GDP (US$ Billion)

15.06 (2018)

World Ranking 123/193

GDP Per Capita (US$)

5,239 (2018)

World Ranking 103/192

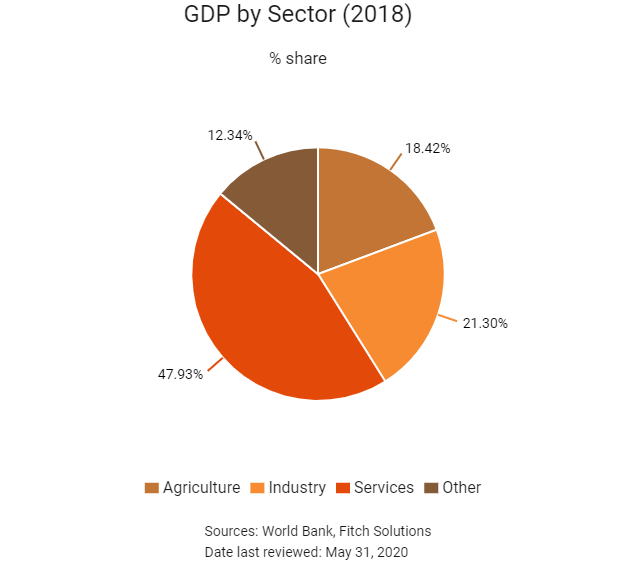

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

77.1 (2018)

Currency (Period Average)

Albanian Lek

109.85per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Albania has been transformed from one of the poorest countries in Europe into an upper-middle-income country. Albania is implementing important reforms to revitalise growth and job creation, while advancing the integration agenda of the European Union (EU). Recognising these challenges, the government has embarked on a broad-based reform program focused on macroeconomic and fiscal sustainability, financial sector stabilisation, energy concerns, pensions, and territorial administration. Enhanced regional connectivity and access to regional and global markets, coupled with export and market diversification, can also help promote faster growth. Albania is richly endowed with underdeveloped natural resources–such as oil and minerals, including chromite – which makes it a potentially attractive destination for foreign investors. The Patos-Marinza oilfield is the largest onshore oilfield in continental Europe.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

October 2018

The Albanian Investment Development Agency (AIDA), with the support of the Ministry of Europe and Foreign Affairs, organised a meeting between representatives of ChinaCham Hungary – the Hungarian-Mainland Chinese Economic Chamber – and Albanian businesses at the Ministry of Finance and Economy. Discussions were held on establishing business partnerships with Mainland China and providing opportunities for investment in Albania.

November 2018

The Albanian and Romanian Chambers of Commerce and Industry announced at a forum in Tirana that they would strengthen co-operation in the sectors of energy, agribusiness, tourism and construction.

December 2018

The Albanian parliament has approved a EUR32 million (USD36 million) loan agreement signed in December 2018 with German Development Bank KfW to support energy projects in the country.

February 2019

South Korea's Yura Tech announced that it will start producing automobile parts in Zhupan, southern Albania, in 2019. The project could lead to several factories employing 4,000 people.

August 2019

The Albanian parliament approved a public-private partnership (PPP) contract worth EUR50.1 million with Gjikuria for the Orikum-Dukat road project in the country. The contract covers the construction and maintenance of a 14.7km long road connecting the yacht port in the coastal village of Orikum to Dukat village in the Vlora region. The 13-year concession for the project was awarded in November 2018. The road, when completed, is expected to ease traffic in Albania's southern coastal area.

September 2019

Montenegro Bonus, Albania's Albgaz, Bosnian firm BH-Gas and Croatia's Plinacro planned to complete the preliminary design of the 516km Ionian-Adriatic Pipeline (IAP) by September 2020. The IAP will carry natural gas from Albania's Fier to Split in Croatia via Montenegro and Bosnia & Herzegovina. The bi-directional pipeline will be able to carry 5 billion cubic metres of natural gas a year. In Fier, IAP would connect to the under-construction Trans Adriatic Pipeline. The firms have agreed to set up an equal stake joint venture for the construction of the pipeline.

October 2019

In mid-October, EU leaders were unable to reach unanimous agreement that talks should begin with both Albania and North Macedonia after a 12-month review that came to an end in June. Although the bulk of EU leaders were in favour of progressing Albanian accession negotiations, France, the Netherlands and Denmark were opposed, which, given the requirement for unanimity, means that talks will not begin at this stage.

November 2019

Albanian Railways was seeking bids from the prequalified firms for the rehabilitation of 34km Durres-Tirana Public Transport Terminal railway line and a new 5km rail link to Tirana International Airport in Albania. The project concerns design and build of 39km of railway infrastructure, including the signalling and communication. The tenders are part of a EUR90.3 million scheme, which will be funded by the European Bank of Reconstruction and Development, Western Balkan Investment Fund and the government of Albania. Bids are due for the first stage by January 15 2020 and the rehabilitation will allow trains to run at line at 100km/h.

March-May 2020

Since announcing its first cases of the Covid-19, Albania had adopted a number of measurements to curtail the spread of the coronavirus. The country had adopted some of the toughest restrictive measures in Europe, due to the country’s close proximity to Italy. The government announced a fiscal package of around 2.8% of GDP consisting of budget spending, sovereign guarantees and tax deferrals.

