GDP (US$ Billion)

2.58 (2018)

World Ranking 167/193

GDP Per Capita (US$)

3,160 (2018)

World Ranking 131/192

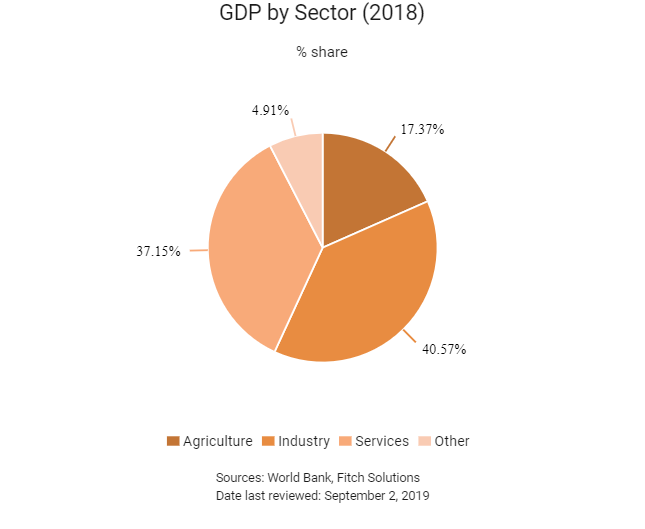

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

86.7 (2018)

Currency (Period Average)

Bhutanese Ngultrum

70.42per US$ (2019)

Political System

Constitutional monarchy

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

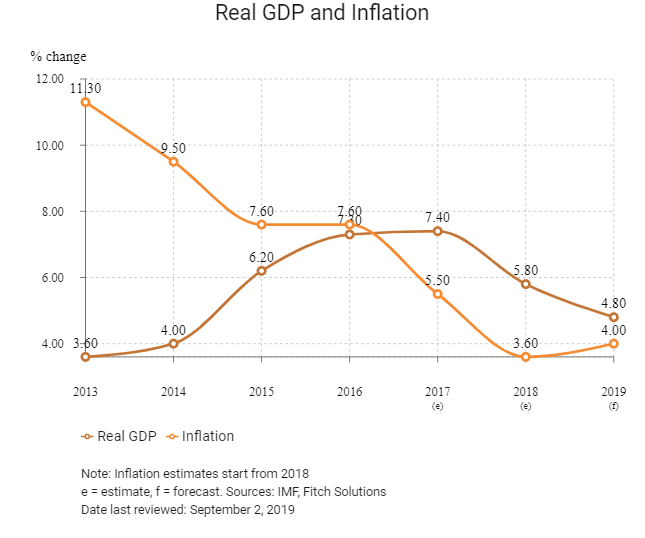

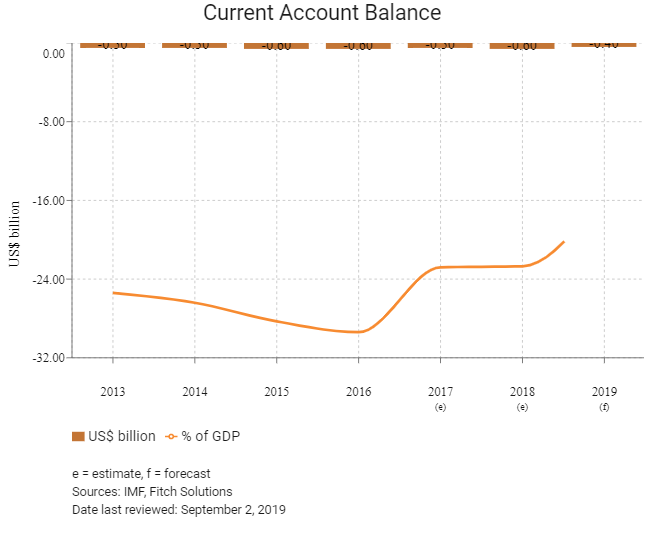

Bhutan has developed considerably in recent years and made remarkable progress in decreasing poverty and improving human development indicators. Hydropower construction (including the PHP-II, a megaproject collaboration between the governments of Bhutan and India, slated for completion in September 2019) and supportive fiscal and monetary policies, such as the 2016 Economic Development Policy and accompanying 2017 Fiscal Incentives Bill, are contributing to solid growth and low inflation. Nevertheless, structural challenges remain, such as large current account deficits, high public debt and an underdeveloped private sector. The new government formed by the Druk Nyamrup Tshogpa (DNT) party is expected to prioritise welfare and infrastructure spending in the years ahead.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

January 2015

John Kerry became the first-ever United States secretary of state to hold a cabinet-level meeting with a Bhutanese official when he met Bhutanese Prime Minister Tshering Tobgay in India.

October 2018

The third National Assembly elections to the lower house of the Parliament took place on October 18, 2018 with the DNT party winning in the run-off election of the two-phase system. Lotay Tshering, the president of DNT, would be the new prime Minister of Bhutan.

