GDP (US$ Billion)

245.23 (2018)

World Ranking 46/193

GDP Per Capita (US$)

23,113 (2018)

World Ranking 43/192

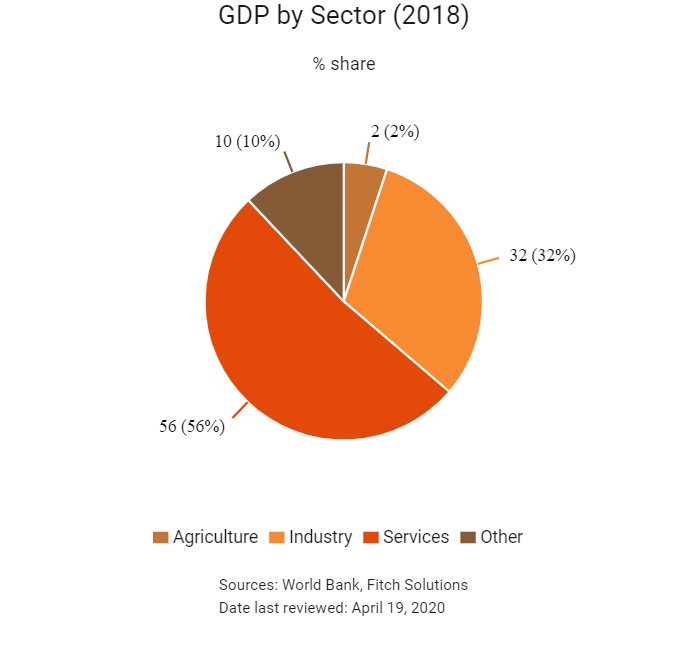

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

150.4 (2018)

Currency (Period Average)

Czech Koruna

22.93per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

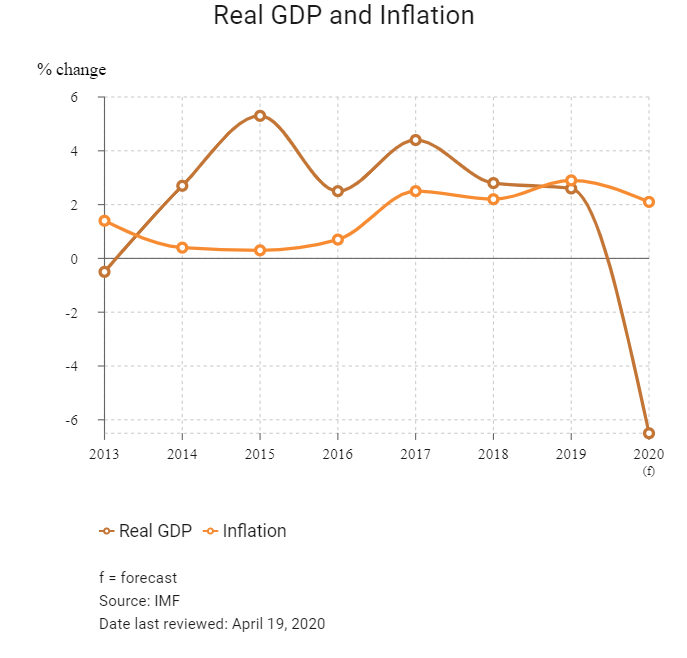

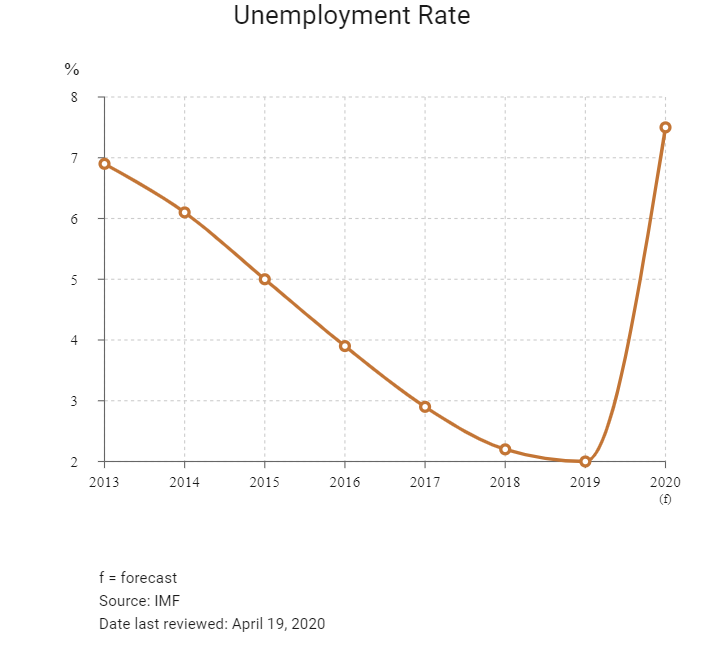

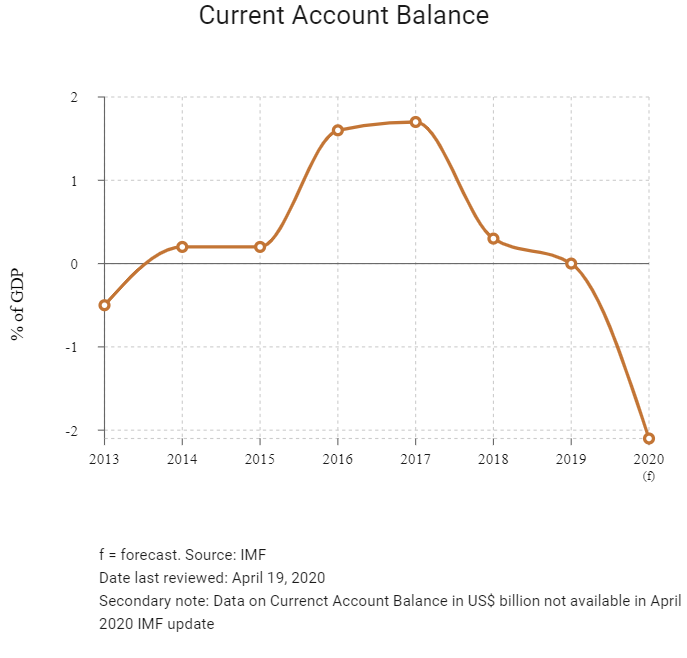

Maintaining an open investment climate has been a key element of the Czech Republic's transition to a functioning market economy. As a member of the European Union (EU), with an advantageous location in Europe, a relatively low-cost structure and a well-qualified labour force, the country is an attractive destination for foreign investment. Real GDP growth peaked in 2017, but will remain solid over the coming years and outperform the wider EU. On the back of strong household demand, the trade surplus will slightly narrow, but the country's current account will stay relatively balanced in the years ahead. However, in the absence of strong productivity gains, the country's tight labour market will put upward pressure on unit labour costs and begin to weigh on the country's competitiveness.

Sources: US Department of State, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

October 2017

Legislative elections were held. The ANO 2011 party won 78 out of 200 available seats.

January 2018

Presidential elections were held over two rounds and Miloš Zeman was elected for a second term.

June 2018

Andrej Babiš was reappointed as the Prime Minister.

July 2018

A coalition government was formed.

September 2018

The railway infrastructure authority in the Czech Republic started building civil structures for the construction of the Prague-Zahradní Město and the Praha-Eden stations in the 10th Prague district. The stations would be built as part of a project to construct a four-rail track that was proposed to have a line speed of 120km/h. The project entailed an overall cost of CZK4.4 billion, of which CZK3 billion was funded by the EU.

April 2019

The European Commission, under the EU Cohesion Policy, would invest EUR4 billion in 25 infrastructure projects, worth EUR8 billion, in 10 member states. The Czech Republic's allocation included EUR76 million for upgrading the Prague-Pilsen rail corridor.

