traditional and unique handicraft processing industry.

- Item 5: Educations, sports, human resources development and labour skill development, and vocational training institutions or centres, and the production of educational and sports equipment.

- Item 6: Construction of modern hospitals, pharmaceutical and medical equipment factories, and the production of and treatment by traditional medicine.

- The Law on Investment Promotion stipulated uniform business registration requirements and tax incentives for foreign and domestic investors. The government also provides special incentives for priority sectors, including tourism, telecommunication and education.

- The 2010 Law on Investment Promotion states that foreign and domestic investors are offered the same tax incentives and business registration procedures.

- Under the 2010 Prime Ministerial Decree 443 on SEZs and Specific Economic Zones, foreign investors are encouraged to invest in the country's various zones.

- Foreign investors seeking to establish operations in Laos are typically required to go through several steps prior to commencing operations. In addition to an investment licence, foreign investors are required to obtain other permits, including an annual business registration from the Ministry of Industry and Commerce, a tax registration from the Ministry of Finance, a business logo registration from the Ministry of Public Security, permits from each ministry related to the investment, appropriate permits from local authorities, and an import-export licence. Obtaining the necessary permits can pose a challenge, especially in areas outside the capital. In addition, the lack of substantive regulations on merger and acquisition activities makes some transactions challenging to carry out.

- The government has instituted a number of measures to encourage foreign investment and increased private investment. The Lao Stock Exchange opened on October 10, 2010, and the first day of trade was January 11, 2011. Foreigners involved in large-scale FDI projects may also be obliged to give the state partial ownership in their firm.

- Foreign partners in a joint venture (JV) must contribute at least 30% of the company's registered capital. Throughout the period of operation of a foreign enterprise, the local assets of the enterprise must not be less than its registered capital.

- The exploitation of natural resources for the generation of energy requires a JV with a local party. Individual companies in the petrochemical industry are required to file an annual import plan. The government controls the retail price and profit margins of gasoline and diesel.

- On September 13, 2011, Laos issued a new ministerial decree relating to the Law on Investment Promotion of 2009 in order to allow foreign investors to own land in Laos. According to this new regulation, foreigners are allowed to purchase a maximum of 800sq m of land from provincial and national authorities if they have invested at least USD500,000 in the country.

- There are local equity ownership requirements in the production of beer and other alcohol production, as well as the production of medicine and the wholesale of beverages, tobacco, clothes and machinery.

- Laos does not allow for investors to participate in the security and defence industries, funerals and related services, religious education, the manufacture of cultural products that are damaging to national culture, and chemical substances and industrial waste that may be hazardous to human health. Foreigners are also prohibited from producing a number of cultural handicrafts, as well as from fishing and operating fish farms (unless certain conditions are met).

- The mining industry's future remains unclear as the negative environmental effects of mining activity worsen. In 2012, the government issued a moratorium on new mining ventures, and announced in November 2016 that it was considering a permanent ban on new projects in the sector. It is unlikely that this will be the case as Laos is heavily dependent on rents from the industry; however, potential investors should expect increased regulatory oversight.

- Laos has a number of bilateral investment treaties (BITs) in place. The following countries have all entered into agreements with the the government of Laos including Australia, Mainland China, Cuba, Denmark, France, Germany, Japan, South Korea, Kuwait, Mongolia, Myanmar, Netherlands, Pakistan, Russia, Singapore, Sweden, Switzerland, Thailand, United Kingdom and Vietnam. In addition, Malaysia, Belarus and Cambodia have signed agreements with Laos that have yet to come into effect.

- Mainland China is looking to establish a free trade zone in the Mekong region on the border between Laos and Thailand. The Chinese government will waive tariffs and VAT on goods coming from the zone.