Sources: BBC Country Profile – Timeline, Invest in Albania, Reuters, Albanian Ministry of Infrastructure and Energy, Tirana Times, Fitch Solutions

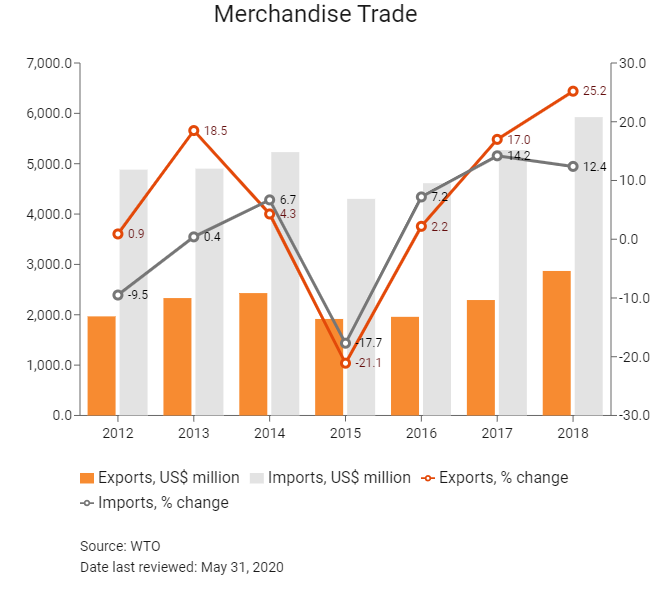

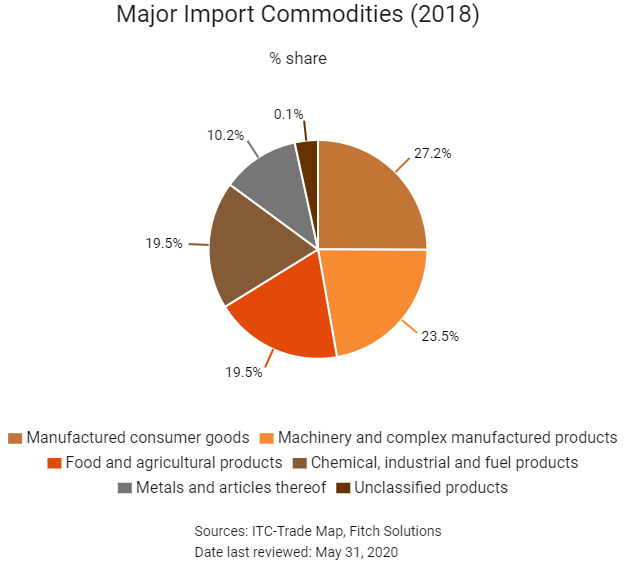

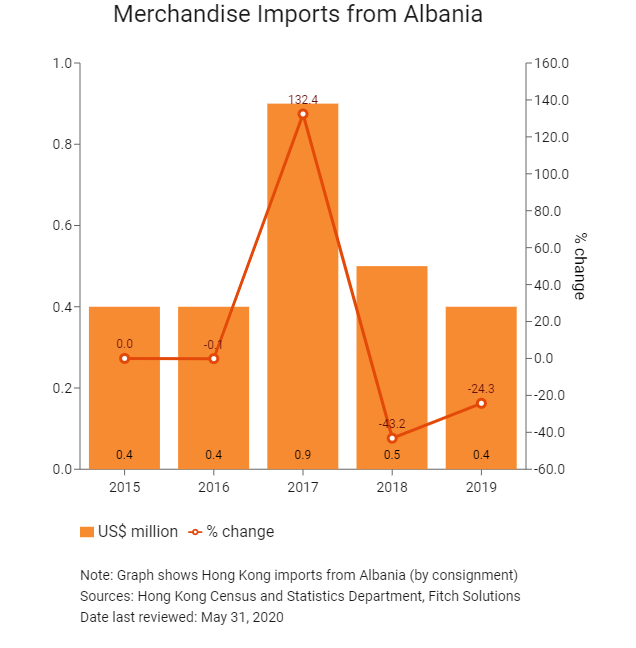

Merchandise Trade

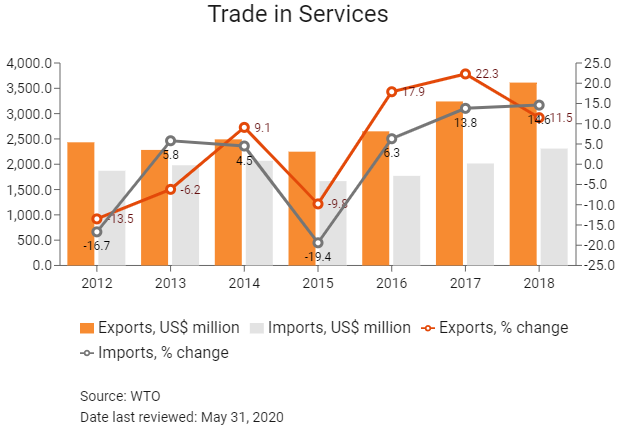

Trade in Services

- Albania joined the World Trade Organization (WTO) in September 2000. As a result, Albania grants Most Favoured Nation (MFN) treatment to all of its trading partners.

- Albania's average tariff rate is 1.1%, which is the second-lowest in South East Europe (out of 12 states) and the fourth-lowest in the wider Emerging Europe region (out of 31 states).

- Albania has no significant non-tariff trade barriers. However, administrative bureaucracy, such as the use of sanitary or phytosanitary measures, can delay the movement of goods and increase costs. Furthermore, the application of market prices, often referred to as 'reference prices' in calculating customs duties and other customs taxes, has become a concern and is a potential barrier for businesses involved in trading activities.

- In January 2015, Albania eliminated import tariffs on products, such as live bovine animals and swine, live poultry, eggs, wheat or flour, and petroleum oils. The government also reduced import tariffs on new pneumatic tyres made of rubber, from 15% to 10%.