June 2019

On June 27, 2019, Czech Prime Minister Andrej Babiš survived a vote of no confidence over alleged conflict of interest and EU subsidies fraud. The final count came in at 85 against and 85 for, while another 30 members of parliament abstained from the vote.

August 2019

Railway infrastructure manager SŽDC had started rehabilitation work on the railway section between Oldřichov u Duchcov and Bílina in the Czech Republic. The CZK1.9 billion (USD81.5 million) project included adjustment of railway tracks in the Oldřichov u Duchcova railway station, on the siding to Duchcovská svarovna, on the connection of branching lines to Litvínov and Teplice forest gate and on the Oldřichov u Duchcova-Bílina double track section.

August 2019

EU antitrust regulators charged Deutsche Telekom’s Czech unit, O2 CZ and Czech telecoms infrastructure provider Cetin with restricting competition via their network sharing deal.

September 2019

VINCI's France-based construction subsidiary Eurovia, in a joint venture (JV) with STRABAG Rail and Elektrizace železnic Praha, secured a EUR120 million (USD132 million) contract to upgrade the 8.7km railway section between Prague and Cernosice in Czech Republic. This section formed part of the country's third railway transit corridor. Works were scheduled to be completed in June 2022.

January 2020

The Czech Republic and the Republic of Somaliland were reportedly in talks to boost their bilateral trade relations. According to the Somaliland delegation, Czech Republic investors could enormously benefit from the existing, vast investment opportunities in the areas of agriculture, fisheries, tourism, infrastructure and livestock.

March 2020

The Czech government approved the Tax Liberation Package on March 16, 2020 to mitigate the impacts of the Covid-19 pandemic. For corporate income tax (CIT) returns, the package included a flat waiver of the fine for late submission of personal and CIT return and default interest until 1 July 2020 and a waiver of the fine for late submission of any tax claim. Furthermore, for value added tax (VAT), the package offered a flat waiver of the CZK1,000 fine for late submission of a control statement arising between January 1 and July 31, 2020. The General Financial Directorate also issued an instruction for other cases of waiver of fines for late submission of a control statement based on an individual request, if the late submission occurred in the period from January 1 to July 31, 2020.

April 2020

The Czech Senate granted the central bank powers to buy a wider scope of assets in markets and adopted other measures giving businesses and people some relief from restrictions imposed to curb the coronavirus outbreak.

Sources: BBC Country Profile – Timeline, national sources, IMF, Fitch Solutions

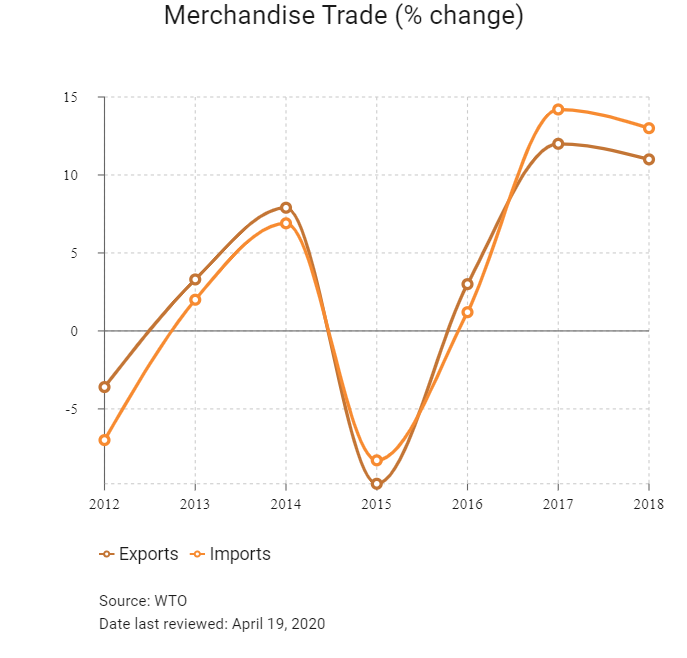

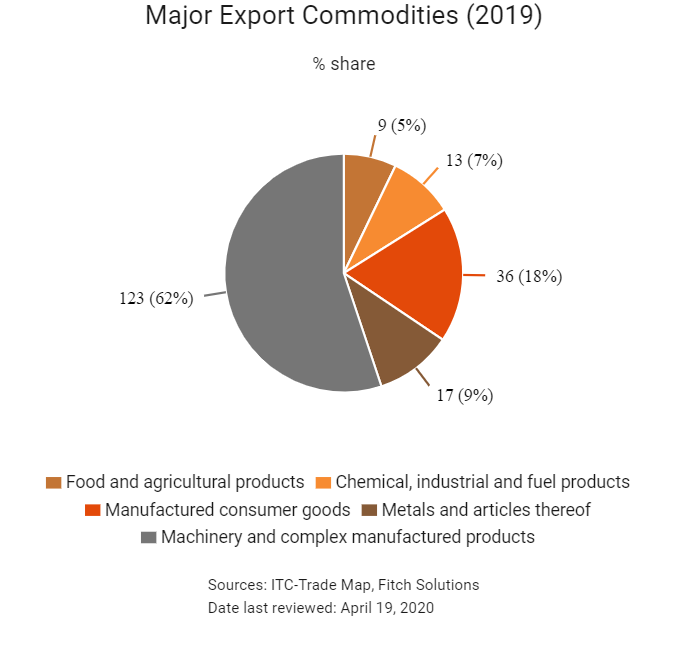

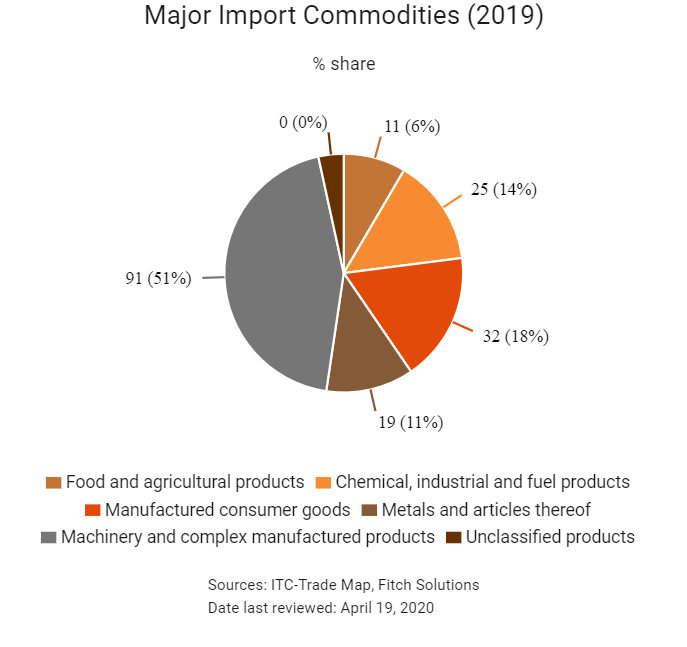

Merchandise Trade

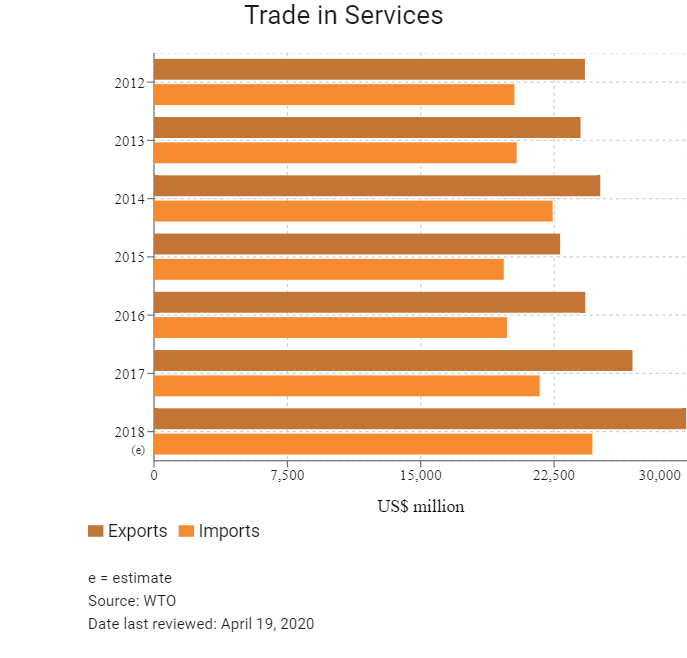

Trade in Services

- The Czech Republic has been a member of the World Trade Organization (WTO) since April 15, 1993.