Sources: BBC Country Profile – Timeline, Fitch Solutions, The Indian Institute for Defence Studies and Analyses

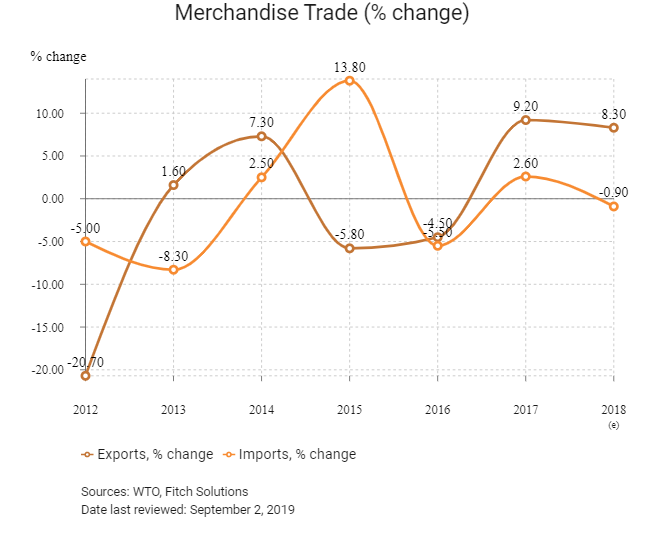

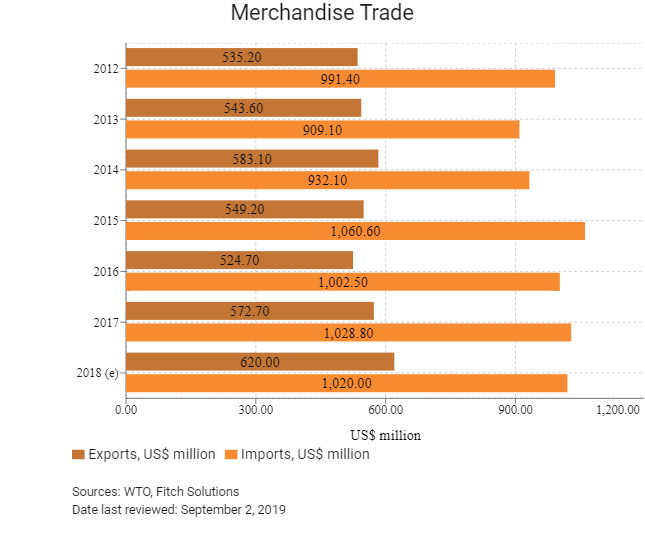

Merchandise Trade

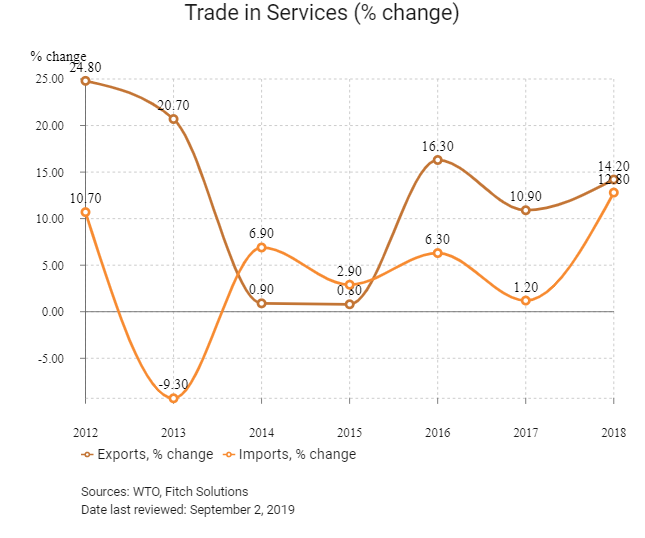

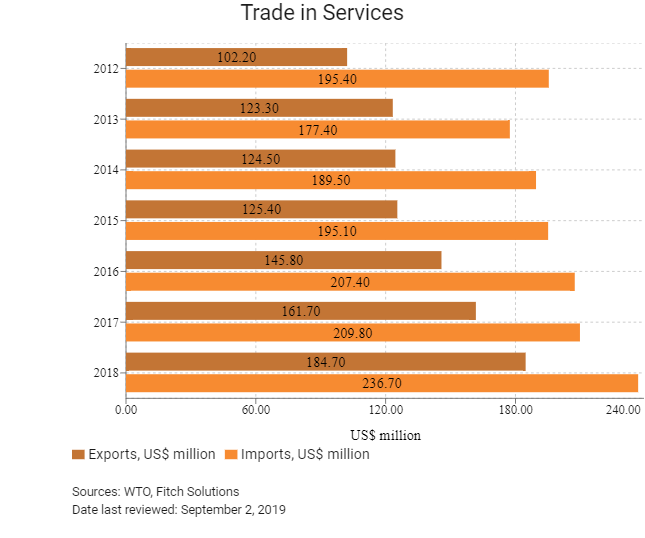

Trade in Services

- Bhutan is not yet a member of the World Trade Organization (WTO). Its Working Party was established in October 1999, when the country started its WTO accession negotiations. The Working Party met for the fourth time in January 2008 (most recent meeting), but progress has stalled due to the resistance of the previous government.