- Albania's Business and Investment Development Strategy 2014-2020 stipulates that its trade policy objectives are guided by WTO principles. The country also complies with the ambitions and objectives of the EU in the area of business and investments promotion. The strategy guarantees the absence of quantitative restrictions on imports and exports (except in cases of environmental protection or assistance to fragile industries, cultural heritage, forestry and arms and ammunitions), export subsidies, any kind of tax on exports and export bans.

- In May 2018, representatives of the Durres Port Authority, in Albania, and the Rijeka Port Authority, in Croatia, signed a memorandum of understanding to widen bilateral co-operation in the field of maritime transport and port industry. The two states also agreed to co-operate on issues related to economic promotion in order to boost trade.

Sources: WTO – Trade Policy Review, Republic of Albania Ministry of Economic Development, Trade & Entrepreneurship, Fitch Solutions

Trade Updates

In mid-October, EU leaders were unable to reach unanimous agreement that talks should begin with both Albania and North Macedonia after a 12-month review that came to an end in June 2019.

Multinational Trade Agreements

Active

- The Central European FTA (CEFTA): CEFTA came into force on May 1, 2007 and helps to increase trade between regional counterparts and foster non-EU bilateral relations. The signatories are Albania, Bosnia and Herzegovina, Serbia, Moldova, Montenegro, North Macedonia and Kosovo.

- Albania and the European Free Trade Association (EFTA): EFTA consists of Switzerland, Norway, Iceland and Liechtenstein. The main focus of the EFTA is on the liberalisation of trade in goods. The agreements with Liechtenstein and Switzerland entered into force on November 1, 2010 and the agreements with Norway and Iceland entered into force on August 1 and October 1, 2011 respectively.

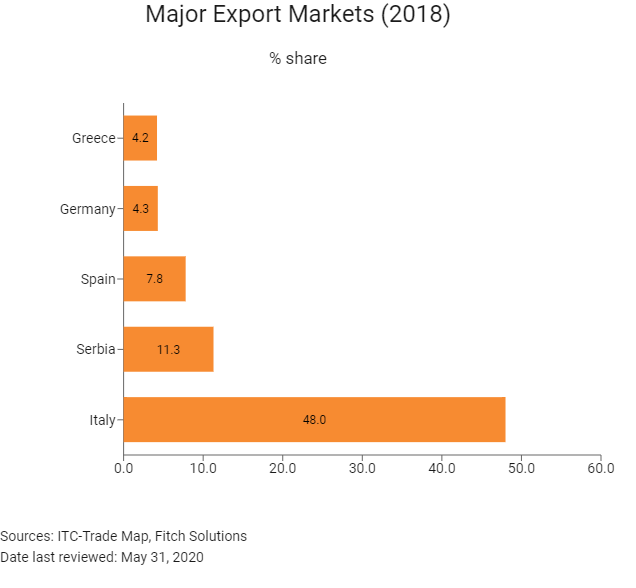

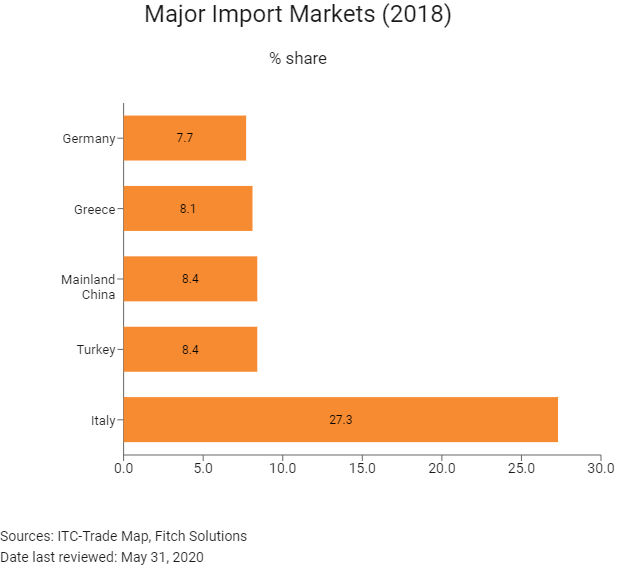

- Stabilisation and Association Agreement between Albania and the EU: The bilateral free trade agreement (FTA) entered into force on December 1, 2006 for trade in goods and on April 1, 2009 for trade in services. The agreements stimulate Albania's already large export and import volumes with EU member states, including Germany, Italy and Greece.

- The bilateral FTA between Albania and Turkey: The FTA covers trade in goods and entered into force on May 1, 2008. Turkey is Albania's third-largest supplying market as of 2017, with imports from Turkey accounting for 7.5% of Albania's total imports, of which articles of apparel and clothing accessories (knitted or crocheted) made up the highest percentage.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