Sources: WTO – Trade Policy Review, the International Trade Administration, US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Savan-Seno SEZ (established in 2003) |

Location Advantage: |

|

Boten Beautiful Land SEZ (established in 2003) |

Location Advantage: |

|

Golden Triangle SEZ (established in 2007) |

Location Advantage: |

|

Thatluang Lake SEZs (established in 2011) |

Location Advantage: |

|

Thakhek SEZs (established in 2012) |

Location Advantage: |

|

Long Thanh – Vientiane Specific Economic Zone (established in 2012) |

Location Advantage: |

|

Dongphosy SEZ (established in 2012) |

Location Advantage: |

|

Phoukhyo SEZ (established in 2010) |

Location Advantage: |

|

Pakse-Japan Small-and Medium-Sized Enterprise (SME) SEZ (established 2015) |

In September 2015, the government approved the development of an SEZ in the southern city of Pakse, a 625-hectare site dedicated to Japanese SMEs. |

|

For all Special Zones: |

Investors also benefit from: |

Sources: Laos Ministry of Planning and Investment – Investment Promotion Department, Fitch Solutions

- Value Added Tax: 10%

- Corporate Income Tax: 24%

Source: Lao PDR Ministry of Finance

Important Updates to Taxation Information

The passage of the revised State Budget Law (SBL) in December 2015 should help to strengthen public financial management in Laos over the coming years. According to the Ministry of Finance, the revised law, which became effective in 2017, will help to strengthen the authority of the National Assembly in budget oversight, as well as enhance the capacity of the Ministry of Finance in budget management. Greater fiscal discipline and monitoring, as well as improving regional integration, will have positive implications for the tax burden that firms and individuals in the country face.

Sources: Lao PDR Ministry of Finance, Fitch Solutions

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

PT |

Corporate income tax is staggered such that the standard rate is 24%. Tobacco businesses are subject to tax at a rate of 26%. A progressive tax rate of between 3% and 7% is applicable to small and medium enterprises, depending on the nature of the business and its revenue. |

|

Withholding Tax |

Dividends: 10% |

|

VAT |

10%; applicable to businesses with an annual income of LAK400 million (USD50,000) or more |

|

Social security |

Both employers and employees are required to pay into the national social security fund under the Social Security Decree at 6% of gross salary by the employer and 5.5% by the employee. |

Sources: Lao PDR Ministry of Finance, Fitch Solutions

Date last reviewed: April 19, 2020

Localisation Requirements

Employers are required to give priority to Lao nationals. To employ foreign nationals, approval must be obtained from the Ministry of Labour and Social Welfare. Foreign workers also need to possess a skill that is in short supply in the country. Companies must make a proposal through the Skills Development and Employment Department of the Ministry of Labour and Social Welfare or through the labour sections of provinces or municipalities in order to hire foreign employees. The total percentage of foreign workers as a proportion of the total workforce is capped at 10% for foreign workers undertaking menial labour and 20% for professionals with specialised skills. Foreign workers are allowed to enter into employment agreements for an initial period of 12 months, renewable for another 12 months. The period of employment for a foreign worker in Laos cannot exceed 5 years in total. Depending on the expertise of the employee and the requirements of the business, employers can request from the Labour Administration Authority that a foreign worker continues working for another additional period, which cannot exceed 5 years.

Obtaining Foreign Worker Permits for Skilled Workers

Foreign workers are legally required to have a valid employment visa and work permit before commencing work in Laos. A sponsor is required from a locally licensed and incorporated entity in order to apply for work permits. There are different types of work visas issued in Laos. A labour visa (LA-B2) is the most common type held for the purposes of living and working in Laos. Work visas may be valid for a period of 3, 6 or 12 months and are be renewable for a total period not exceeding 5 years.

Visa/Travel Restrictions

Laos has an open visa policy. Nationals from member states of the ASEAN do not require a visa to enter Laos for a limited stay of between 14 and 90 days, depending on the country and type of passport held. Nationals of many countries can be issued a visa on arrival; however, nationals of certain countries are not eligible for a visa on arrival and must secure one in advance. On July 11, 2019, Laos launched its e-visa service to streamline the application and approval process. However, the e-visa system can currently only be used at three international ports: Wattay International Airport, Lao-Thai Friendship Bridge 1 and Luang Prabang International Airport.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B3 (Positive) |

08/01/2020 |

|

Standard & Poor's |

Not rated |

Not rated |

|

Fitch Ratings |

B- (Stable) |

12/02/2020 |

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

141/190 |

154/190 |

154/190 |

|

Ease of Paying Taxes Index |

156/190 |

155/190 |

157/190 |

|

Logistics Performance Index |

82/160 |

N/A |

N/A |

|

Corruption Perception Index |

132/180 |

130/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, Transparency International