- A WTO Reference Centre was inaugurated by Lyonpo Lekey Dorji, Bhutan's Minister of Economic Affairs, at the Department of Trade in Thimphu, Bhutan, on September 14, 2016. The Reference Centre will serve as a centre of information on WTO issues and international trade for government officials, the private sector, academic institutions and the general public.

- Bhutan has an average tariff rate of 10%, the fourth highest in the South Asia region (out of eight countries), as well as numerous non-tariff barriers.

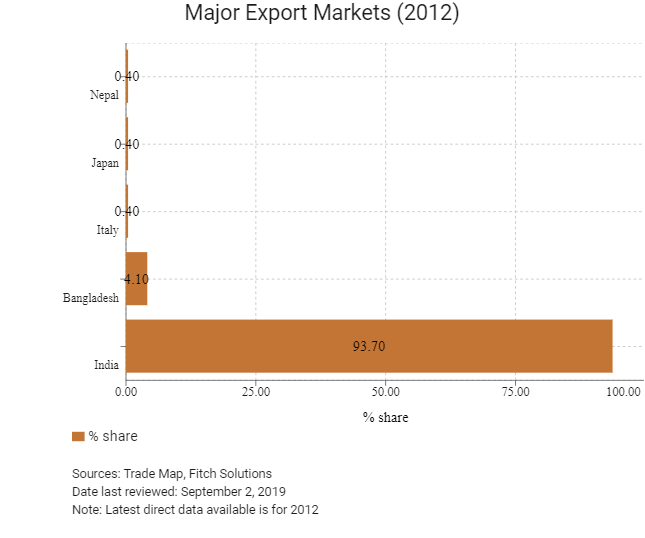

- Various logistical and technical barriers exist to trade development and diversification in Bhutan. The main hurdle is the underdevelopment of Bhutan's supply chain. That said, market access and demand for Bhutan's goods and services are rather favourable due to the country's completely open access to the Indian market as part of one of the most liberal trade agreements in the world (meaning that Bhutan's trade with India is not restricted by tariffs or rules of origin). It also has duty-free and quota-free access to European and United States markets as a Least Developed Country through the European Union's General System of Preferences and Everything But Arms programmes (although, so far, Bhutan has not been able to make full use of this facility). Nevertheless, the World Bank 2018 Ease of Doing Business Report ranks Bhutan 26th out of 190 states in the Trading Across Borders index.

- Bhutan accepts sanitary and phytosanitary (SPS) measures of other countries using internationally recognised and accepted SPS approaches in practice. Since neighbouring countries tend to have similar pest and disease profiles, SPS barriers to trade tend to be relatively low. However, SPS barriers to trade with industrialised countries may be very significant.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

In June 2018, the seven-country grouping BIMSTEC (The Bay of Bengal Initiative on Multi-Sectoral Technical and Economic Cooperation) attended a two-day regional conference on 'Advancing BIMSTEC Cooperation'. The emphasis of the talks was on the need to conclude the free trade agreement (FTA) among the members of BIMSTEC to advance economic cooperation.