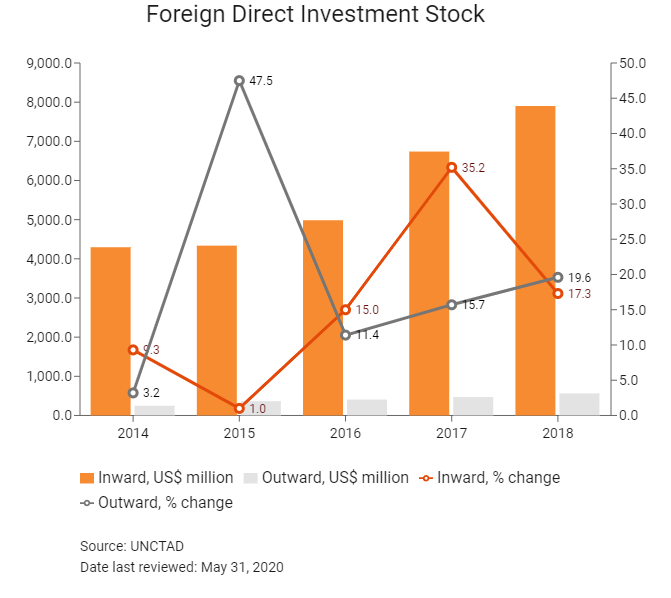

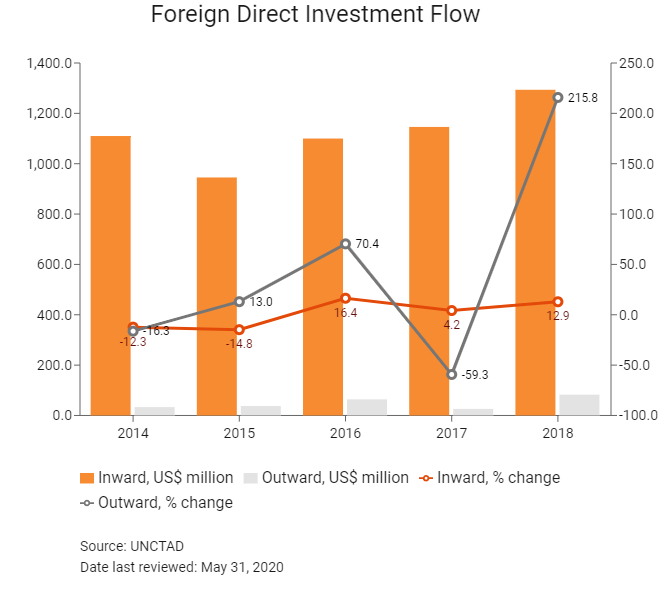

Foreign Direct Investment

Foreign Direct Investment Policy

- The Albanian government approved a new Law on Strategic Investments in 2015 to attract FDI. This law outlines investment incentives and offers fast-track administrative procedures to foreign and domestic investors, depending on the size of the investment and number of jobs created.

- The AIDA is in charge of promoting foreign investments in the country. The Law on Strategic Investments states that AIDA, as the Secretariat of the Strategic Investment Council, serves as a one-stop shop for foreign investors, from filing of the application form, to granting the status of strategic investment/investor.

- The Law on Foreign Investment outlines specific protections for foreign investors and Albanian law does not distinguish between domestic and foreign investment. There are no restrictions on foreign ownership or control of domestic corporations in Albania. Almost all sectors allow 100% foreign ownership of companies. A few exceptions include international air passenger transport (foreign interest in airline companies is limited to 49% ownership for investors outside the Common European Aviation Zone), electric power transmission (must be 100% state owned), and television broadcasting (no entity may own more than 40% of a television company).

- Albania has bilateral investment treaties in force with 36 countries, including one with Mainland China that entered into force on September 1, 1995.

- Albania aims to lead the region in FDI by 2020 through measures such as innovative business development, the cultivation of small- and medium-sized enterprises and entrepreneurship (notably by women) and the use of public and private sector institutions to develop industrial clusters.

Sources: WTO – Trade Policy Review, International Trade Administration, US Department of Commerce, Investment Policy Hub UNCTAD, Republic of Albania Ministry of Economic Development, Trade & Entrepreneurship, Albania Investment Development Agency, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Albania currently has no functional duty free import zones, although legislation exists for the creation of such zones. |

In May 2015, amendments to the Law on the Establishment and Operation of Technical and Economic Development Areas (TEDA) established the legal framework for the creation of TEDAs, which are similar to free trade zones, and defined the incentives for businesses investing and operating in the development of these zones. |

|

General incentives |

The Law on Strategic Investments identified the following sectors to be promoted through special administrative procedures: |

Sources: US Department of Commerce, Albania Investment Development Agency, Fitch Solutions

- Value Added Tax: 20%

- Corporate Income Tax: 15%

Source: Republic of Albania Ministry of Finance and the Economy

Important Updates to Taxation Information

- In November, the government proposed a number of measures intended to clamp down on tax evasion, notably to make it compulsory for foreign investors to pay capital gains tax when selling assets in Albania by ensuring that transactions cannot be made tax-free. Another proposal – or aspiration – is to introduce a fiscal package that will improve the business climate and boost investment by reducing the dividend tax to 8%. The government has indicated that the reduced rate would also apply to undistributed profits from the pre-2018 period provided the tax was paid by the end of September 2019. The government also wishes to increase – from 6% to 9% – the mining royalty on chromium exports, to discourage exports of raw chromium and encourage a local processing industry.

- The minimum and maximum salary for social and health contribution purposes have increased from ALL24,000 to ALL26,000, and from ALL105,850 to ALL114,670, respectively.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

- 15% on taxable profits for companies with annual turnover exceeding ALL14 million |

|

Capital Gains Tax |

Capital gains are subject to tax at 15% |

|

Withholding Taxes |

15% on interest, royalties. 8 % on dividend income |

|

Social Security Contributions |

Employers must pay social and health contributions to the tax authorities at a rate of 15% and 1.7% respectively (employees pay 9.5% and 1.7%). The social contributions are paid between the minimum and maximum gross salary, which from January 2019 are ALL26,000 and ALL114,670 respectively. The health contributions are calculated on the total gross salary. |

|

VAT |

Standard rate of 20%; A lower rate of 6% applies to the supply of accommodation services and the supply of all types of service provided in four- and five-star hotels. Zero rating applies to milk, dentistry, medical care and tuition. |

|

Real Estate Tax |

This tax is levied on buildings as well as agricultural and non-agricultural land. For a building, the tax due is calculated annually as a percentage of the value of the building, depending on its use. A residential building is taxed 0.05%, a building used commercially is taxed 0.20% and a construction site can potentially be taxed 30%. The tax on either type of land is levied by hectare (agricultural) or square metre (non-agricultural), varying by district. |

Source: Republic of Albania Ministry of Finance and the Economy

Date last reviewed: May 31, 2020

Foreign Worker Permits

Although visa, residence and work permit requirements are simple in Albania and do not pose a burden on potential investors, the Law on Foreigners requires foreign businesses to prove that foreign employees are less than 10% of the total workforce before the government can grant work permits.