- Since 2014, the country has been a member of the EU, which has a common set of tariffs and customs levied on various imports and exports; consequently, the EU customs code applies. The trade policy of the Czech Republic is largely identical to that of the wider region. The EU updated its trade policy (and by extension its import tariffs, customs, duties and procedures) in 2017.

- The Czech Republic has a number of free zones. These free zones are legally separate entities to the rest of the region or country's customs territory and act as a temporary site for warehousing goods in transit from non-EU states. Goods are kept in these zones until the necessary legal and bureaucratic requirements are met – such as tariffs. Any charges on goods transported into the country are only applicable once the goods leave the free zone.

- The EU applies a common external tariff which is applicable to all members. However, variations exist and can be determined by consulting the Tarif Intégré de la Communauté (TARIC), which stipulates the regulations and rates for specific types of goods. The TARIC is available on the EC's website and is updated daily. Agricultural goods generally have the highest tariffs applied to them.

- The EU is party to at least 50 FTAs and access to other markets of the countries concerned is currently mediated through those agreements. The EU's scheme on generalised system of preferences (GSP) entered into effect on January 1, 2014. Under the scheme, tariff preferences have been removed for imports into the EU from countries where per capita income has exceeded USD4,000 for four years in a row.

- The EU has imposed various anti-dumping measures on a wide range of products – predominantly in the areas of textiles, parts, steel, iron and machinery – coming from Mainland China and a few other Asian nations to protect domestic industries. A number of products from Mainland China are subject to the EU's anti-dumping duties, including ceramic tiles, ceramic tableware and kitchenware, fasteners, ironing boards, and solar glass. On November 13, 2016, the EC imposed a provisional anti-dumping duty on imports of some of the primary and semi-processed metals from Mainland China.

- The Czech Republic is party to the EU Common Customs Tariff (CCT), which applies to the import of goods across the external borders of the EU. The tariff is common to all EU members, but the rates of duty differ from one kind of import to another depending on what they are and where they come from. The rates depend on the economic sensitivity of products. Tariff rates in the Czech Republic are particularly low, at an average of 1% and among the lowest globally, ensuring lower costs for exporters and importers, particularly if trade is taking place within the EU customs union.

- The standard VAT rate is 21%, with various reduced rates applicable. The first reduced VAT rate of 15% is applied to a certain subset of goods, such as general foodstuff. A second reduced VAT rate of 10% is further applicable to goods such as baby food, medicines and books. Goods imported into the Czech Republic are calculated on the declared customs value plus applicable duty and excise tax.

- The Czech Republic has no excise duties aside from those common to the region. Excise taxes are imposed on the following goods produced in or imported into the Czech Republic: fuels and lubricants; tobacco products; and beer, wine and liquor. The rate is determined by the type and quantity of the product and must be paid within 10 days of being notified by the Customs Office of the tax amount due.

- Regulations on product labelling, as well as safety regulations, are available via TARIC.

- Goods' rules of origin (for tariff purposes) are as follows: If a product is wholly produced in one territory, the country of origin is that country. If a good is produced in multiple countries/territories, the country of origin is determined as the last country where the product underwent its 'last, substantial, economically justified processing or working, in an undertaking equipped for that purpose, resulting in the manufacture of a new product or representing an important stage of manufacture'.

- The import of the following products is prohibited in the EU: Controlled substances that deplete the ozone layer, and fish of vessels from Cambodia and Guinea.

- The import of the following products is restricted in the EU: Certain animal and plant species, waste, and certain goods which could be used for capital punishment.

- Nine types of goods imported into the EU are subject to licensing. These goods are (broadly): Textiles, various agricultural products, iron and steel products, ozone-depleting substances, rough diamonds, waste shipment, harvested timber, endangered species, and drug precursors.

Sources: WTO – Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- The EU Common Market: The transfer of capital, goods, services and labour between member nations enjoys free movement. The common market extends to the 28 member nations of the EU, namely Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the United Kingdom. As the Czech Republic's main trade partners are in the EU, the absence of customs charges with member countries greatly enhances its trade volumes.

- European Economic Area (EEA)-European Free Trade Association (Iceland, Liechtenstein, Norway and Switzerland): While it enhances trade flows between these countries and the Czech Republic, only Switzerland is a fairly major trading partner.

- EU-Turkey: The customs union within the EU provides tariff-free access to the European market for Turkey, benefitting both exporters and importers. As Turkey has steady trade flows with the Czech Republic (being in the country's top 20 exporting partners and top 21 importing partners), tariff-free access has enhanced trade flows between the two countries.

- EU-Canada Comprehensive Economic and Trade Agreement (CETA): CETA is expected to strengthen trade ties between the two regions, having come into effect in October 2016. Some 98% of trade between Canada and the EU is duty-free under CETA. The agreement is expected to boost trade between partners by more than 20%. The Czech Republic expects CETA to improve trade in goods and services between the two countries while boosting foreign direct investment (FDI). CETA also opens up government procurement. Canadian companies will be able to bid on opportunities at all levels of the EU government procurement market and vice versa. CETA means that Canadian provinces, territories and municipalities are opening their procurement to foreign entities for the first time, albeit with some limitations regarding energy utilities and public transport.

- EU-Japan Economic Partnership Agreement (EPA): In July 2018, the EU and Japan signed a trade deal that promises to eliminate 99% of tariffs that cost businesses in the EU and Japan nearly EUR1 billion annually. According to the EC, the EU-Japan EPA will create a trade zone covering 600 million people and nearly a third of global GDP. The result of four years of negotiation, the EPA was finalised in late 2017 and came into force on February 1, 2019 after the EU Parliament ratified the agreement in December 2018. The total trade volume of goods and services between the EU and Japan is an estimated EUR86 billion. The key parts of the agreement will cut duties on a wide range of agricultural products and it seeks to open up services markets, particularly financial services, e-commerce, telecommunications and transport. Japan is the EU's second biggest trading partner in Asia after Mainland China. EU exports to Japan are dominated by motor vehicles, machinery, pharmaceuticals, optical and medical instruments and electrical machinery.

- The EU-Mercosur FTA: The deal which is between the EU and Mercosur states (Argentina, Brazil Paraguay and Uruguay) was reached on June 28, 2019. The EU is Mercosur's number one trade and investment partner. EU exports to Mercosur were EUR45 billion in goods in 2018 and EUR23 billion in services in 2017. The EU is the biggest foreign investor in Mercosur with a stock of EUR381 billion, while Mercosur's investment stock in the EU amounts to EUR52 billion in 2017. The goal of the new EU-Mercosur trade deal is to remove the barriers and help EU firms, especially smaller ones, to export more; strengthen worker’s rights and ensure environmental protection, encourage companies to act responsibly, and uphold high food safety standards; and protect quality EU food and drink products labelled as Geographical Indications from imitations.

- EU-Vietnam FTA: In June 2019, the EU and Vietnam finalised and signed their fait trade agreenebt (FTA). The agreement will eliminate 99% of tariffs, although some will be cut over a 10-year period and other goods, notably agricultural products, will be limited by quotas.