Multinational Trade Agreements

Active

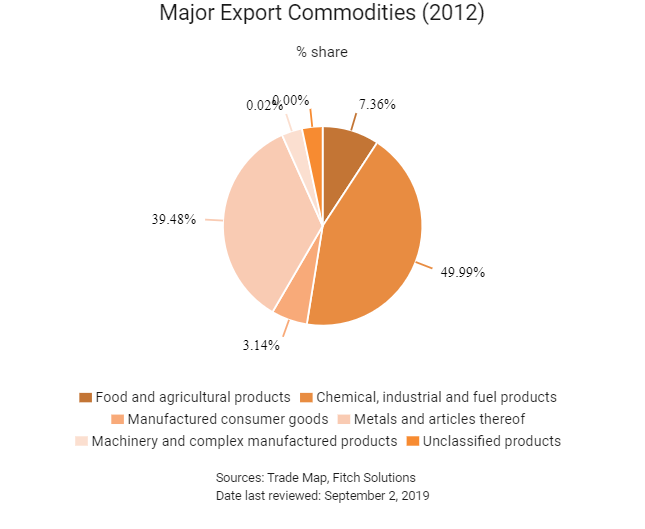

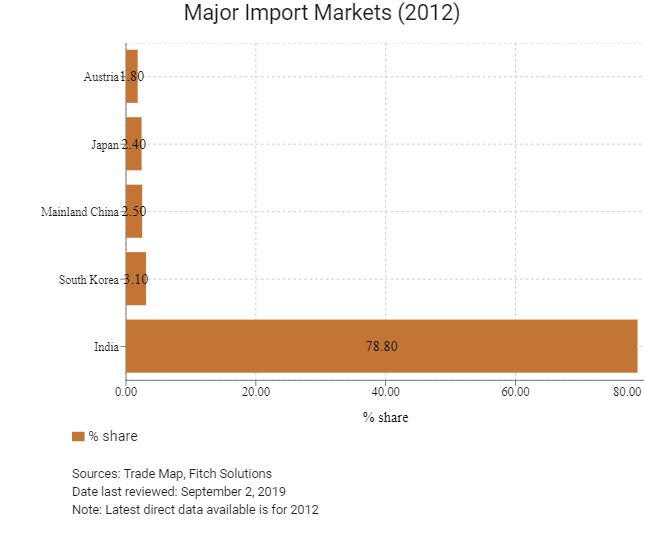

- Bhutan-India Bilateral FTA: The agreement covers trade in goods and entered into force in July 2006. Hydropower is the mainstay of Bhutan's economy, accounting for over 40% of total exports, with almost 90% going to India. Market access and demand for Bhutan's goods and services are rather favourable due to the country's completely open access to the Indian market as part of one of the most liberal trade agreements in the world. This highly liberal bilateral FTA features duty-free and quota-free trade and, therefore, trade with India is not restricted by tariffs or rules of origin. Beyond hydroelectricity exports to India, overall exports remain minimal and of low value. Most imported goods travel overland through India to get to Bhutan, and India accounts for nearly 95% of Bhutan's exports and nearly 80% of its imports.

- South Asian FTA (SAFTA): SAFTA is a plurilateral FTA between Bhutan, Afghanistan, Bangladesh, India, Maldives, Nepal, Pakistan and Sri Lanka. The agreement covers trade in goods and originally entered into force in January 2006.

Under Negotiation

The BIMSTEC: BIMSTEC is a plurilateral FTA that is currently under negotiation. The agreement will focus on the trading of goods between Bhutan, Myanmar, Sri Lanka, Bangladesh, India, Nepal and Thailand. The bloc will bring together 1.5 billion people, or 21% of the world's population, and will have a combined GDP of more than USD2.85 trillion.

Source: WTO Regional Trade Agreements database

Foreign Direct Investment

Foreign Direct Investment Policy

- Bhutan currently does not have an investment promotion authority. In its place, a foreign direct investment (FDI) division has been established in the Department of Industry to provide focused support for FDI.

- As of May 2018, Bhutan had approved 64 FDI projects worth BTN34.0 billion since the country allowed foreign investment in 2002. The economic affairs ministry commented that 19 projects had been approved in principle from 2017 to Q118; the total number of projects is 83. 65% of investors are from Asia, 25% from Europe, 9% from America the rest are from the Oceania region. According to the department's annual report, companies related to the FDI have created 4,871 jobs as of 2016, of which 93% have been filled by locals.

- 100% foreign ownership is allowed in the sectors of education services (except technical and vocational institutions), private health, five-star hotels, infrastructure, research and development, head office services and information technology. Up to 51% foreign ownership is allowed in the financial services industry, while up to 74% foreign ownership is allowed in all other activities, except those in the Negative List, which include sectors such as media and broadcasting, the distribution of services in wholesale, retail and micro trade, and in mining and sales of minerals in primary or raw form.

- Foreign investment is given the same treatment as similar domestic investment, unless otherwise specified as above.

- Foreign firms may borrow from financial institutions in Bhutan and the debt-equity ratio shall be as per the provisions of the Royal Monetary Authority's prudential regulations.

- Foreign investors have the right to repatriate their invested capital and any capital gains secured in the currency of investment.

- FDI is encouraged in areas that contribute to the development of: the green and sustainable economy; the promotion of socially responsible and ecologically sound industries; the promotion of culturally and spiritually sensitive industries; investments in services that promote Brand Bhutan; and the creation of a knowledge society.

- The mining sector in Bhutan has the potential to be a major driver of economic growth and development. However, mining activities are on Bhutan's Negative List, which means that foreigners are restricted from engaging in mining activities and sales of minerals in primary or raw form.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Kuensel

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Bhutan operates two industrial estates: the Pasakha Industrial Estate (272 acres) located in Chhukha district (southern Bhutan) and Bjemina Industrial Estate (34.4 acres) located in Thimphu district (western Bhutan). |

General business incentives (not limited to the industrial estates) include: |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: Varies 5%-100%

- Corporate Income Tax: 30%

Source: UNCTAD-ICC Investment Guides

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

30% on net profits. Losses incurred in a given year can be carried forward and then adjusted in the three following income years |

|

Withholding Tax |

2% for nationals holding a license, 5% for those without a license and 3% for non-nationals |

|

Value Added Tax |

- Plant and machine units - exempt |

|

Rural Land Tax |

0.2% to 2.5% of land value |

|

Property transfer |

5% of property sale value |

|

Green Tax |

20% for passenger vehicles with 1,800cc and above and 5% for those below 1,800cc |

Source: UNCTAD-ICC Investment Guides

Date last reviewed: March 22, 2019

In 2004, the National Assembly decided to limit the number of foreign workers in the country to 45,000. Thanks to the hydropower projects, there are more than 53,000 foreign workers in the country.