Localisation Requirements

While some workers in the Albanian labour force are highly skilled, many work in low-skill jobs or have outdated skills. The education level of the workforce is low, constricting economic prospects and access to high-quality jobs. The government provides fiscal incentives for labour force training for the inward processing industry, which includes the shoe and textile sectors.

Visa/Travel Restrictions

Foreign nationals from 85 jurisdictions, from Europe, North America, South America and some parts of Asia (including Hong Kong), can enter Albania without a visa for a maximum stay of 90 days.

Sources: Government websites, Republic of Albania Ministry for Europe and Foreign Affairs, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B1 (Stable) |

02/08/2019 |

|

Standard & Poor's |

B+ (Stable) |

05/02/2016 |

|

Fitch Ratings |

N/A |

N/A |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

65/190 |

63/190 |

82/190 |

|

Ease of Paying Taxes Index |

125/190 |

122/190 |

123/190 |

|

Logistics Performance Index |

88/160 |

N/A |

N/A |

|

Corruption Perception Index |

99/180 |

106/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, Transparency International

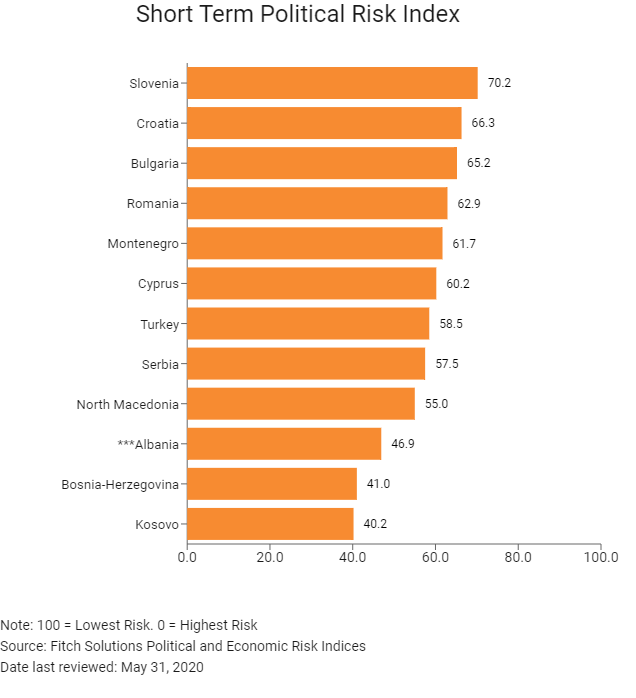