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

157/202 |

170/201 |

169/201 |

|

Short-Term Economic Risk Score |

34.6 |

34.2 |

33.8 |

|

Long-Term Economic Risk Score |

41.3 |

40.1 |

40.0 |

|

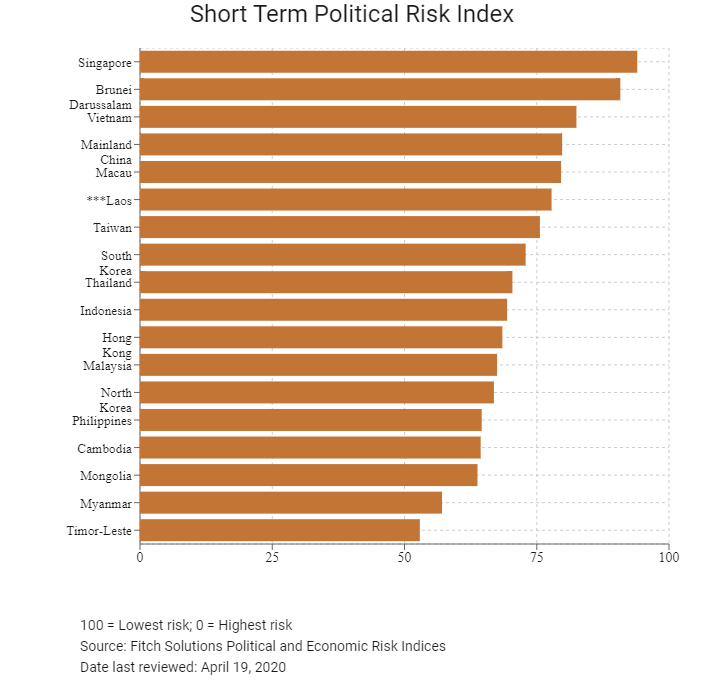

Political Risk Index Rank |

128/202 |

127/201 |

126/201 |

|

Short-Term Political Risk Score |

80.4 |

80.4 |

77.8 |

|

Long-Term Political Risk Score |

56.5 |

56.5 |

56.5 |

|

Operational Risk Index Rank |

144/201 |

146/201 |

145/201 |

|

Operational Risk Score |

38.3 |

38.4 |

38.4 |

Source: Fitch Solutions

Date last reviewed: April 19, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

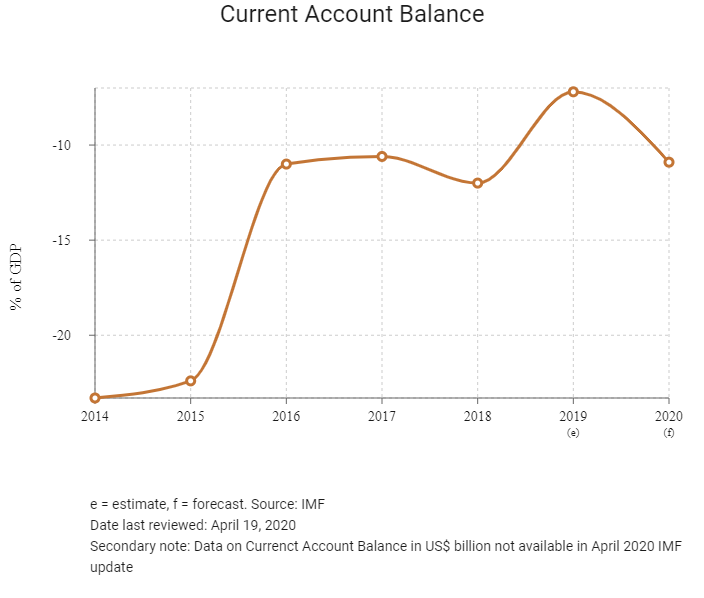

Benefits to the economy stem from growth in the power sector, ASEAN regional growth and a robust infrastructure project pipeline. However, downside risks to the country's long-term economic outlook are widespread poverty, weak public finances, elevated external debt stock, low import cover, and an underdeveloped financial system. These factors leave the country vulnerable to shocks, particularly as economic activity cools. At the same time, a narrow economic base and heavy dependency on just a handful of regional trade partners also pose risks to the country's ability to sustain its economic growth momentum. In 2020 private consumption will come under strong headwinds due to the Covid-19 pandemic as a general aversion to travel due to virus concerns globally is taking a heavy toll on tourism-related services in Laos - a sector that accounts for 12.0% of GDP (both directly and indirectly) and 10.5% of employment in the country.