Foreign Worker Permits

Firms need approval from the Department of Labour to recruit foreign workers. Applications are approved within one week. Businesses hiring workers with Indian citizenship need to sign an agreement with their respective Regional Immigration Office. Approval for additional expatriate workers depends on whether a company made efforts to hire a suitable Bhutanese candidate. A firm needs to have documented two attempts to advertise and recruit for a Bhutanese worker locally.

Visa/Travel Restrictions

The policy 'High Value, Low Impact Tourism' makes travel to the Kingdom of Bhutan highly regulated to minimise the impact on the country's society and environment. Bhutanese policy ensures that only a limited number of tourists enter the country at any given time, preventing mass tourism and the alteration of the country's character.

Indian citizens do not need a visa to enter Bhutan due to the 1949 Treaty between the two states that allows for free movement of people between the two nations on a reciprocal basis.

Citizens of Bangladesh and the Maldives do not need a visa for Bhutan, as well as diplomatic passport holders of Switzerland and Thailand. All other passports require a visa to Bhutan.

Upon entry to Bhutan, all foreigners are issued a seven- or 14-day 'Entry Permit' that is valid for Thimphu and Paro only. The rest of Bhutan is considered a restricted area, and foreigners need a 'Restricted Area Permit' to enter.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Not rated |

Not rated |

|

Standard & Poor's |

Not rated |

Not rated |

|

Fitch Ratings |

Not rated |

Not rated |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2017 |

2018 |

2019 |

|

|

Ease of Doing Business Index |

73/190 |

75/190 |

81/190 |

|

Ease of Paying Taxes Index |

19/190 |

17/190 |

15/190 |

|

Logistics Performance Index |

N/A |

149/160 |

N/A |

|

Corruption Perception Index |

26/180 |

25/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, Transparency International