- EU-SADC EPA (Botswana, Lesotho, Mozambique, Namibia, South Africa and Eswatini): An agreement between the EU and the SADC delegations was reached in 2016 and is fully operational for SADC members following the ratification of the agreement by Mozambique. The remaining six member of the SADC now included in the deal (the Democratic Republic of the Congo, Madagascar, Malawi, Mauritius, Zambia and Zimbabwe) are seeking economic partnership agreements with the EU as part of other trading blocs – such as with East or Central African communities.

Ratification Pending

EU-Central America Association Agreement (Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, Panama, Belize and the Dominican Republic): An agreement between the parties was reached in 2012 and is awaiting ratification. The agreement has been provisionally applied since 2013. The EU and Central America meet annually to discuss issues and best practices related to the implementation of the agreement, and the most recent meeting of the Association Committee and sub-committees was held in Antigua, Guatemala between June 18, 2019, and June 27, 2019.

Under Negotiation

- EU-Australia: The EU, Australia's second largest trade partner, has launched negotiations for a comprehensive trade agreement with Australia. Bilateral trade in goods between the two partners has risen steadily in recent years, reaching almost EUR48 billion in 2017 and bilateral trade in services added an additional EUR27 billion. The negotiations aim to remove trade barriers, streamline standards and put European companies exporting to or doing business in Australia on equal footing with those from countries that have signed up to the Trans-Pacific Partnership or other trade agreements with Australia. The Council of the EU authorised opening negotiations for a trade agreement between the EU and Australia on May 22, 2018.

- EU-United States (Trans-Atlantic Trade and Investment Partnership): This agreement was expected to increase trade and services, but it is unlikely to pass under the Trump administration in the United States against the backdrop of rising global trade tensions. The EU and the United States have the largest bilateral trade and investment relationship and enjoy the most integrated economic relationship in the world.

Sources: WTO Regional Trade Agreements Database, Fitch Solutions

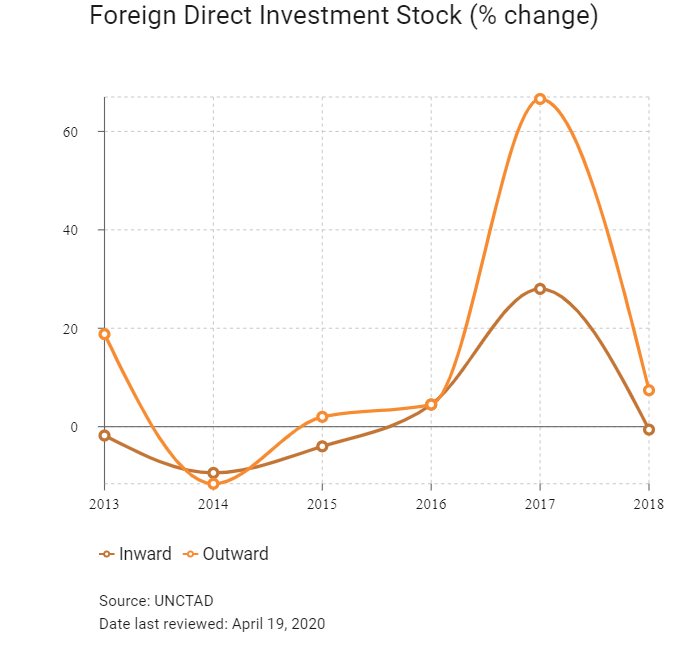

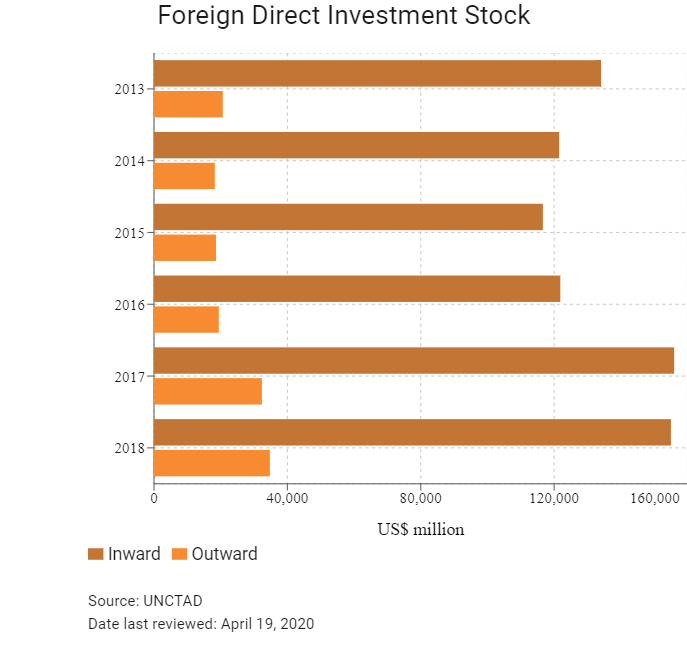

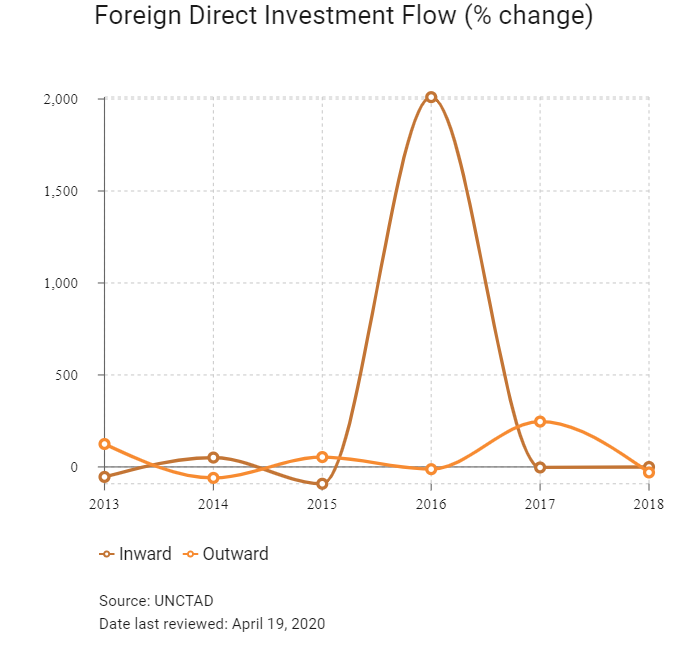

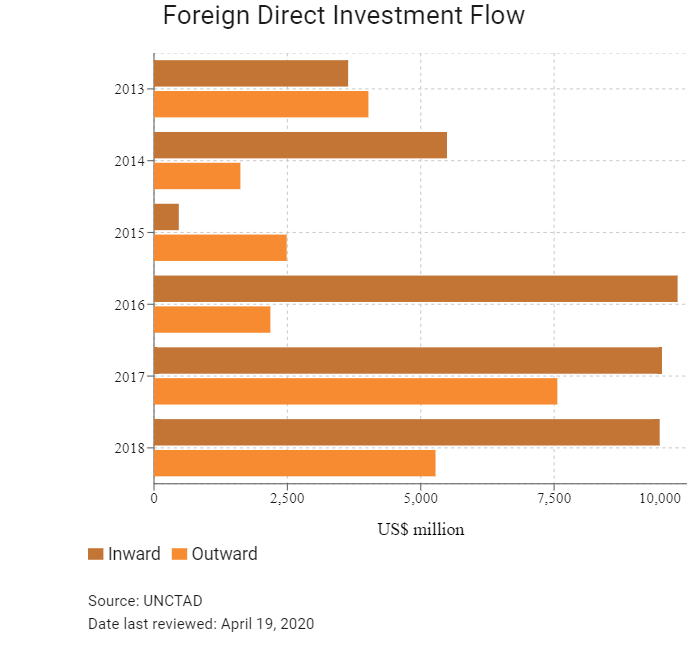

Foreign Direct Investment

Foreign Direct Investment Policy

- CzechInvest is the government body responsible for FDI promotion, licensing and regulations.