OPERATIONAL RISK

The major industries in Laos include mining, hydropower, agriculture and light manufacturing. As a developing state that is still in the process of implementing investor-friendly reforms and regional economic integration, Laos poses a number of pertinent operational risks to businesses. The small and largely undiversified labour market suffers from limited skills development, particularly in rural areas. The transport network is underdeveloped and relies heavily on a poor-quality road system and limited alternative freight options, increasing logistics costs that are already elevated owing to burdensome trade bureaucracy and high fuel costs.

Source: Fitch Solutions

Date last reviewed: April 20, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Laos score |

38.4 |

39.5 |

35.5 |

41.0 |

37.6 |

|

East and Southeast Asia average |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

East and Southeast Asia position (out of 18) |

15 |

18 |

16 |

14 |

14 |

|

Asia average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia position (out of 35) |

26 |

30 |

25 |

20 |

27 |

|

Global average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

145 |

166 |

149 |

124 |

142 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Singapore |

83.3 |

77.5 |

90.3 |

79.0 |

86.3 |

|

Hong Kong |

81.5 |

72.0 |

89.0 |

80.7 |

84.5 |

|

Taiwan |

73.0 |

68.3 |

75.3 |

76.3 |

71.9 |

|

South Korea |

70.8 |

62.4 |

70.5 |

79.7 |

70.4 |

|

Malaysia |

69.6 |

62.6 |

74.9 |

74.0 |

66.8 |

|

Macau |

63.9 |

60.9 |

69.5 |

56.2 |

69.1 |

|

Brunei Darussalam |

61.3 |

59.1 |

59.1 |

60.1 |

67.0 |

|

Thailand |

60.7 |

56.6 |

67.7 |

69.2 |

49.4 |

|

Mainland China |

58.8 |

54.9 |

61.4 |

71.8 |

47.3 |

|

Indonesia |

54.4 |

55.1 |

55.1 |

55.7 |

51.8 |

|

Vietnam |

53.4 |

49.3 |

57.5 |

57.8 |

49.0 |

|

Mongolia |

51.1 |

55.3 |

52.5 |

41.0 |

55.6 |

|

Philippines |

47.3 |

57.5 |

49.7 |

45.5 |

36.2 |

|

Cambodia |

40.6 |

44.5 |

43.0 |

35.2 |

39.8 |

|

Laos |

38.4 |

39.5 |

35.5 |

41.0 |

37.6 |

|

Myanmar |

33.1 |

47.8 |

39.1 |

27.8 |

17.8 |

|

North Korea |

32.4 |

51.1 |

18.5 |

27.8 |

32.3 |

|

Timor-Leste |

31.9 |

40.3 |

32.5 |

22.5 |

32.3 |

|

Regional Averages |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 19, 2020

Hong Kong’s Trade with Laos

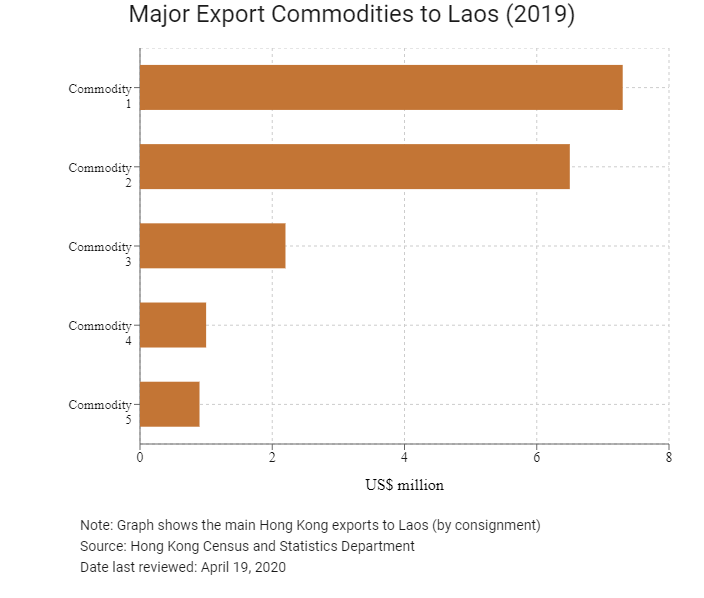

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Miscellaneous manufactured articles | 7.3 |