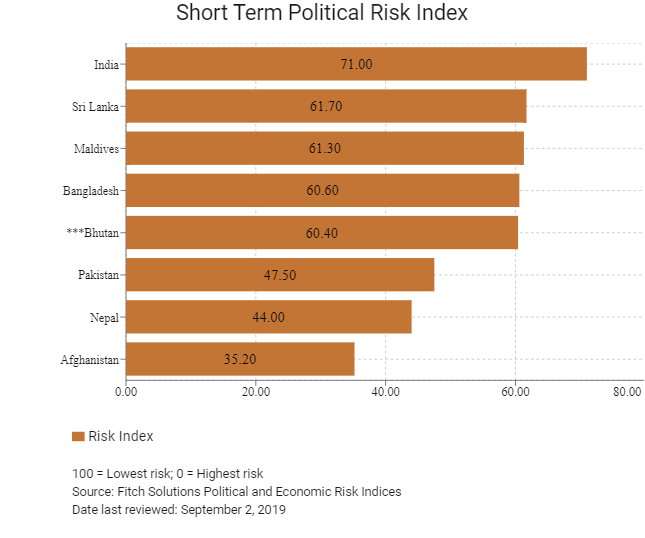

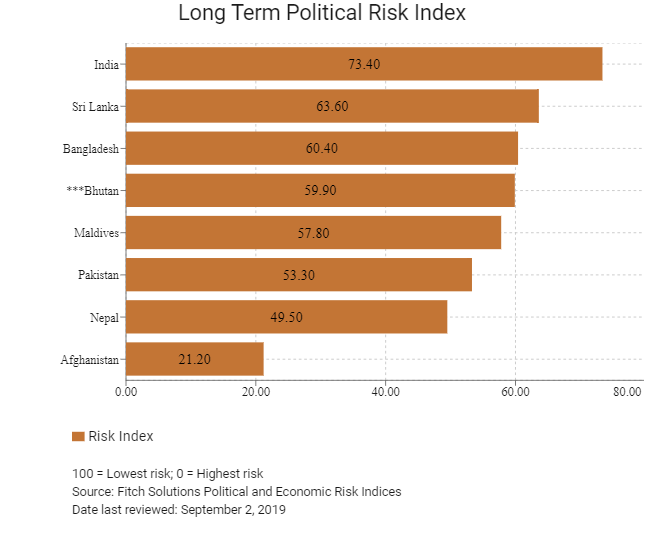

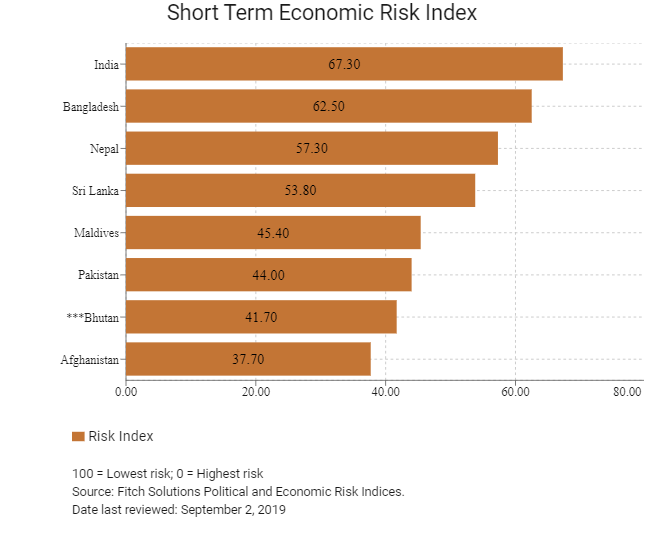

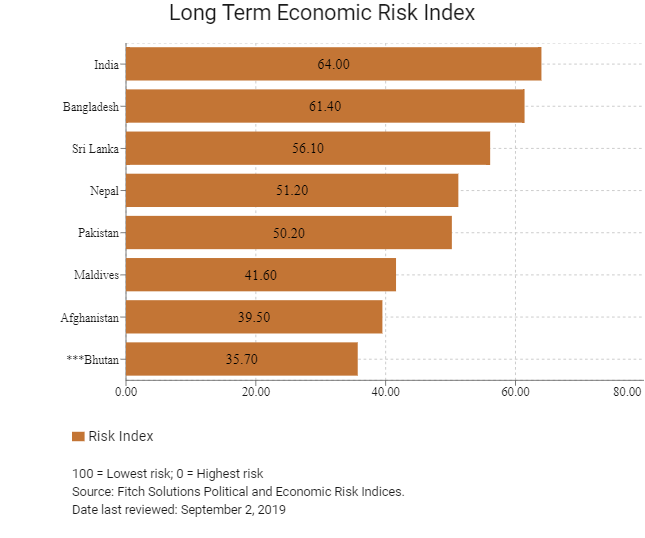

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2017 |

2018 |

2019 |

|

|

Economic Risk Index Rank |

N/A |

192/202 |

190/202 |

|

Short-Term Economic Risk Score |

40.8 |

42.1 |

41.7 |

|

Long-Term Economic Risk Score |

35.3 |

35.3 |

35.3 |

|

Political Risk Index Rank |

N/A |

113/202 |

112/202 |

|

Short-Term Political Risk Score |

61 |

60.4 |

60.4 |

|

Long-Term Political Risk Score |

57.6 |

59.9 |

59.9 |

|

Operational Risk Index Rank |

N/A |

85/201 |

92/201 |

|

Operational Risk Score |

51.4 |

51.6 |

50.6 |

Source: Fitch Solutions

Date last reviewed: March 22, 2019

Fitch Solutions Risk Summary

ECONOMIC RISK

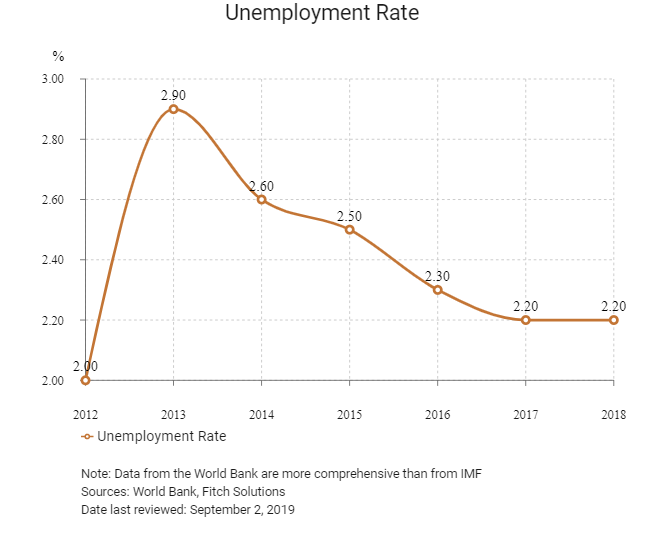

Hydropower construction and supportive fiscal and monetary policy in Bhutan have contributed to solid growth. Nevertheless, structural challenges remain, including large current account deficits, an underdeveloped private sector and a high youth unemployment rate. Further delays in infrastructure projects, particularly hydropower construction raise risks for macroeconomic prospects over the medium term.

OPERATIONAL RISK

Attractive business opportunities, outside of the construction sector, remain limited in Bhutan relative to its peers in the region. 95% of Bhutan's manufacturing sector comprises small and cottage industries, which employ an average of four people per business. These businesses generally operate in publishing and printing, and the manufacturing of furniture, other wood-based products, and food and beverages. However, these firms lack economies of scale. The landlocked nature of the country, complex terrain and limited transport connections raise the cost of trade and risk of supply chain disruptions. However logistics risks are easing over time, as according to the World Economic Forum, Bhutan has achieved 100% electricity access.