- Foreigners in the Czech Republic face few restrictions in the real estate market and are free to purchase property – including agricultural land, industrial land and commercial real estate. Real estate (land and buildings) located in the Czech Republic must be registered in the Cadastral Register, which is maintained by the Cadastral Office.

- Foreign investors can establish sole proprietorships, joint ventures and branch offices in the Czech Republic. Foreign and domestic investors are treated equally in the eyes of the law, except for certain investment projects in the banking, insurance and defence sectors.

- All businesses (local and foreign) must be registered with the Commercial Register and obtain a commercial licence in order to operate.

- The country enacts laws on auditing, accounting, and bankruptcy. These laws include the use of international accounting standards (IAS), which enable companies using the common practice to streamline operations across countries.

- Companies operating in two or more countries in the EU can also benefit from the Societas Europaea scheme in the Czech Republic. This enables companies to operate regionally within a single legal structure, which facilitates mergers and boosts flexibility of operations.

- There is no limit on foreign participation in commercial enterprises. Foreigners are entitled to set up new commercial companies, subsidiaries or branches, either wholly-owned or in partnership with natural or legal persons; buy into an existing company via the acquisition of shares, bonds, or other securities; acquire concessions, acquire ownership rights over non-residential real estate improvements, including land, via establishment of a Czech company; and acquire industrial or other intellectual property rights.

- Investors benefit from generous tax relief and government assistance to locate in underdeveloped areas. For example, the Act on Investment Incentives (which came into force in July 2012) provides a 10-year income tax abatement for investors in certain industries, such as manufacturing, research and development, high technology, and strategic services. Investors are eligible for job creation grants, training and retraining grants, and cash grants on capital investments of up to 5% of the costs.

Sources: WTO – Trade Policy Review, International Trade Administration, US Department of Commerce, CzechInvest, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

11 Free Trade Zones (FTZs) |

- The Czech Republic offers incentives to foreign and domestic firms that invest in manufacturing, technology, research and development centres and business support service centres. |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 21%

- Corporate Income Tax: 19%

Sources: Ministry of Finance of the Czech Republic, Fitch Solutions

Important Updates to Taxation Information

- Starting 2020, the following measures transposing the EU Anti-Tax Avoidance Directive (ATAD) have come into effect:

- Hybrid mismatches, effective for tax periods commencing on/after 1 January 2020

- Exit taxation, effective for tax periods commencing on/after 1 January 2020

- The Czech government has drafted a law introducing a 7% digital tax on large internet companies, such as Facebook and Google, by mid-2020. The new tax will apply to internet companies with global turnover of more than EUR750 million and taxable income in the Czech Republic of more than CZK50 million (USD2.21 million) in a year. It will not affect local companies.

- In 2019, the government implemented the amendment to the Income Tax law. The amendment was made in order to comply with the EU Anti-Tax Avoidance Directive, which contains five legally-binding anti-abuse measures that all member states should apply against common forms of aggressive tax planning.

- The Czech government plans to increase excise tax on spirits by 13% from January 2020.

- The VAT legislation ammendment shall contain new provisions that deal with losses and the related correction of input VAT deduction, VAT treatment of vouchers and VAT registration of members of a VAT group in relation to transformation.

- Starting January 1st, in all EU Member States the VAT exemption for the supply of goods to another EU Member State will only apply to sales to VAT-registered customers in that EU Member State.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Resident company: CIT |

Standard rate is 19%; 5% rate applies to income; 0% rate applies to pension funds |

|

Dividends |

15%; rate is increased to 35%, effective from 2013, for dividends paid to Czech non-residents from countries outside the EU, unless superceded by a double tax treaty with the Czech Republic. |

|

Non-resident companies: Capital gains on sale of shares in resident companies |

0% on gains by qualifying EU parent companies |

|

Social security contributions (all employers) |

- Social security contributions (general): 21.5% of gross salaries |

|

VAT/GST (standard) |

The standard VAT rate is 21%, with a number of reduced rates applicable. The first reduced VAT rate of 15% is applied to a certain subset of goods, such as general foodstuff; a second reduced VAT rate of 10% is further applicable to goods such as baby food, medicines and books. Goods imported into the Czech republic are calculated on the declared customs value plus applicable duty and excise tax. |

|

Property Transfer Tax |

4% of sale price |

Sources: Ministry of Finance of the Czech Republic, Fitch Solutions

Date last reviewed: April 19, 2020

Work Permit

Citizens that are not from the EU require a work permit in order to work within the Czech Republic. EU member citizens do not require a work permit, but their employer must inform the job office about their employment. Citizens of the EEA (with EU member states, Iceland, Norway and Lichtenstein) and Switzerland do not require a visa to enter, reside and work in the country. No work permit is needed by foreigners from outside the EU if they have a permanent residence or a family reunion permit, have been granted asylum, study in the Czech Republic or have blue or green cards.

Obtaining Foreign Worker Permits

Employers must first apply for a permit to hire foreign workers. A permit is granted once no suitable candidate can be found in the Czech Republic or in other EU member states. The vacant position must be reported to the local district Labour Office and cannot be changed at a later stage to fit the profile of a potential employee. The candidate must then apply for a work permit. The government issues the permit for a maximum of 2 years, which can be repeatedly prolonged always for maximum of 2 years and may be renewed as many times as needed. The permit process takes an average of one month.

Employee Card

An Employee Card is a permit for long-term residence in the Czech Republic where the purpose is employment, regardless of the level of required professional qualifications. Foreign nationals (not from the EU/EEA member states and Switzerland) with an employee card are entitled to work in the job for which the employee card was issued, or to work in the job for which the Department for Asylum and Migration Policy of the Ministry of the Interior granted consent.

Blue Card

The Blue Card is intended for the stay of a highly qualified employee. A foreigner holding a Blue Card may reside in the Czech Republic and work in the job for which the Blue Card was issued or change that job under the conditions defined. High qualification means a duly completed university education or higher professional education which lasted for at least three years. The Blue Card is issued with a term of validity three months longer than the term for which the employment contract has been concluded; however, this is for a maximum period of two years. The Blue Card can be extended. One of the conditions for issuing the Blue Card is a wage criterion – the employment contract must contain gross monthly or yearly wage at least 1.5 times the gross average annual wage.

Short-term Work Visa

A short-term work visa can be granted by a Czech embassy upon on application for a maximum period of 90 days to be used within 180 days. The visa must be for the purpose of employment and the application must be submitted, beside general requirements, with a work permit, employment contract and proof of securing accommodation.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Aa3 (Stable) |