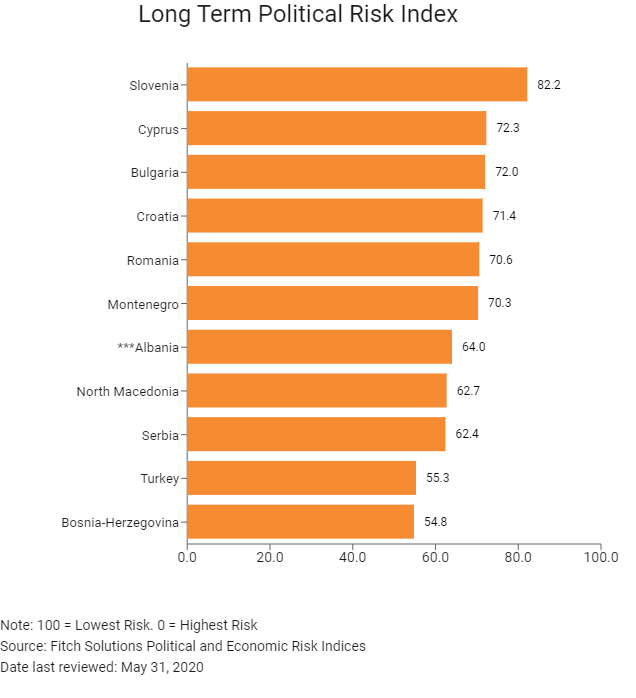

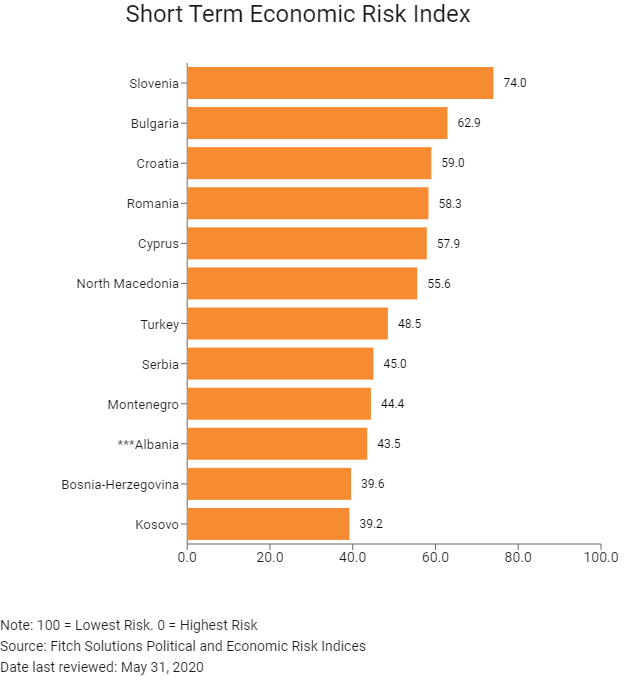

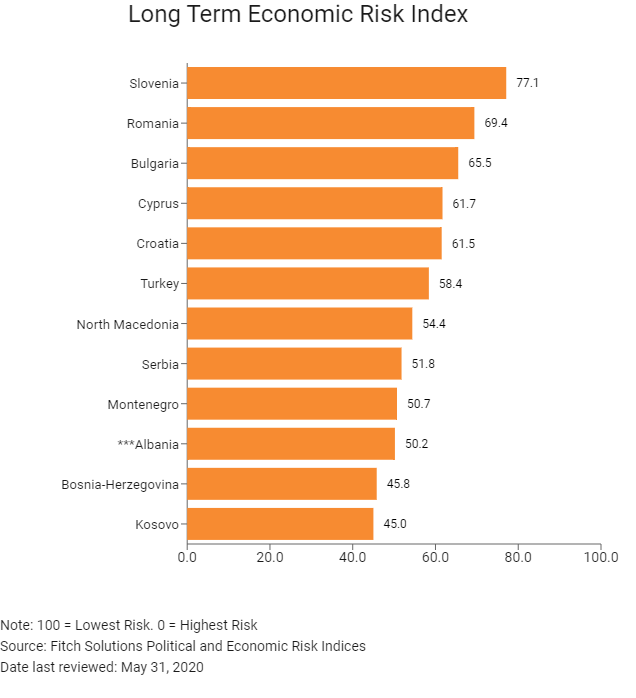

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

111/201 |

115/201 |

110/201 |

|

Short-Term Economic Risk Score |

44.4 |

45.2 |

43.5 |

|

Long-Term Economic Risk Score |

50.2 |

50.3 |

50.2 |

|

Political Risk Index Rank |

61/201 |

62/201 |

90/201 |

|

Short-Term Political Risk Score |

59.8 |

53.5 |

46.9 |

|

Long-Term Political Risk Score |

71.3 |

71.3 |

64.0 |

|

Operational Risk Index Rank |

93/201 |

92/201 |

106/201 |

|

Operational Risk Score |

50.7 |

50.6 |

48.3 |

Source: Fitch Solutions

Date last reviewed: May 31, 2020

Fitch Solutions Risk Summary

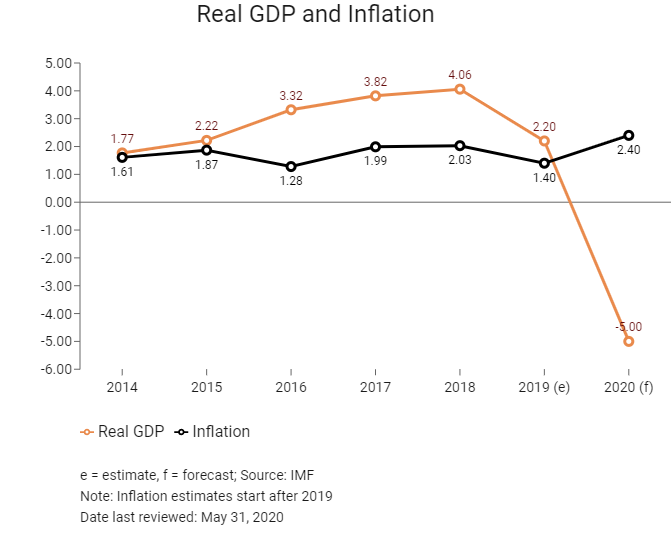

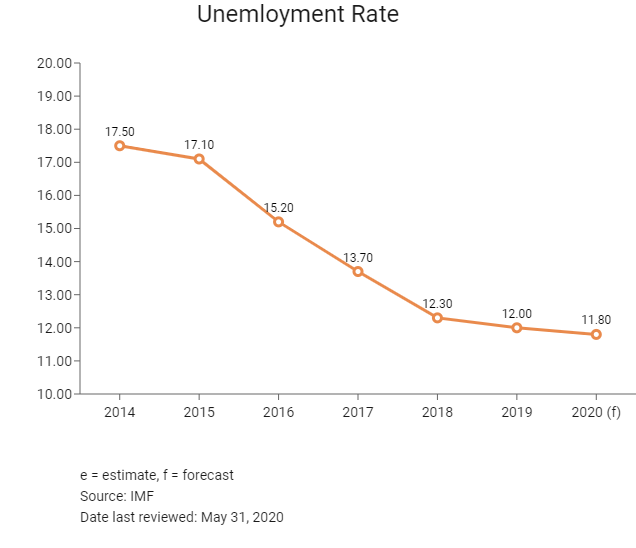

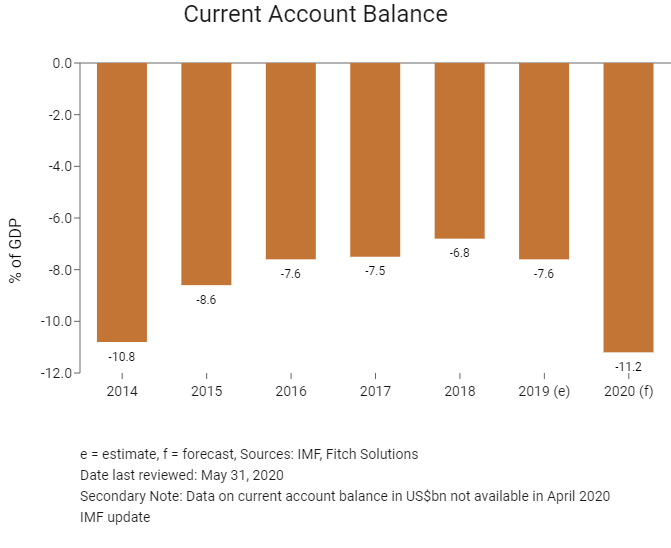

ECONOMIC RISK

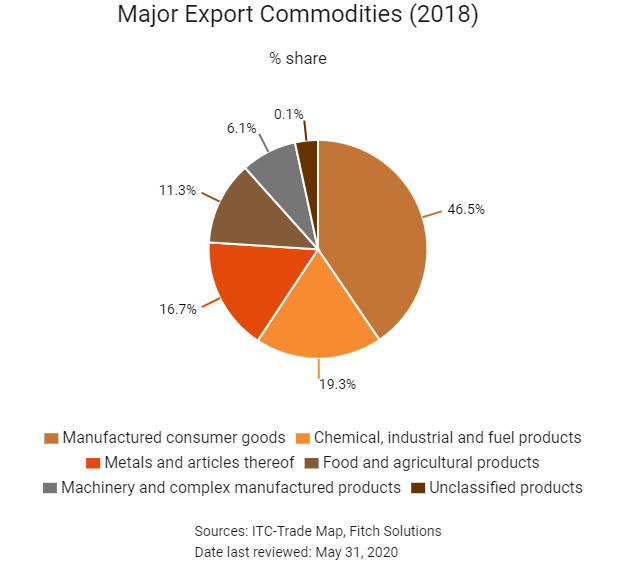

Albania's economic potential is unlikely to be unlocked unless the government can implement key structural reforms over the next few years. Namely, to improve labour market flexibility and make exports more competitive. Some progress is being made, however, reforms are unlikely to occur at a satisfactory pace in the