| Commodity 2 | Textile yarn, fabrics, made-up articles, and related products | 6.5 |

| Commodity 3 | Telecommunications and sound recording and reproducing apparatus and equipment | 2.2 |

| Commodity 4 | Office machines and automatic data processing machines | 1.0 |

| Commodity 5 | Tobacco and tobacco manufactures | 0.9 |

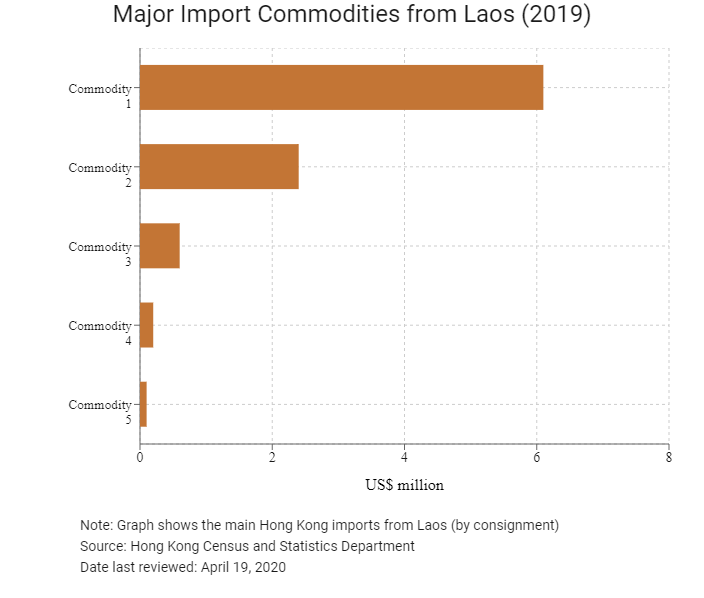

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Tobacco and tobacco manufactures | 6.1 |

| Commodity 2 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 2.4 |

| Commodity 3 | Miscellaneous manufactured articles | 0.6 |

| Commodity 4 | Cork and wood | 0.2 |

| Commodity 5 | Meat and meat preparations | 0.1 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

|

2019 |

Growth rate (%) |

|

Number of Laotian residents visiting Hong Kong |

2,623 |

-21.8 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Sources: Hong Kong Tourism Board, Fitch Solutions

|

2019 |

Growth rate (%) |

|

|

Number of East and South Asian citizens residing in Hong Kong |

2,834,871 |

3.4 |

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years.

Sources: United Nations Department of Economic and Social Affairs – Population Division, Fitch Solutions

Date last reviewed: April 19, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Lao companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Laos

- Laos has a BIT with Mainland China that entered into force on June 1, 1993.

- The agreement between Mainland China and Laos for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income, was signed in January 1999 and entered into force in June 1999.

Sources: State Taxation Administration, UNCTAD

Chamber of Commerce (or Related Organisations) in Hong Kong

Hong Kong-ASEAN Economic Cooperation Foundation (HKAECF)

The main activities of HKAECF are to contribute to the fostering, promotion and facilitation of economic cooperation between Hong Kong and the 10 member countries of ASEAN ('1+10'), and between the ASEAN region and Mainland China ('10+1') with Hong Kong serving as a high value-adding and facilitating key international hub, bridge, connector, promotor and investor.

Address: Hong Kong-ASEAN Economic Cooperation Foundation Limited, G.P.O. Box 12779, Hong Kong

Email: secretariat@hk-asean.com

Source: Hong Kong-ASEAN Economic Cooperation Foundation

Consulate General of the Lao PDR in Hong Kong

Address: Room 1402, 14/F, Arion Commercial Centre, 2-12 Queen's Road West, Sheung Wan, Hong Kong

Email: laoscghkmc@gmail.com

Tel: (852) 2544 1186

Fax: (852) 2544 1187

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

HKSAR passport holders need a visa to enter Laos. Diplomatic and service passport holders have visa-free access to Laos for 14 days. HKSAR passport holders can also apply for a visa upon arrival at Lao International Airports or Lao International border checkpoints for tourist purpose for 30-day stay. Visitors intending to travel to Laos through the specific five ports of entry can apply for online visa via the e-visa system www.laoevisa.gov.la.

Sources: Visa on Demand, Fitch Solutions

Date last reviewed: April 19, 2020

Laos

Laos