04/10/2019 |

|

Standard & Poor's |

AA- (Stable) |

24/08/2011 |

|

Fitch Ratings |

AA- (Stable) |

24/01/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

30/190 |

35/190 |

41/190 |

|

Ease of Paying Taxes Index |

53/190 |

45/190 |

53/190 |

|

Logistics Performance Index |

22/160 |

N/A |

N/A |

|

Corruption Perception Index |

38/180 |

44/180 |

N/A |

|

IMD World Competitiveness |

29/63 |

33/63 |

N/A |

Sources: World Bank, IMD, Transparency International

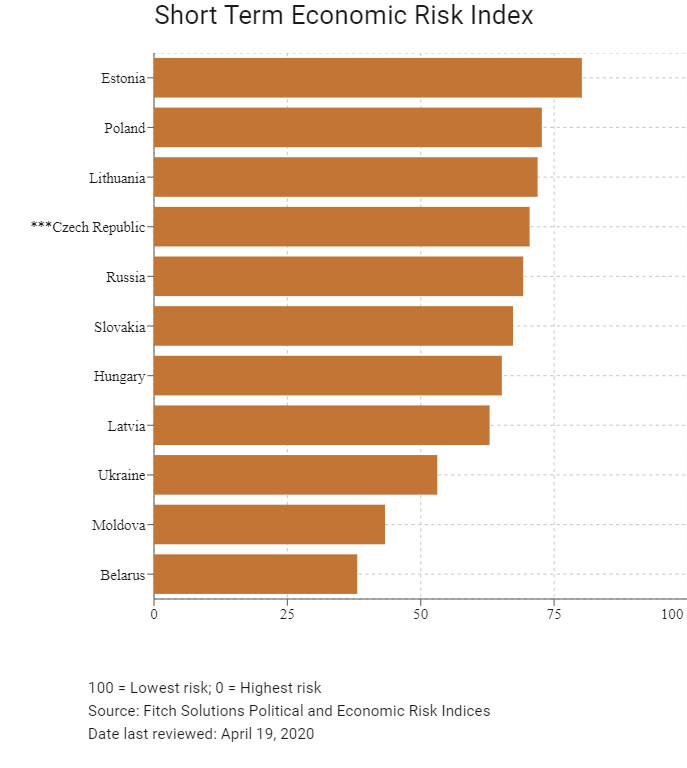

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

15/202 |

8/201 |

14/201 |

|

Short-Term Economic Risk Score |

77.1 |

74.6 |

70.4 |

|

Long-Term Economic Risk Score |

75.9 |

78.2 |

76.7 |

|

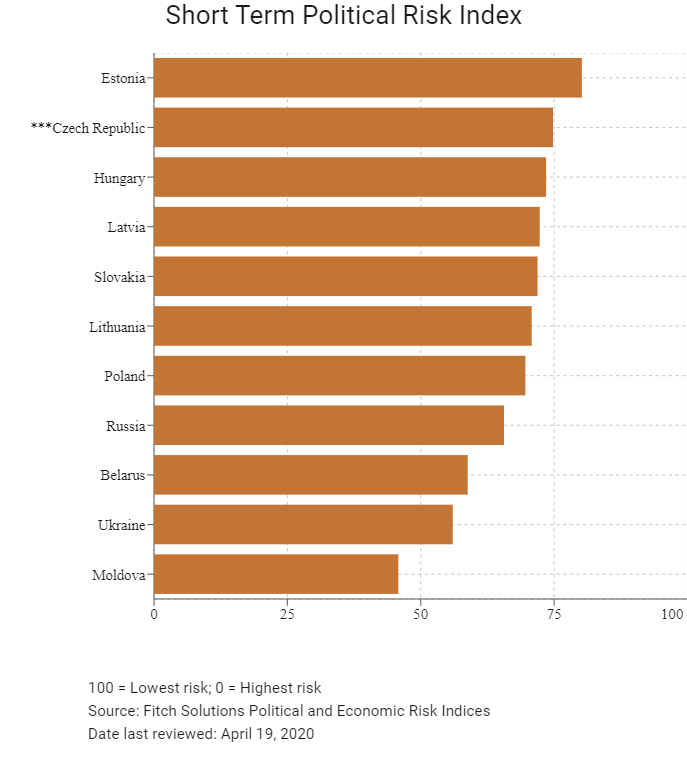

Political Risk Index Rank |

11/202 |

10/201 |

10/201 |

|

Short-Term Political Risk Score |

74.8 |

74.8 |

74.8 |

|

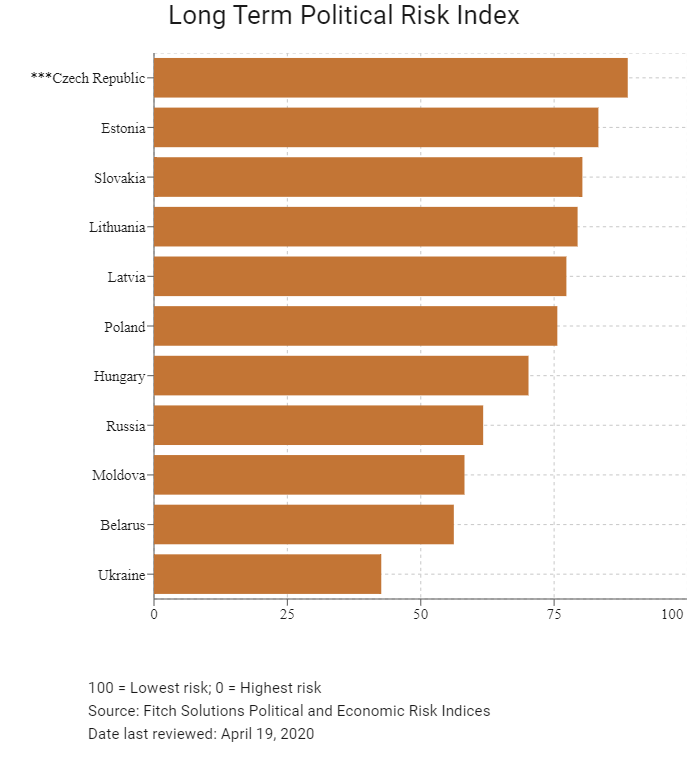

Long-Term Political Risk Score |

88.8 |

88.8 |

88.8 |

|

Operational Risk Index Rank |

24/201 |

30/201 |

29/201 |

|

Operational Risk Score |

71.4 |

69.5 |

69.4 |

Source: Fitch Solutions

Date last reviewed: April 19, 2020

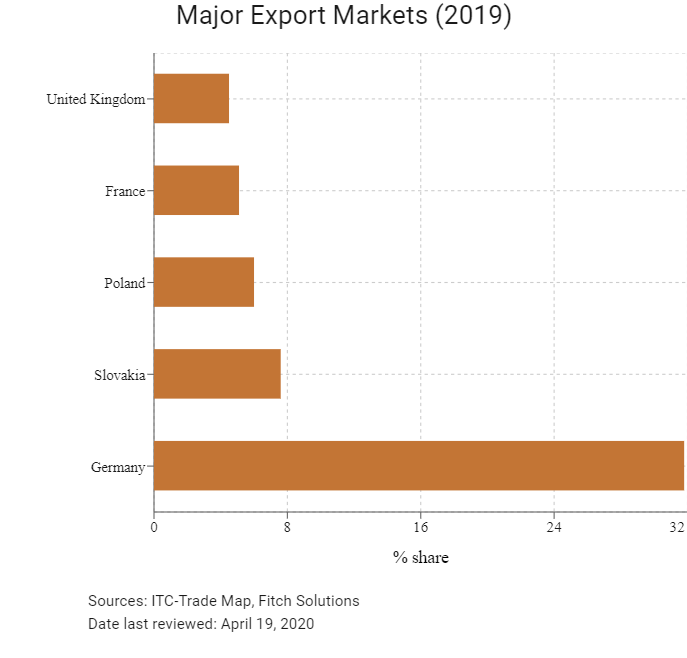

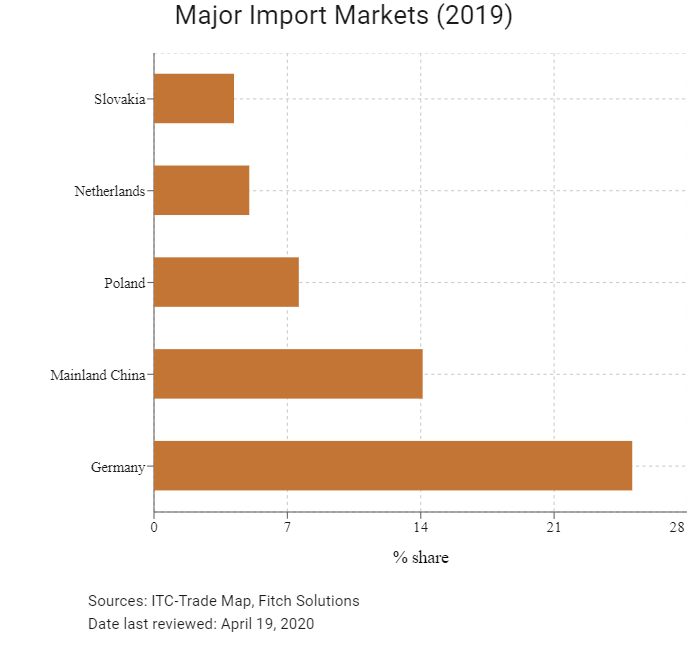

Fitch Solutions Risk Summary

ECONOMIC RISK

The Czech Republic is one of the most stable economies in emerging Europe. However, it is highly exposed to the eurozone, particularly to Germany, via trade and financial links. Slowdown in the eurozone presents major headwinds to the Czech economy, disadvantaging its large export-oriented manufacturing sector. Economic growth in the Czech Republic will slow over the coming years. This slowdown comes on the back of fading external sector resilience, as ongoing weakness in Germany’s manufacturing sector will increasingly weigh on Czech export and domestic demand growth. Risks to this outlook remain titled to the downside, as negative knock on effects related to the novel Covid-19 outbreak could dent Czech growth significantly. Nonetheless, the recent uptick in fixed investment growth in the Czech Republic and relatively high spending on research and development will prevent the tight labour market and high wage growth from impeding the country's competitiveness going forward.

OPERATIONAL RISK

The Czech Republic's regionally competitive operating environment is supported by a low crime and security risk profile, a well-developed transport network, a well-educated labour force and its membership of the EU, all of which have attracted high levels of foreign investment. Key downside risks to investors are the high cost of fuel which elevates operating costs, and the tightening labour market which is adding upward pressure to labour costs.