Source: Fitch Solutions

Date last reviewed: March 22, 2019

Fitch Solutions Political and Economic Risk Indices

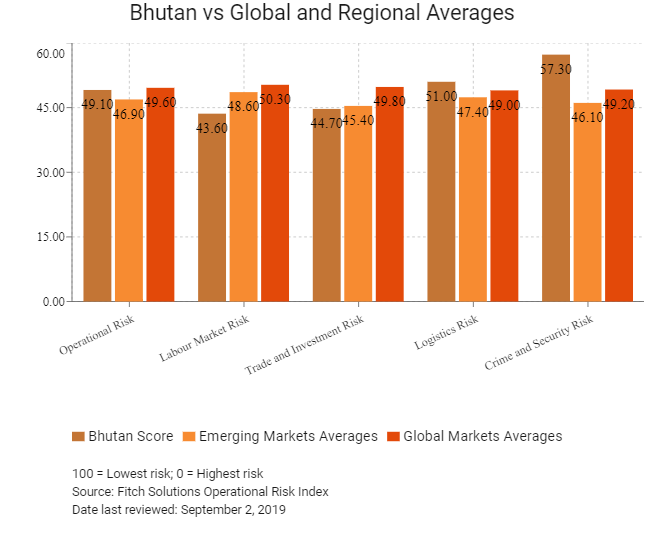

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Bhutan Score |

50.6 |

44.5 |

44.6 |

51.0 |

62.5 |

|

South Asia Average |

41.9 |

43.7 |

40.2 |

43.4 |

40.5 |

|

South Asia Position (out of 8) |

2 |

5 |

4 |

3 |

1 |

|

Asia Average |

48.7 |

50.6 |

48.2 |

46.0 |

50.1 |

|

Asia Position (out of 35) |

14 |

24 |

20 |

14 |

7 |

|

Global Average |

49.6 |

49.7 |

49.9 |

49.0 |

49.8 |

|

Global Position (out of 201) |

92 |

132 |

126 |

88 |

54 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

India |

50.7 |

44.6 |

53.7 |

61.8 |

42.8 |

|

Bhutan |

50.6 |

44.5 |

44.6 |

51.0 |

62.8 |

|

Sri Lanka |

50.1 |

45.0 |

49.0 |

58.2 |

48.4 |

|

Maldives |

48.8 |

50.3 |

45.6 |

39.5 |

59.9 |

|

Bangladesh |

38.4 |

50.1 |

28.9 |

39.0 |

35.5 |

|

Nepal |

37.5 |

40.9 |

33.3 |

34.9 |

41.1 |

|

Pakistan |

34.9 |

36.9 |

38.3 |

43.1 |

21.4 |

|

Afghanistan |

24.5 |

37.3 |

28.5 |

19.7 |

12.3 |

|

Regional Averages |

41.9 |

43.7 |

40.2 |

43.4 |

40.5 |

|

Emerging Markets Averages |

46.7 |

48.1 |

45.5 |

47.4 |

46.0 |

|

Global Markets Averages |

49.5 |

49.7 |

48.9 |

49.8 |

49.8 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 22, 2019

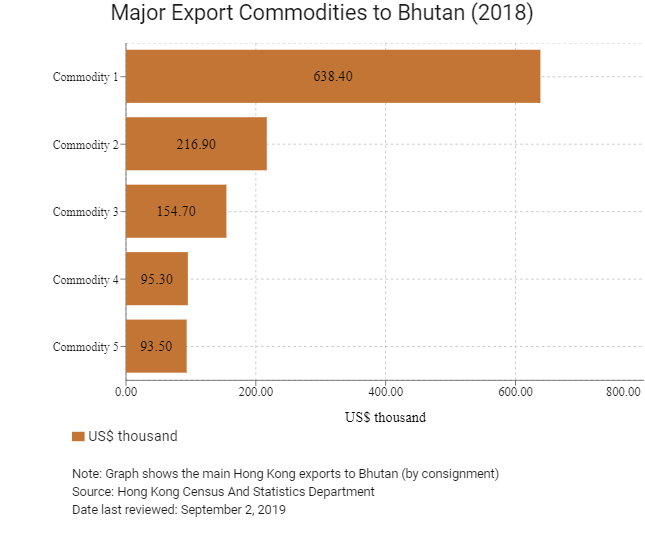

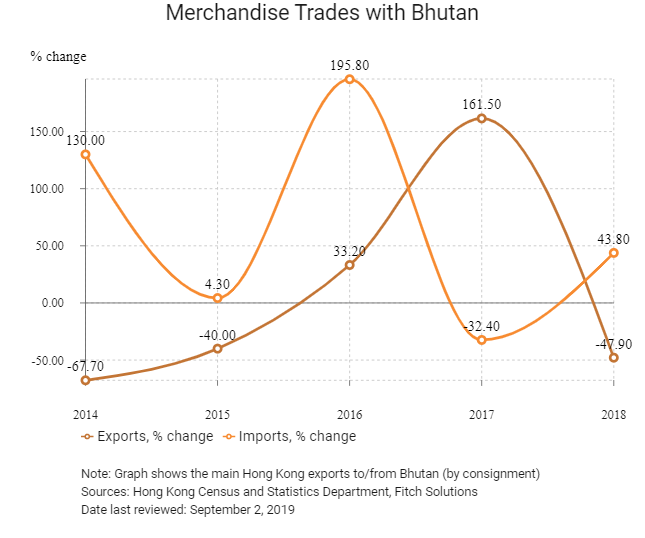

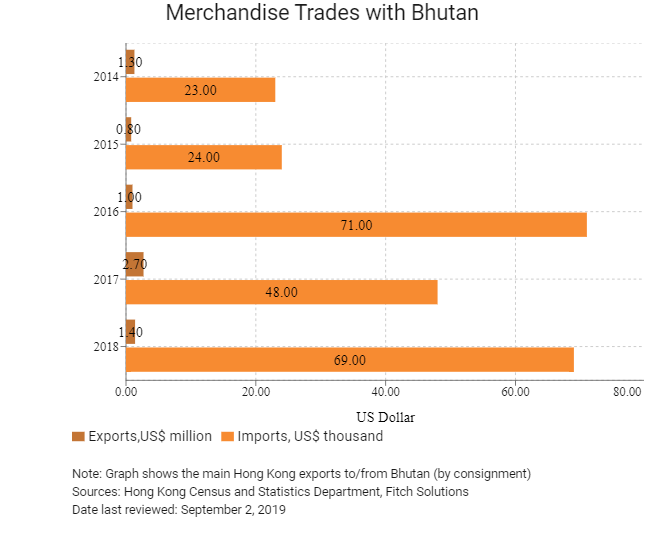

Hong Kong’s Trade with Bhutan

|

Export Commodity |

Commodity Detail |

Value (US$ thousand) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

638.4 |

|

Commodity 2 |

Office machines and automatic data processing machines |

216.9 |

|

Commodity 3 |

Essential oils, resinoids and perfume materials; and toilet, polishing and cleansing preparations |

154.7 |

|

Commodity 4 |

Photographic apparatus, equipment and supplies; optical goods; and watches and clocks |

95.3 |

|

Commodity 5 |

Miscellaneous manufactured articles |

93.5 |