coming years. As a result, Albania will remain bound to a low growth trajectory and one of Europe's poorest countries. With few sustainable growth drivers, Albania's economy will remain overly reliant on shaky household consumption for growth, which is a risky trend. Albanian economic growth will contract in 2020 after a 2019 slowdown and a weak global outlook due to Covid-19. Domestic demand and exports will register negative growth, which will be partially cushioned by easy monetary policy and expansionary fiscal policy. The external sector will remain the weak spot for the economy, largely due to tepid economic growth in Italy, which accounts for around half of Albanian exports.

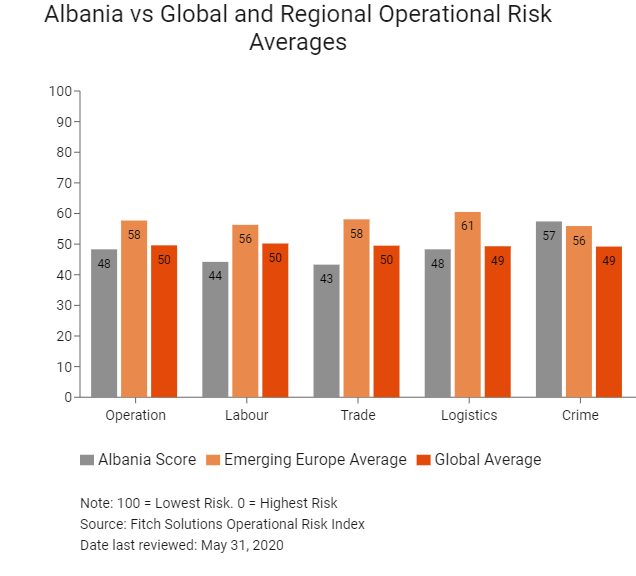

OPERATIONAL RISK

Albania is witnessing a transformation which has led to a gradually improving regulatory framework and streamlined business initiatives, which should help foreign direct investment recover gradually over the years ahead. This alone, however, will need to be matched by government spending on infrastructure projects and spending on new productive capacity from businesses.

Source: Fitch Solutions

Date last reviewed: May 31, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Albania Score |