Source: Fitch Solutions

Date last reviewed: April 19, 2020

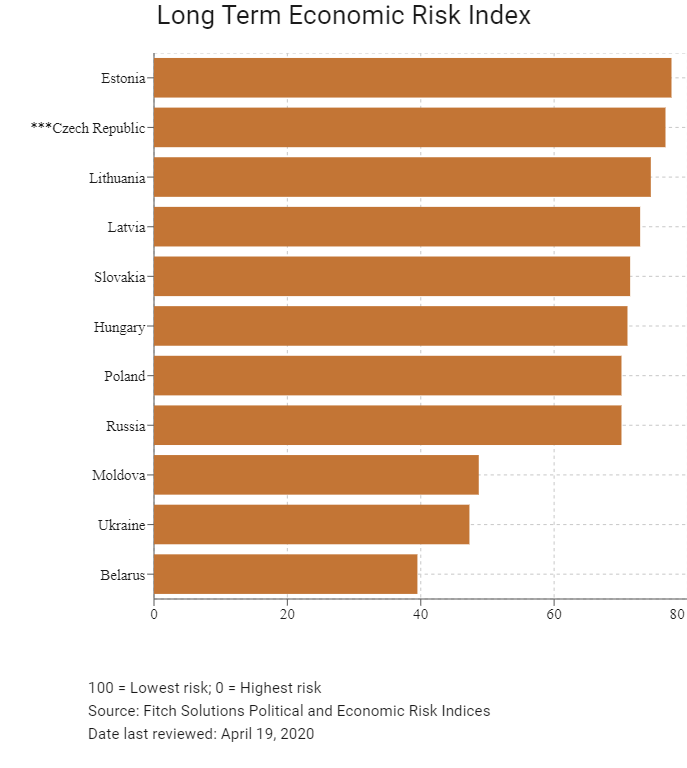

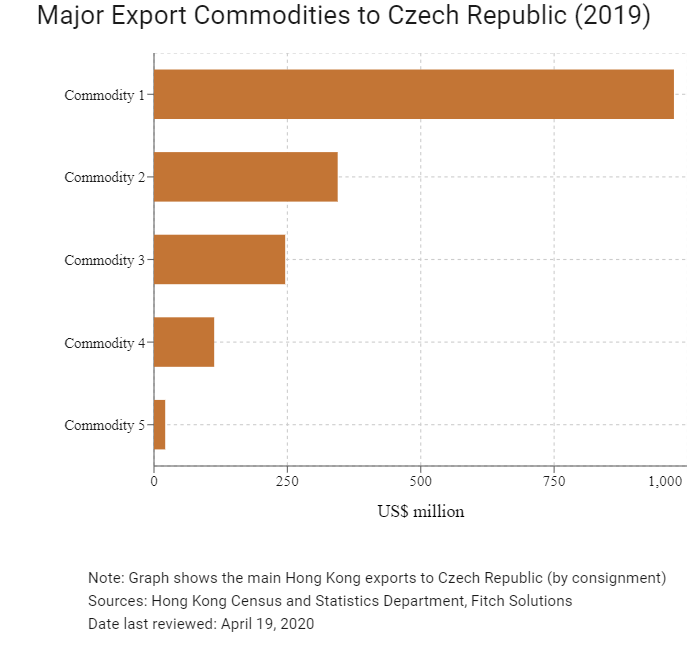

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Czech Republic Score |

69.4 |

60.6 |

67.0 |

73.6 |

76.5 |

|

Central and Eastern Europe Average |

62.5 |

58.6 |

62.8 |

67.5 |

61.2 |

|

Central and Eastern Europe Position (out of 11) |

2 |

5 |

4 |

3 |

1 |

|

Emerging Europe Average |

57.7 |

56.3 |

58.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

2 |

8 |

5 |

4 |

2 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

29 |

39 |

40 |

28 |

21 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Estonia |

70.9 |

63.1 |

75.0 |

71.0 |

74.3 |

|

Czech Republic |

69.4 |

60.6 |

67.0 |

73.6 |

76.5 |

|

Lithuania |

69.4 |

61.3 |

71.1 |

74.3 |

71.0 |

|

Poland |

68.1 |

59.2 |

64.9 |

75.5 |

72.8 |

|

Latvia |

67.1 |

63.5 |

68.2 |

69.4 |

67.4 |

|

Slovakia |

63.7 |

52.1 |

66.2 |

66.8 |

69.6 |

|

Hungary |

63.6 |

55.7 |

62.5 |

70.1 |

66.3 |

|

Belarus |

59.2 |

60.1 |

58.7 |

66.6 |

51.3 |

|

Russia |

58.0 |

65.9 |

57.4 |

67.9 |

40.6 |

|

Moldova |

49.7 |

44.8 |

51.4 |

53.4 |

49.3 |

|

Ukraine |

48.6 |

57.9 |

48.4 |

54.4 |

33.6 |

|

Regional Averages |

62.5 |

58.6 |

62.8 |

67.5 |

61.2 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 19, 2020

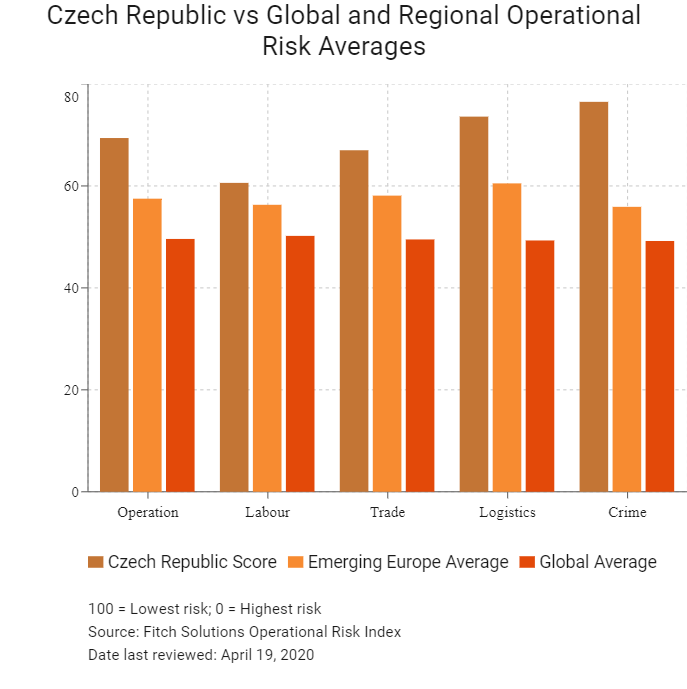

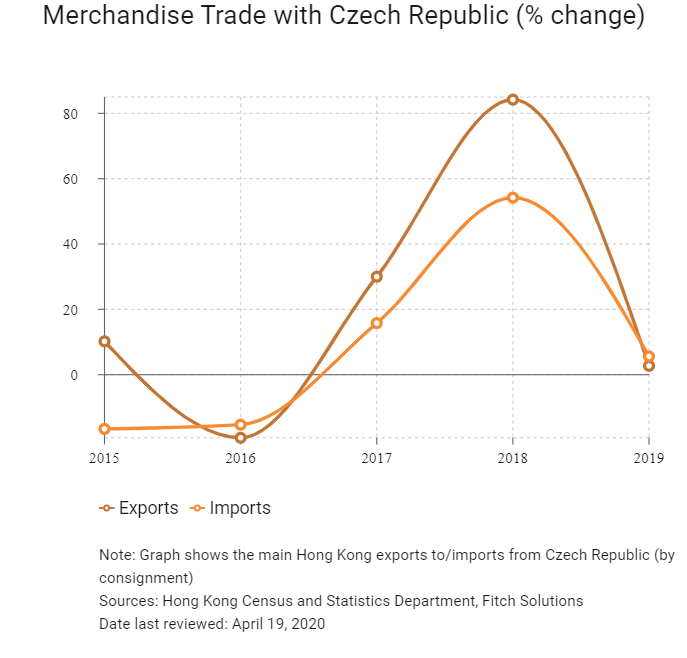

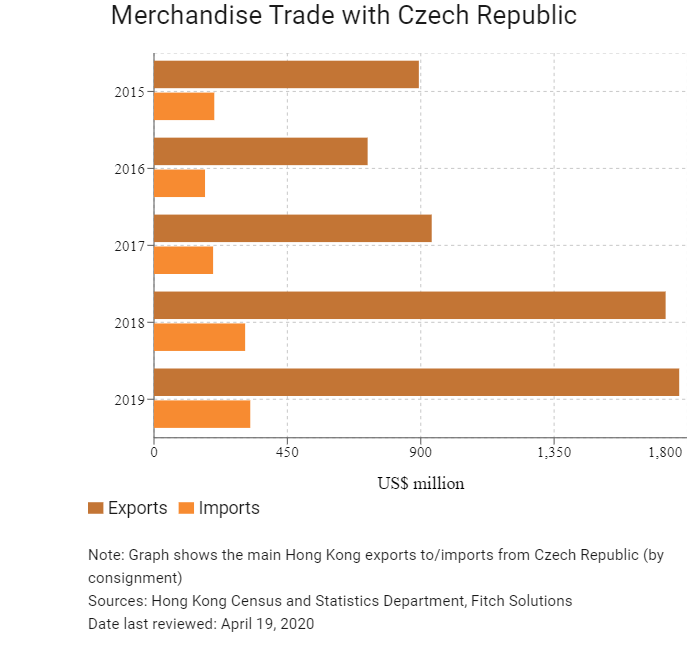

Hong Kong’s Trade with Czech Republic

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

974.6 |

|

Commodity 2 |

Office machines and automatic data processing machines |

344.3 |

|

Commodity 3 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

245.9 |

|

Commodity 4 |

Miscellaneous manufactured articles |

112.8 |

|

Commodity 5 |

Photographic apparatus, equipment and supplies and optical goods; watches and clocks |

21.0 |

|

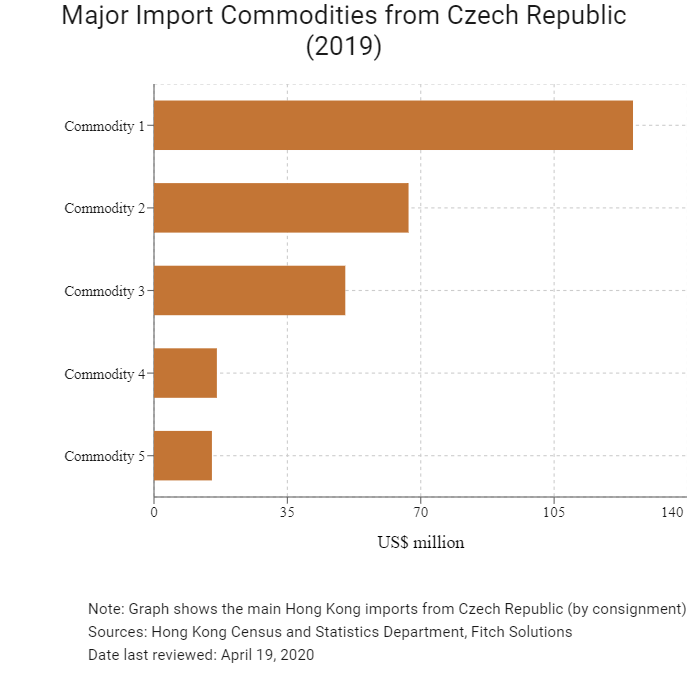

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

125.7 |

|

Commodity 2 |

Office machines and automatic data processing machines |

66.8 |

|

Commodity 3 |

Telecommunications and sound recording and reproducing apparatus and equipment |

50.2 |

|

Commodity 4 |

Professional, scientific and controlling instruments and apparatus |

16.5 |

|

Commodity 5 |