|

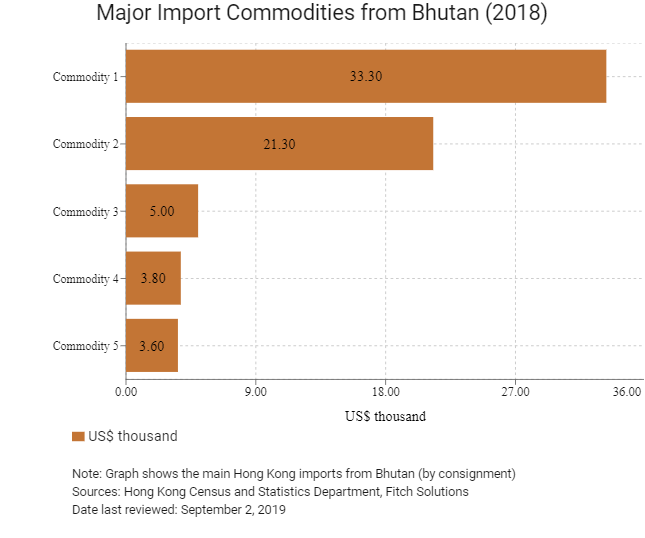

Import Commodity |

Commodity Detail |

Value (US$ thousand) |

|

Commodity 1 |

Essential oils and resinoids and perfume materials; toilet, polishing and cleansing preparations |

33.3 |

|

Commodity 2 |

Photographic apparatus, equipment and supplies and optical goods and watches and clocks |

21.3 |

|

Commodity 3 |

Miscellaneous edible products and preparations |

5.0 |

|

Commodity 4 |

Miscellaneous manufactured articles |

3.8 |

|

Commodity 5 |

Special transactions and commodities not classified according to kind |

3.6 |

Exchange Rate HK$/US$, average

7.75 (2014)

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

Sources: Hong Kong Census and Statistics Department, Fitch Solutions, Trade Map

Date last reviewed: March 22, 2019

|

2017 |

Growth rate (%) |

|

|

Number of Bhutan residents visiting Hong Kong |

1,260 |

-6.0 |

Source: Hong Kong Tourism Board

|

2017 |

Growth rate (%) |

|

|

Number of Asia Pacific residents visiting Hong Kong |

54,482,538 |

3.5 |

|

Number of South Asians residing in Hong Kong |

36,680 |

1.6 |

Visitor sources: Hong Kong Tourism Board, Fitch Solutions

Resident source: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: March 22, 2019

Commercial Presence in Hong Kong

|

2017 |

Growth rate (%) |

|

|

Number of Bhutanese companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Chamber of Commerce (or Related Organisations) in Hong Kong

Bhutanese Consulate in Hong Kong

Address: Room 2205, Universal Trade Centre, 3 Arbuthnot Road, Central, Hong Kong

Email: enquiry@bhutanconsulate.hk

Tel: (852) 2810 1720

Fax: (852) 2810 8840

Source: Hong Kong Protocol Division Government Secretariat

Visa Requirements for Hong Kong Residents

Hong Kong residents must obtain a visa clearance prior to travel to Bhutan. Visas are processed through an online system by a licensed Bhutanese tour operator directly or through a foreign travel agent.

Source: Tourism Council of Bhutan

Date last reviewed: March 22, 2019

Bhutan

Bhutan