48.3 |

44.2 |

43.3 |

48.3 |

57.4 |

|

Southeast Europe Average |

57.5 |

52.9 |

57.9 |

60.7 |

58.5 |

|

Southeast Europe Position (out of 12) |

10 |

12 |

12 |

12 |

8 |

|

Emerging Europe Average |

57.7 |

56.3 |

58.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

25 |

30 |

28 |

27 |

16 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

106 |

138 |

126 |

97 |

71 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Slovenia |

69.2 |

57.7 |

63.5 |

74.1 |

81.4 |

|

Romania |

63.7 |

60.0 |

60.8 |

66.1 |

67.8 |

|

Cyprus |

62.7 |

56.0 |

66.0 |

63.0 |

65.8 |

|

Croatia |

62.5 |

53.2 |

56.9 |

70.3 |

69.5 |

|

Bulgaria |

61.7 |

58.2 |

63.6 |

60.9 |

64.1 |

|

Serbia |

58.2 |

59.6 |

60.1 |

60.7 |

52.4 |

|

Montenegro |

58.1 |

56.7 |

59.8 |

57.7 |

58.0 |

|

North Macedonia |

56.3 |

44.9 |

62.7 |

59.8 |

57.8 |

|

Turkey |

56.1 |

53.2 |

59.9 |

65.2 |

46.1 |

|

Albania |

48.3 |

44.2 |

43.3 |

48.3 |

57.4 |

|

Bosnia-Herzegovina |

47.5 |

46.0 |

44.3 |

50.7 |

49.0 |

|

Kosovo |

46.0 |

45.1 |

54.0 |

51.6 |

33.2 |

|

Regional Averages |

57.5 |

52.9 |

57.9 |

60.7 |

58.5 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 31, 2020

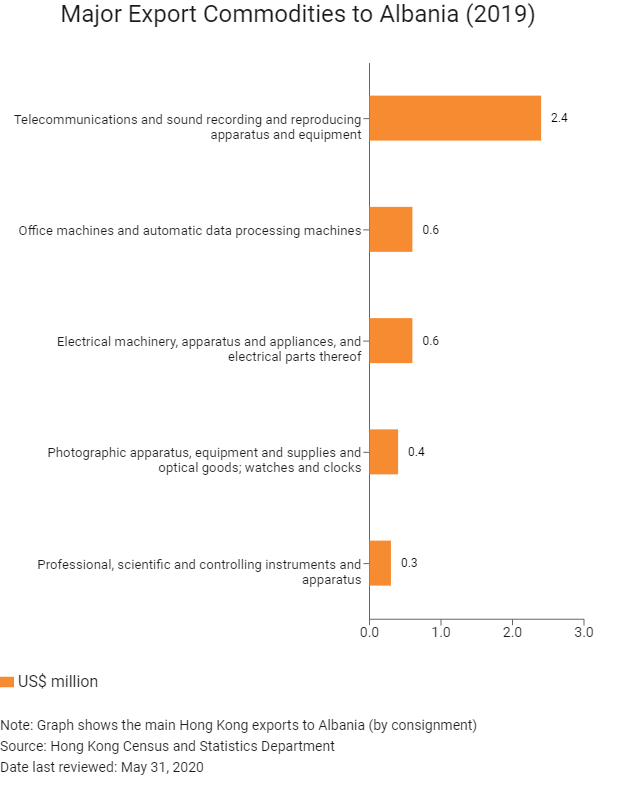

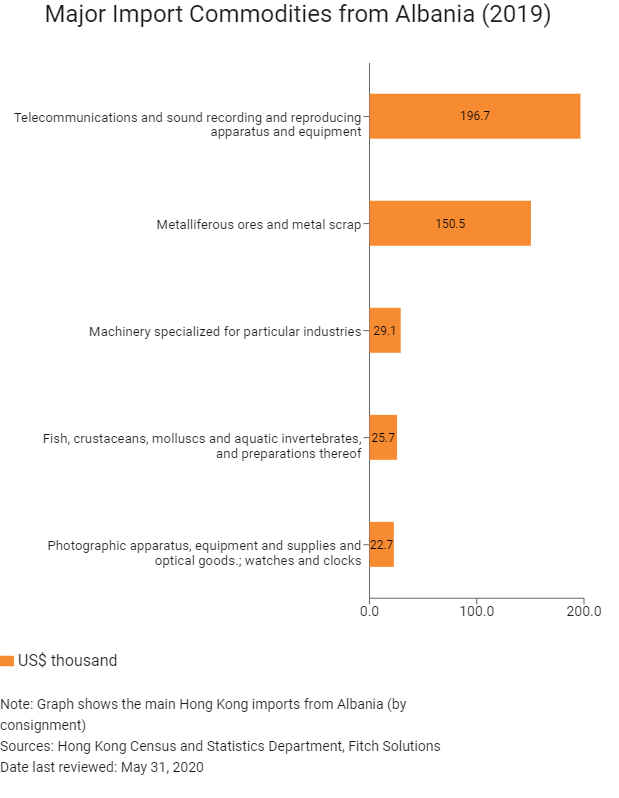

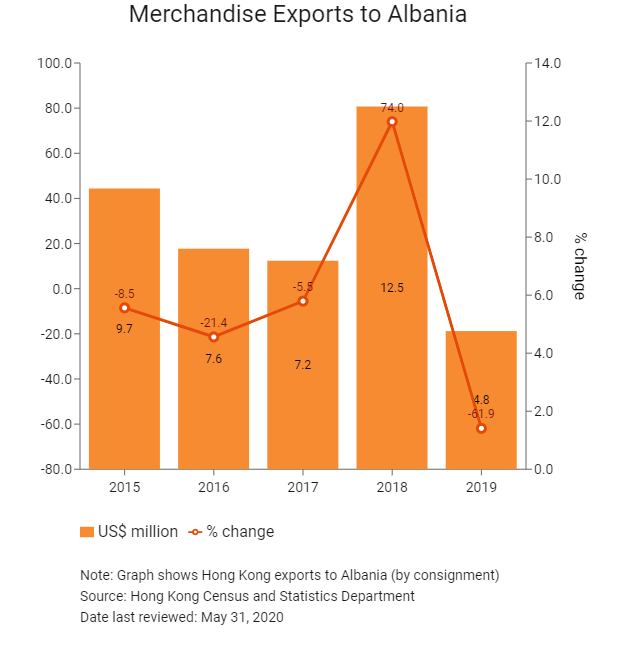

Hong Kong’s Trade with Albania

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Albanian residents visiting Hong Kong |

729 |

-24.5 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Source: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of emerging Europe citizens residing in Hong Kong |

114 |

29.5 |

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years.

Source: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: May 31, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Albanian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong/Mainland Chinaand Albania

- There is a bilateral investment treaty between Albania and Mainland China that entered into force on September 1, 1995.

- A double taxation agreement between Albania and Mainland China was signed on September 13, 2004 and has been in force since January 1, 2006.

Sources: Investment Policy Hub UNCTAD, State Administration of Taxation of the People's Republic of Mainland China

Chamber of Commerce (or Related Organisations) in Hong Kong

Consulate of Albania in Hong Kong

Address: 23/F, Admiralty Centre Tower II, 18 Harcourt Road, Admiralty, Hong Kong

Email: albania.consulate@gmail.com

Tel: (852) 2867 1313

Source: Protocol Division Government Secretariat Hong Kong

Visa Requirements for Hong Kong Residents

HKSAR passport holders have visa-free access to Albania for a stay of not more than 14 days on condition that the duration of the stay does not exceed 90 days within a period of 180 days.

Source: Republic of Albania Ministry for Europe and Foreign Affairs

Date last reviewed: May 31, 2020

Albania

Albania