Miscellaneous manufactured articles |

15.2 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Czech residents visiting Hong Kong |

9,554 |

-14.5 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Source: Hong Kong Tourism Board

Date last reviewed: April 19, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of EU companies in Hong Kong |

2,334 |

22.5 |

|

- Regional headquarters |

507 |

14.2 |

|

- Regional offices |

764 |

23.0 |

|

- Local offices |

1,063 |

26.5 |

Source: Hong Kong Census and Statistics Department

Treaties and agreements between Hong Kong and Czech Republic

- Air Service Agreement and Air Service Transit Agreement

- Mutual Legal Assistance Agreement

- Surrender of Fugitive Offenders Agreement

- Transfer of Sentenced Persons Agreement

- Double Taxation Avoidance Agreements (DTAs)-The Czech Republic has DTAs with the Mainland China and concluded a DTA with Hong Kong in December 2012

Sources: Hong Kong Department of Justice, State Administration of Taxation (The People's Republic of China)

Commercial and Economic Section in Hong Kong

The European Chamber of Commerce

- The European Chamber of Commerce creates business opportunities via its network of Chambers, business associations and government agencies.

- The Commercial and Economic Section of the Consulate General of the Czech Republic in Hong Kong also promotes the economic interests of the Czech Republic in Hong Kong and Macao. It provides a full range of export and import trade services and assistance, as well as investment information and advice to companies from Czech Republic, Hong Kong and Macao.

Address: Room 1302, 13/F, 168 Queen’s Road Central, Central, Hong Kong

Email: commerce_hongkong@mzv.cz

Tel: (852) 2511 5133

Fax: (852) 2511 6833

Source: The European Chamber of Commerce in Hong Kong

Consulate General of the Czech Republic in Hong Kong

Address: 1204-5, Great Eagle Centre, 23 Harbour Road, Wan Chai, Hong Kong

Email: hongkong@embassy.mzv.cz, hongkong@embassy.mzv.cz (for visa and consular related enquiries)

Tel: (852) 2802 2212

Fax: (852) 2802 2911

Source: Consulate General of the Czech Republic

Visa Requirements for Hong Kong Residents

HKSAR passport holders do not need a visa to the Schengen area for a stay of up to 90 days in any 180-day period.

Source: Consulate General of the Czech Republic

Date last reviewed: April 19, 2020

Czech

Czech